4582, Michigan Business Tax Penalty and Interest Computation for Underpaid Estimated Tax 2023-2026

Understanding IRS Form 4582: Michigan Business Tax Penalty and Interest Computation

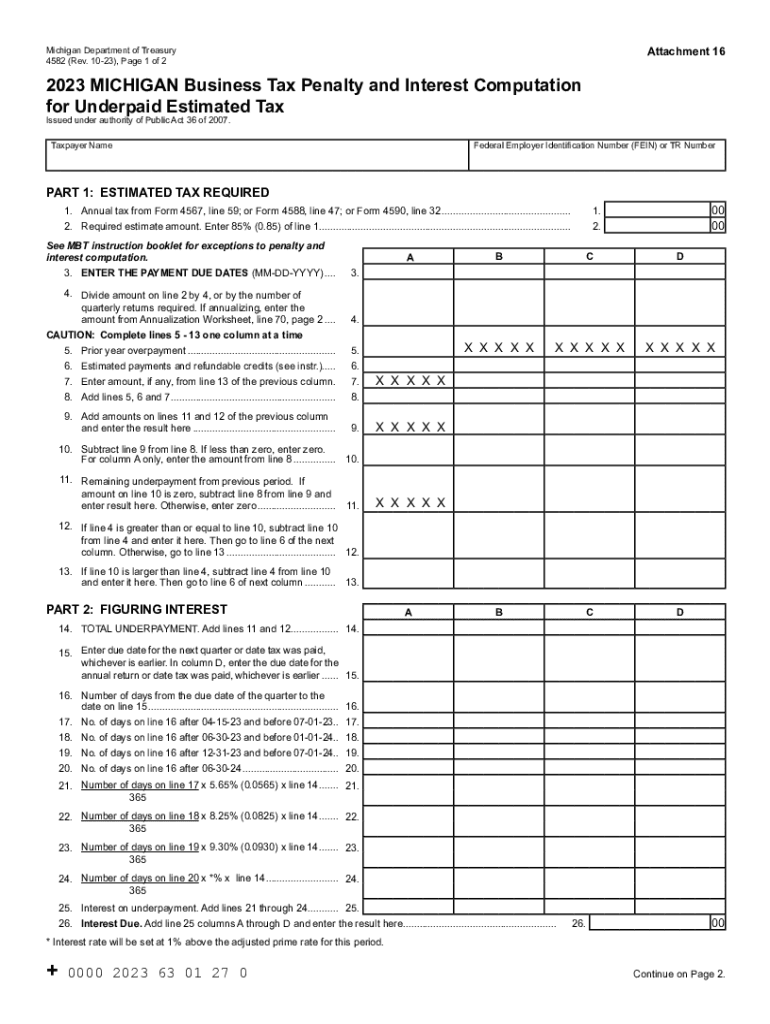

The IRS Form 4582 is specifically designed for calculating penalties and interest for underpaid estimated taxes related to the Michigan Business Tax. This form is essential for businesses that may have underestimated their tax liabilities, leading to potential penalties. Understanding this form is crucial for compliance and avoiding unnecessary financial burdens.

Steps to Complete IRS Form 4582

Completing the IRS Form 4582 involves several key steps to ensure accuracy and compliance:

- Gather all necessary financial documents, including previous tax returns and estimated tax payments.

- Calculate the total estimated tax due for the year.

- Determine the amount of tax already paid to identify any underpayment.

- Follow the form's instructions carefully to input the calculated penalty and interest amounts.

- Review all entries for accuracy before submission.

Legal Use of IRS Form 4582

The IRS Form 4582 must be used in accordance with Michigan tax laws. It is legally required for businesses that have underpaid their estimated taxes. Proper use of this form ensures that businesses remain compliant with state regulations and avoid additional penalties. It is advisable to consult with a tax professional if there are uncertainties regarding the form's application.

Filing Deadlines and Important Dates

Timely filing of IRS Form 4582 is critical to avoid additional penalties. Generally, the form should be submitted by the due date of the tax return for the year in which the underpayment occurred. It is important to stay informed about specific deadlines, as they can vary based on the tax year and any changes in legislation.

Penalties for Non-Compliance with IRS Form 4582

Failing to file IRS Form 4582 or submitting it inaccurately can result in significant penalties. These penalties may include additional interest on the underpaid tax amount and potential fines from the state. Understanding the implications of non-compliance can motivate businesses to ensure they file correctly and on time.

Examples of Using IRS Form 4582

Practical examples can illustrate how IRS Form 4582 is utilized. For instance, if a business estimated its tax liability at $10,000 but only paid $8,000, it would need to calculate the penalty and interest on the $2,000 underpayment. This example highlights the importance of accurate estimations and timely payments to avoid penalties.

Obtaining IRS Form 4582

IRS Form 4582 can be obtained through the Michigan Department of Treasury's website or directly from tax professionals. It is important to ensure that you are using the most current version of the form to comply with all regulations. Accessing the correct form is the first step in addressing any underpayment issues effectively.

Quick guide on how to complete 4582 michigan business tax penalty and interest computation for underpaid estimated tax

Prepare 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax seamlessly across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The simplest method to modify and eSign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax with ease

- Locate 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or cover sensitive details with the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome form searches, or errors that require printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Revise and eSign 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax while ensuring outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4582 michigan business tax penalty and interest computation for underpaid estimated tax

Create this form in 5 minutes!

How to create an eSignature for the 4582 michigan business tax penalty and interest computation for underpaid estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 4582 and why is it important?

IRS Form 4582 is used to report the surrender of a monetary contractor. This form is vital for businesses to ensure compliance with federal regulations and to properly document the surrender process to the IRS.

-

How can airSlate SignNow help with completing IRS Form 4582?

With airSlate SignNow, you can easily complete and eSign IRS Form 4582 online. Our platform streamlines the process, allowing users to fill out the form digitally and get it signed by all necessary parties without any hassle.

-

Is airSlate SignNow cost-effective for businesses needing to process IRS Form 4582?

Yes, airSlate SignNow offers a cost-effective solution for businesses of all sizes that need to process IRS Form 4582. Our competitive pricing plans ensure you can eSign documents without overspending, making compliance both simple and affordable.

-

What features does airSlate SignNow offer for IRS Form 4582 handling?

airSlate SignNow provides robust features for handling IRS Form 4582, including customizable templates, secure eSigning, and real-time tracking. These features streamline your workflow, ensuring that your forms are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for IRS Form 4582?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage IRS Form 4582. Whether you use CRM systems, accounting software, or cloud storage, our platform connects with your existing tools for a smoother experience.

-

What are the benefits of using airSlate SignNow for IRS Form 4582?

Using airSlate SignNow for IRS Form 4582 provides several benefits: it saves time on paperwork, reduces the risk of errors, and ensures that your documents are securely stored and easily accessible. This leads to greater efficiency in managing important compliance documents.

-

Are there any document security measures for IRS Form 4582 with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including IRS Form 4582. We employ advanced encryption techniques and secure cloud storage to protect sensitive information, ensuring that your data remains confidential and secure.

Get more for 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax

- Special olympics medical form special olympics washington

- Special olympics form

- Endocrinologistcascade endocrinologyvince montes md form

- User guide making an online application for an amateur form

- Authorization to release confidential substance use disorder treatment form

- Swedish urology group patient history formfemale

- Wisconsin marriage license form

- Updated contact or address information

Find out other 4582, Michigan Business Tax Penalty And Interest Computation For Underpaid Estimated Tax

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement