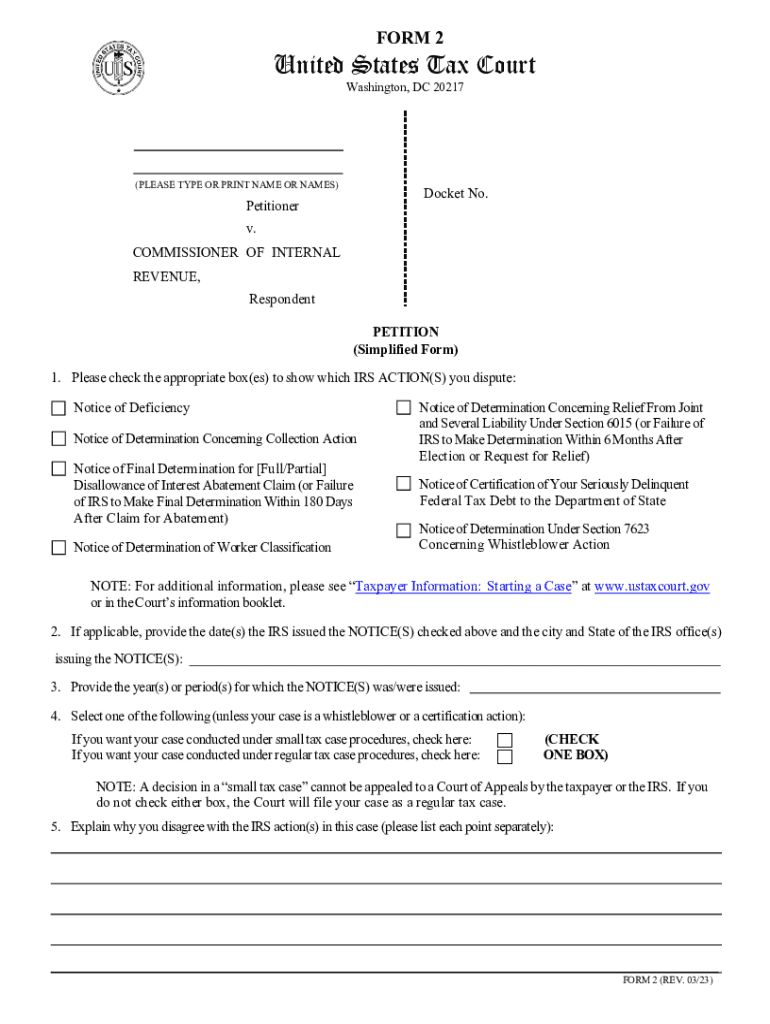

Petition Form

Understanding the Petition

The Petition is a formal request submitted to the United States Tax Court, seeking a review of a tax-related decision made by the Internal Revenue Service (IRS). This document is crucial for taxpayers who wish to challenge IRS determinations regarding tax deficiencies, penalties, or other disputes. It serves as the starting point for legal proceedings in tax matters, allowing individuals or entities to present their case before a judge. Understanding the purpose and structure of the Petition is essential for anyone considering this legal avenue.

Steps to Complete the Petition

Completing the Petition involves several key steps to ensure accuracy and compliance with tax court requirements. First, gather all relevant documentation related to your tax dispute, including notices from the IRS and any supporting evidence. Next, fill out the Petition form accurately, providing detailed information about your case and the specific issues you are contesting. It is important to follow the instructions carefully and ensure that all necessary information is included. After completing the form, review it thoroughly for any errors before submission.

Legal Use of the Petition

The legal use of the Petition is governed by specific rules and regulations set forth by the United States Tax Court. This document must be filed within a designated timeframe, typically within ninety days of receiving a notice of deficiency from the IRS. Proper legal use also entails adhering to the court's procedural rules, including formatting requirements and the inclusion of specific information. Failure to comply with these legal standards may result in dismissal of the case.

Filing Deadlines and Important Dates

Timely filing of the Petition is critical for maintaining your rights in tax disputes. The primary deadline is usually ninety days from the date of the IRS notice of deficiency. However, there may be additional deadlines related to specific circumstances, such as appeals or motions. It is advisable to keep track of these important dates and to file the Petition as early as possible to avoid complications. Missing a deadline can severely limit your options for contesting the IRS's determination.

Required Documents for Submission

When submitting the Petition to the United States Tax Court, certain documents must accompany it to support your case. These typically include a copy of the IRS notice of deficiency, any relevant tax returns, and documentation that substantiates your claims. It is important to ensure that all required documents are complete and organized, as this can significantly impact the court's review process. Incomplete submissions may lead to delays or unfavorable outcomes.

Examples of Using the Petition

There are various scenarios in which taxpayers may utilize the Petition to contest IRS decisions. For instance, a self-employed individual may challenge a tax deficiency related to reported income, while a retired taxpayer might dispute penalties imposed for late filing. Each example highlights the importance of the Petition as a tool for asserting taxpayer rights and addressing disputes with the IRS. Understanding these scenarios can help individuals determine if filing a Petition is appropriate for their situation.

Handy tips for filling out Petition online

Quick steps to complete and e-sign Petition online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Gain access to a GDPR and HIPAA compliant platform for optimum simpleness. Use signNow to electronically sign and share Petition for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the petition

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with tax court documents?

airSlate SignNow is a powerful eSignature solution that simplifies the process of sending and signing documents. For tax court cases, it allows users to securely eSign and manage important legal documents, ensuring compliance and efficiency in handling tax-related matters.

-

How does airSlate SignNow ensure the security of documents related to tax court?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect your documents, including those related to tax court. This ensures that sensitive information remains confidential and accessible only to authorized users.

-

What features does airSlate SignNow offer for managing tax court documents?

airSlate SignNow offers a range of features tailored for managing tax court documents, including customizable templates, automated workflows, and real-time tracking of document status. These features streamline the process, making it easier to prepare and submit necessary paperwork for tax court.

-

Is airSlate SignNow cost-effective for businesses dealing with tax court cases?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses, including those dealing with tax court cases. Our pricing plans are flexible and cater to various needs, ensuring that you get the best value while efficiently managing your document signing processes.

-

Can airSlate SignNow integrate with other tools for tax court management?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your workflow for tax court management. Whether you use CRM systems, cloud storage, or project management tools, our integrations help streamline your document processes.

-

How can I track the status of documents sent for tax court using airSlate SignNow?

With airSlate SignNow, you can easily track the status of documents sent for tax court. Our platform provides real-time updates and notifications, allowing you to see when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

-

What are the benefits of using airSlate SignNow for tax court documentation?

Using airSlate SignNow for tax court documentation offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. By digitizing the signing process, you can focus more on your case and less on paperwork, ultimately improving your overall productivity.

Get more for Petition

- Form 59a

- Au digital computershare com w8ben form

- Formato de solicitud y notificacin detranscripcin para

- Colorado dr0021 form

- The hartford forms online

- Elsa referral form

- Application to rent screening fee fillable form 404801995

- Sv 120 response to petition for private postsecondary school violence restraining orders form

Find out other Petition

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later