Sc1040nr Form

What is the SC1040NR?

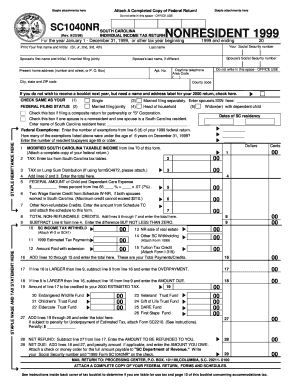

The SC1040NR is a tax form used by non-resident individuals in South Carolina to report their income and calculate their state tax liability. This form is specifically designed for those who earn income in South Carolina but do not reside in the state. It allows non-residents to accurately report their earnings while ensuring compliance with state tax regulations.

How to Obtain the SC1040NR

To obtain the SC1040NR, individuals can visit the South Carolina Department of Revenue's official website, where the form is available for download. Additionally, tax preparation offices may provide printed copies of the form. It is important to ensure that you are using the most current version of the SC1040NR to comply with the latest tax regulations.

Steps to Complete the SC1040NR

Completing the SC1040NR involves several key steps:

- Gather all necessary documentation, including W-2 forms, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in South Carolina, ensuring to include only the income that is subject to state tax.

- Calculate your tax liability using the provided tax tables or formulas.

- Sign and date the form before submitting it.

Legal Use of the SC1040NR

The SC1040NR is legally recognized as a valid document for reporting non-resident income in South Carolina. To ensure its legal standing, it must be completed accurately and submitted by the designated deadlines. Utilizing a reliable eSignature platform, such as signNow, can further enhance the legal validity of your submission by providing a secure and compliant method for signing the form electronically.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the SC1040NR to avoid penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates helps ensure timely compliance with state tax obligations.

Required Documents

When completing the SC1040NR, certain documents are required to support your income claims. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you intend to claim

- Identification documents, such as a driver's license or Social Security card

Penalties for Non-Compliance

Failing to file the SC1040NR or submitting it late can result in penalties imposed by the South Carolina Department of Revenue. These penalties may include fines based on the amount of tax owed and interest on any unpaid taxes. Understanding the importance of timely and accurate filing can help avoid these financial repercussions.

Quick guide on how to complete sc1040nr

Effortlessly finalize Sc1040nr on any device

Managing documents online has gained widespread acceptance among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Sc1040nr on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Sc1040nr with ease

- Obtain Sc1040nr and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and then click the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Sc1040nr and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc1040nr

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SC1040NR form and why is it important?

The SC1040NR form is essential for non-resident individuals in the U.S. to report their income and calculate their state tax obligations. Using airSlate SignNow, you can easily eSign and send your SC1040NR documents electronically, ensuring compliance and efficiency in your tax management.

-

How does airSlate SignNow help with the SC1040NR process?

airSlate SignNow streamlines the SC1040NR filing process by allowing users to electronically sign and send their documents securely. This convenient eSigning solution saves time and reduces the potential for errors that can arise from manual processes.

-

What are the costs associated with using airSlate SignNow for SC1040NR forms?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different users, making it cost-effective for managing your SC1040NR forms. By choosing a plan that fits your budget, you can take advantage of seamless eSigning features without breaking the bank.

-

Can airSlate SignNow integrate with other software for handling SC1040NR forms?

Yes, airSlate SignNow integrates with various third-party applications, enabling users to streamline their workflows when dealing with SC1040NR forms. This integration capability ensures that you can include eSigning in your existing document management processes seamlessly.

-

What features does airSlate SignNow offer to facilitate SC1040NR eSigning?

airSlate SignNow provides several features to facilitate SC1040NR eSigning, including customizable templates, real-time tracking, and secure storage. These features enhance the user experience and ensure that your SC1040NR documents are managed efficiently and securely.

-

Is airSlate SignNow secure for signing SC1040NR documents?

Absolutely! airSlate SignNow employs robust security measures to protect your SC1040NR documents during the eSigning process. With encrypted data transfer and secure cloud storage, you can confidently manage your sensitive tax documents.

-

How user-friendly is airSlate SignNow for non-technical users filing SC1040NR?

airSlate SignNow is designed with an intuitive interface that caters to users of all technical levels, making it easy for anyone to navigate the SC1040NR eSigning process. Whether you're tech-savvy or not, you'll find the platform simple and accessible.

Get more for Sc1040nr

- Maryland state retirement form 714

- Bright house networks form

- Bws honolulu test forms for bfpa

- Manulife gp5232 form

- Application for direct trustee to trustee transfer non taxable rs5531 n to request the direct transfer of a deceased nyslrs form

- Penn yan substitute teacher preference form

- Title insurance agency application tennessee form

- Notice to terminate lease agreement template form

Find out other Sc1040nr

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form