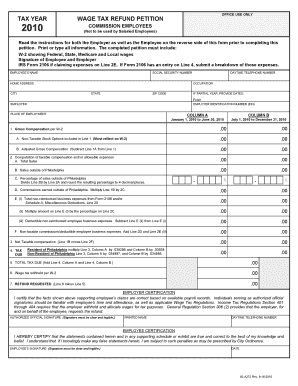

Wage Tax Refund Petition Form

What is the Wage Tax Refund Petition

The Wage Tax Refund Petition is a formal request submitted by individuals to reclaim overpaid wage taxes. This form is essential for taxpayers who have had excess amounts withheld from their paychecks, often due to changes in income, employment status, or tax laws. By filing this petition, taxpayers can initiate the process of recovering funds that are rightfully theirs, ensuring accurate tax compliance and financial management.

Steps to complete the Wage Tax Refund Petition

Completing the Wage Tax Refund Petition involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including pay stubs and tax withholding statements. Next, accurately fill out the form, providing personal information and details regarding the overpayment. After completing the form, review it for any errors or omissions. Finally, submit the petition through the appropriate channels, whether online, by mail, or in person, depending on state requirements.

Legal use of the Wage Tax Refund Petition

The Wage Tax Refund Petition must be used in accordance with federal and state tax laws. It is legally binding when completed correctly and submitted within the designated timeframes. Taxpayers should ensure that they are eligible to file this petition based on their specific tax situation and that they have the necessary supporting documentation to substantiate their claims. Understanding the legal implications helps prevent potential issues with tax authorities.

Required Documents

To successfully file the Wage Tax Refund Petition, several documents are required. These typically include:

- Recent pay stubs that reflect wage tax withholdings

- W-2 forms from previous employers

- Any relevant tax returns

- Documentation supporting claims of overpayment

Having these documents ready will facilitate a smoother filing process and enhance the chances of a successful refund.

Filing Deadlines / Important Dates

Filing deadlines for the Wage Tax Refund Petition can vary by state and specific circumstances. Generally, it is advisable to file as soon as you identify an overpayment. Many states have a statute of limitations, often ranging from three to five years, within which you must submit your petition. Staying informed about these deadlines is crucial to ensure that your claim is processed in a timely manner.

Examples of using the Wage Tax Refund Petition

There are various scenarios in which individuals might utilize the Wage Tax Refund Petition. For instance, a worker who changed jobs mid-year may find that their new employer withheld more tax than necessary due to outdated withholding information. Similarly, self-employed individuals who overestimated their tax payments throughout the year may also file this petition to recover excess funds. Understanding these examples can help taxpayers recognize their eligibility for a refund.

Quick guide on how to complete wage tax refund petition 6165232

Complete Wage Tax Refund Petition effortlessly on any device

Online document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Wage Tax Refund Petition on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Wage Tax Refund Petition without hassle

- Locate Wage Tax Refund Petition and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you'd like to send your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Wage Tax Refund Petition and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage tax refund petition 6165232

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Wage Tax Refund Petition and how does it work?

A Wage Tax Refund Petition is a request for the reimbursement of overpaid wage taxes. It involves completing specific forms and submitting them to the appropriate tax authority. By utilizing airSlate SignNow, users can easily create and manage these petitions digitally, streamlining the process.

-

How can airSlate SignNow assist with my Wage Tax Refund Petition?

airSlate SignNow simplifies the Wage Tax Refund Petition process by providing a platform for electronic signatures and document management. Users can prepare and send documents securely, ensuring that all necessary signatures are obtained efficiently. This helps expedite your refund request.

-

What are the costs associated with filing a Wage Tax Refund Petition using airSlate SignNow?

Using airSlate SignNow to file your Wage Tax Refund Petition is cost-effective, with plans that cater to various needs and budgets. You can choose from monthly or annual subscription options, which provide flexibility depending on your volume of transactions. This transparency in pricing ensures that users can budget accordingly.

-

Are there any special features in airSlate SignNow for Wage Tax Refund Petitions?

Yes, airSlate SignNow includes several features that enhance the Wage Tax Refund Petition process. Features such as customizable templates, status tracking, and automated reminders help ensure that no detail is overlooked. This allows users to focus more on their business while efficiently handling tax petitions.

-

Can I track the status of my Wage Tax Refund Petition in airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your Wage Tax Refund Petition. Users can monitor the petition’s status, ensuring they are notified of any updates or actions needed promptly. This keeps the process transparent and manageable at all times.

-

Is it easy to integrate airSlate SignNow with other tools I use for my Wage Tax Refund Petition?

Yes, airSlate SignNow is designed to integrate seamlessly with various applications and platforms. Whether you are using accounting software or customer relationship management tools, airSlate SignNow can streamline the process of preparing and managing your Wage Tax Refund Petition alongside your existing workflows.

-

What benefits will I get by using airSlate SignNow for my Wage Tax Refund Petition?

Using airSlate SignNow for your Wage Tax Refund Petition offers numerous benefits, including enhanced efficiency, reduced turnaround time, and increased accuracy. The digital management and eSigning capabilities ensure a smoother experience from start to finish, making it easier to handle your petitions.

Get more for Wage Tax Refund Petition

- Michigan withholding tax schedule w form

- Cg 3752 24418205 form

- Projected balance sheet form

- Scientific notation addition and subtraction independent practice worksheet answer key form

- Food in school permisson slipdocx portal cranburyschool form

- Plan review application commercial kitchen hood revised 3 form

- Lake havasu city development services department form

- Custom flashing order form rollfab metal products

Find out other Wage Tax Refund Petition

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors