Form 4338

What is the Form 4338

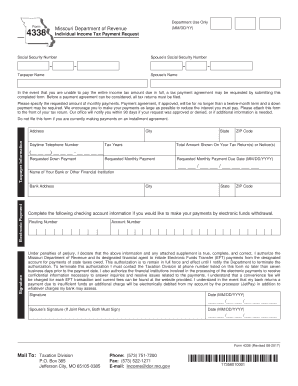

The Form 4338 is a document utilized primarily in Missouri for various administrative and legal purposes. It serves as a formal request or declaration, often related to tax matters or compliance with state regulations. Understanding the specific use and requirements of this form is essential for individuals and businesses to ensure proper adherence to legal standards.

How to use the Form 4338

Using the Form 4338 involves several key steps. First, identify the specific purpose for which the form is required, whether it pertains to tax filings, compliance documentation, or other legal matters. Next, gather all necessary information and documentation that will support the completion of the form. Once the form is filled out, it can be submitted through the appropriate channels, whether online, by mail, or in person, depending on the requirements set forth by the issuing authority.

Steps to complete the Form 4338

Completing the Form 4338 requires careful attention to detail. Follow these steps for accurate submission:

- Review the instructions provided with the form to understand the specific requirements.

- Gather all necessary documentation, including identification and any supporting materials.

- Fill out the form clearly and accurately, ensuring all fields are completed as required.

- Double-check the information for accuracy to avoid potential delays or issues.

- Submit the completed form through the designated method, ensuring compliance with all submission guidelines.

Legal use of the Form 4338

The legal use of the Form 4338 is governed by specific regulations and standards. For the form to be considered valid, it must be completed accurately and submitted in accordance with applicable laws. This includes ensuring that all signatures are obtained where required and that the form is filed within any stipulated deadlines. Utilizing a reliable electronic signing platform can enhance the legal standing of the form, providing an electronic certificate that verifies the authenticity of the submission.

Key elements of the Form 4338

Key elements of the Form 4338 include personal identification information, the purpose of the form, and any relevant financial data. Each section of the form is designed to capture specific information necessary for processing. It is crucial to ensure that all required fields are filled out completely and accurately, as omissions can lead to processing delays or legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4338 can vary based on its purpose. It is important to be aware of any specific dates associated with tax filings or compliance submissions. Missing a deadline can result in penalties or complications with the submission process. Always check the latest guidelines from relevant authorities to ensure timely filing.

Quick guide on how to complete form 4338

Prepare Form 4338 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without obstacles. Manage Form 4338 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 4338 effortlessly

- Find Form 4338 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Decide how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your choice. Edit and eSign Form 4338 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4338

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4338 and how is it used?

Form 4338 is a crucial document for businesses that need to streamline their signing process. It allows users to easily complete and eSign various documents electronically, ensuring that everything is legally binding and officially recorded. With airSlate SignNow, managing your form 4338 becomes a hassle-free task.

-

How can I create and send form 4338 using airSlate SignNow?

Creating and sending form 4338 with airSlate SignNow is simple and user-friendly. You can upload your document, customize the signing fields, and send it to recipients via email. The platform's intuitive interface makes it easy to manage the entire workflow.

-

What features does airSlate SignNow offer for managing form 4338?

airSlate SignNow offers a range of features to enhance the management of form 4338, including templates, reminders, and tracking options. Users can also enjoy advanced security measures to protect sensitive information and the ability to integrate with other tools for a seamless experience.

-

Is there a free trial available for using form 4338 with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore the features available for handling form 4338. You can test the document signing process, integrations, and workflows to see how it fits your business needs before committing to a paid plan.

-

What are the pricing options for airSlate SignNow when using form 4338?

airSlate SignNow provides flexible pricing options tailored to businesses of all sizes, allowing you to choose a plan that fits your needs for managing form 4338. Pricing generally depends on the number of users and features required, ensuring a cost-effective solution for eSignature needs.

-

Can form 4338 be integrated with other software applications?

Absolutely! airSlate SignNow supports integrations with a variety of software applications, facilitating the efficient processing of form 4338. This allows users to connect with CRM systems, payment processors, and other essential tools within their tech stack.

-

What are the benefits of using airSlate SignNow for form 4338?

Using airSlate SignNow for form 4338 provides numerous benefits, including time saving, improved accuracy, and enhanced security. The platform's digital solutions simplify the signing process, making it quicker and more efficient for both senders and recipients.

Get more for Form 4338

- 11 item kutcher adolescent depression scale kads 11 ckcac form

- Satisfaction of preferred mortage jackson marine form

- Nys case registry form

- Cfs 370 5c form

- Building permit application pdf city of waterloo iowa form

- 303 860 6962 form

- Form id sec

- Form n 30 rev corporation income tax return forms fillable

Find out other Form 4338

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form