CITY of GRAND RAPIDS INCOME TAX RESIDENT FORM 2023-2026

What is the Grand Rapids Income Tax Resident Form?

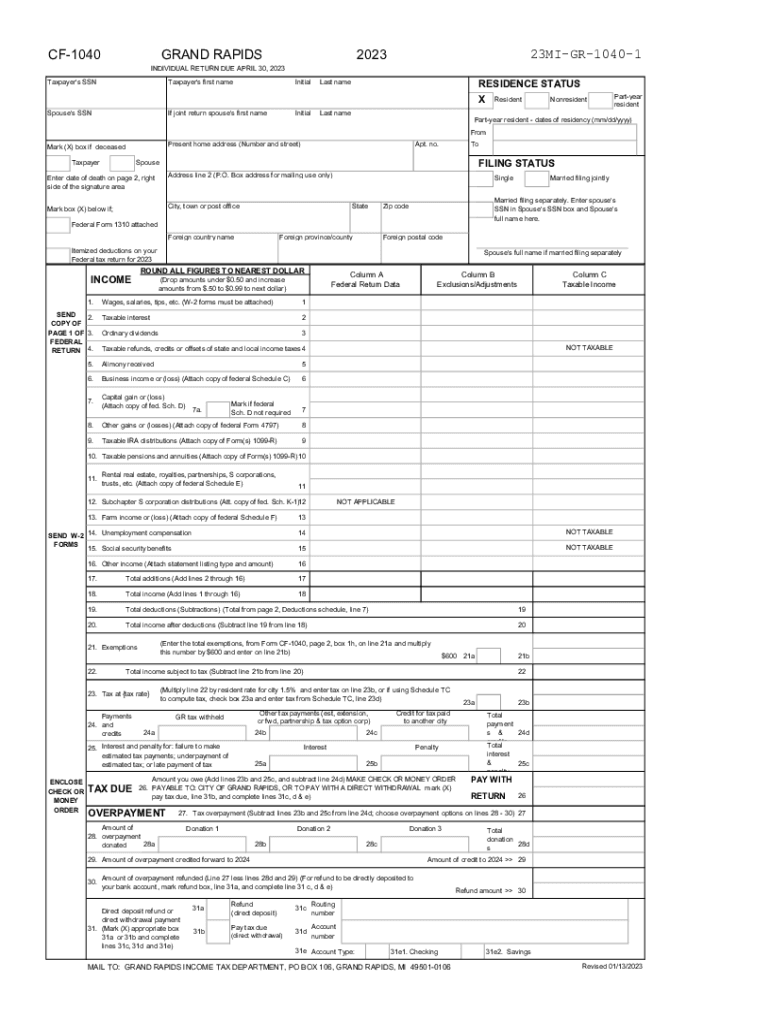

The Grand Rapids Income Tax Resident Form is a crucial document for individuals who reside in Grand Rapids, Michigan, and are required to report their income for local tax purposes. This form is designed to collect information about your earnings, deductions, and tax liabilities, ensuring compliance with local tax laws. The city imposes a tax on residents' income, and this form helps determine the amount owed or any potential refund.

Steps to Complete the Grand Rapids Income Tax Resident Form

Completing the Grand Rapids Income Tax Resident Form involves several steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, such as W-2s, 1099s, and any other income statements. Follow these steps:

- Provide personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and interest.

- Claim any eligible deductions, such as contributions to retirement accounts or education expenses.

- Calculate your total tax liability based on the provided income and deductions.

- Sign and date the form before submission.

How to Obtain the Grand Rapids Income Tax Resident Form

The Grand Rapids Income Tax Resident Form can be obtained through multiple channels. Residents can visit the official city website to download the form directly. Additionally, physical copies are available at designated city offices. If preferred, residents may also request the form to be mailed to them by contacting the city’s tax department.

Form Submission Methods

Once the Grand Rapids Income Tax Resident Form is completed, it can be submitted through various methods. Residents have the option to file online via the city’s tax portal, which offers a streamlined process for electronic submission. Alternatively, forms can be mailed to the tax department or delivered in person at designated city offices. It is essential to keep a copy of the submitted form for personal records.

Filing Deadlines and Important Dates

Filing deadlines for the Grand Rapids Income Tax Resident Form are crucial to avoid penalties. Typically, the form must be submitted by April 30 for the previous tax year. However, extensions may be available under specific circumstances. It is advisable to check the city’s official website for any updates regarding deadlines or changes in tax regulations.

Legal Use of the Grand Rapids Income Tax Resident Form

The Grand Rapids Income Tax Resident Form is legally mandated for all residents earning income within the city limits. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is essential for residents to understand their legal obligations and ensure timely and accurate submission to avoid complications with local tax authorities.

Quick guide on how to complete city of grand rapids income taxresident form

Effortlessly Prepare CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents promptly without any delays. Manage CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The Easiest Way to Edit and eSign CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM with Ease

- Locate CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city of grand rapids income taxresident form

Create this form in 5 minutes!

How to create an eSignature for the city of grand rapids income taxresident form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What services does airSlate SignNow offer for grand rapids income tax return?

airSlate SignNow provides a comprehensive platform for businesses to send and eSign documents, specifically tailored for handling grand rapids income tax return processes. With this solution, businesses can streamline document management, ensuring faster completion of tax returns through efficient electronic signatures and easy document sharing.

-

How can airSlate SignNow simplify my grand rapids income tax return?

Using airSlate SignNow can signNowly simplify your grand rapids income tax return by automating the document signing process. This means you can gather necessary signatures and approvals more quickly, allowing you to focus on accuracy and compliance while minimizing delays associated with traditional methods.

-

Is there a cost associated with using airSlate SignNow for grand rapids income tax return?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, including those focused on grand rapids income tax return. Plans vary based on the volume of documents processed and the features required, but the overall aim is to provide a cost-effective solution that doesn’t compromise on quality.

-

What features does airSlate SignNow offer for managing grand rapids income tax return documents?

airSlate SignNow includes features like customizable templates, in-person signing options, and integration capabilities with popular accounting software. These features ensure that managing your grand rapids income tax return documents is not only efficient but also tailored to your specific workflow.

-

How does airSlate SignNow ensure the security of my grand rapids income tax return documents?

Security is a top priority for airSlate SignNow when it comes to your grand rapids income tax return documents. The platform employs advanced encryption methods and maintains compliance with data protection regulations to ensure that all your sensitive information remains protected throughout the signing process.

-

Can airSlate SignNow integrate with other software for my grand rapids income tax return?

Absolutely! airSlate SignNow offers robust integrations with numerous accounting and financial software, streamlining the process for your grand rapids income tax return. This connectivity allows for seamless data transfer, meaning you can reduce manual data entry and enhance the accuracy of your returns.

-

What are the benefits of using airSlate SignNow for my grand rapids income tax return?

One of the key benefits of using airSlate SignNow for your grand rapids income tax return is the efficiency gained through digital signature capabilities. This not only speeds up the signing process but also improves tracking and management of documents, leading to timely tax submission and compliance with local regulations.

Get more for CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM

- Privacy info kern behavioral health and recovery services form

- Meadowbrook y base registration form

- Apply for admission unisa form

- Update charleston restaurant demolished to make way for form

- All sterilization claims must be processed according to the following federal guidelines form

- Release of information latouche pediatrics

- Fillable online consent for telemedicine health services form

- Checklist for release of protected health informationauthorization forms

Find out other CITY OF GRAND RAPIDS INCOME TAX RESIDENT FORM

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement