Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N to Request the Direct Transfer of a Deceased NYSLRS Memb Form

Understanding the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

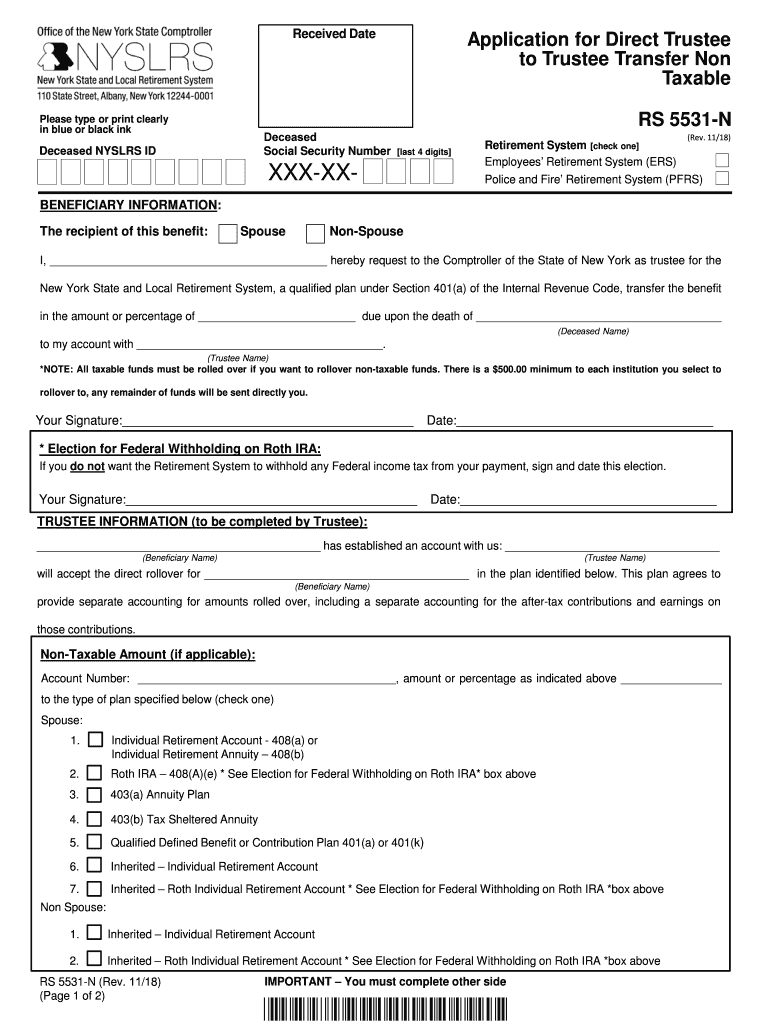

The Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N is a crucial document for beneficiaries seeking to transfer the death benefit of a deceased New York State and Local Retirement System (NYSLRS) member or retiree. This application allows for the direct transfer of benefits to a qualified plan, ensuring that the benefit amount is not reportable for federal income tax purposes. It is designed to facilitate a smooth transition of funds while adhering to IRS regulations regarding non-taxable transfers.

Steps to Complete the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

Completing the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N involves several key steps:

- Gather necessary information about the deceased member or retiree, including their NYSLRS identification number.

- Identify the beneficiary and their qualified plan details, ensuring the plan meets IRS requirements.

- Fill out the application form accurately, providing all required details about the transfer.

- Review the completed application for any errors or omissions before submission.

- Submit the application to the appropriate trustee or financial institution managing the qualified plan.

Required Documents for the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

To successfully complete the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N, certain documents are required:

- A copy of the death certificate of the NYSLRS member or retiree.

- Proof of the beneficiary's identity, such as a government-issued ID.

- Documentation of the qualified plan, including plan name and account number.

- Any additional forms or documents as specified by the trustee or financial institution.

Legal Considerations for the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

When using the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N, it is important to understand the legal implications. This application is governed by IRS guidelines, which dictate that the transfer must be made to a qualified plan to maintain its non-taxable status. Additionally, beneficiaries should ensure compliance with state laws regarding the transfer of retirement benefits. Legal advice may be beneficial to navigate any complexities involved.

Eligibility Criteria for the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

Eligibility for using the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N typically includes:

- The applicant must be a designated beneficiary of a deceased NYSLRS member or retiree.

- The death benefit must be intended for transfer to a qualified retirement plan.

- The benefit amount must not be reportable for federal income tax purposes.

Form Submission Methods for the Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N

The completed Application for Direct Trustee to Trustee Transfer Non Taxable RS5531 N can be submitted through various methods, depending on the requirements of the trustee or financial institution:

- Online submission via the trustee's secure portal, if available.

- Mailing the application to the designated address provided by the trustee.

- In-person submission at the trustee's office or financial institution.

Quick guide on how to complete application for direct trustee to trustee transfer non taxable rs5531 n to request the direct transfer of a deceased nyslrs

Complete Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb seamlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb on any platform through airSlate SignNow's Android or iOS applications, and enhance any document-driven process today.

How to modify and eSign Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb effortlessly

- Obtain Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with a few clicks from any device you prefer. Modify and eSign Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for direct trustee to trustee transfer non taxable rs5531 n to request the direct transfer of a deceased nyslrs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

The Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N is a form used to request the direct transfer of a deceased NYSLRS member or retiree's death benefit to a beneficiary's qualified plan. This application ensures that the transfer is non-taxable and compliant with federal regulations.

-

How do I complete the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

To complete the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N, gather the necessary information about the deceased member or retiree, the beneficiary, and the qualified plan. Follow the instructions provided on the form carefully to ensure all required fields are filled out accurately.

-

What are the benefits of using the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

Using the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N allows beneficiaries to receive death benefits without incurring federal tax liabilities. This process simplifies the transfer of funds and ensures compliance with applicable laws, providing peace of mind during a difficult time.

-

Is there a fee associated with the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

Typically, there are no fees directly associated with submitting the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N. However, it's advisable to check with your financial institution or plan administrator for any potential processing fees that may apply.

-

How long does it take to process the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

The processing time for the Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N can vary depending on the institution handling the transfer. Generally, it may take several weeks to complete the transfer, so it's important to submit the application as soon as possible.

-

Can I track the status of my Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N?

Yes, many financial institutions provide a way to track the status of your Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N. You can contact your plan administrator or check their online portal for updates on your application.

-

What happens if my Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N is denied?

If your Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N is denied, you will typically receive a notification explaining the reason for the denial. You may have the option to appeal the decision or correct any issues and resubmit the application.

Get more for Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb

- Tds declaration form fy 2020 21 for transporter pdf

- Earthquakes 2 gizmo answer key pdf form

- Student exploration stoichiometry answer key form

- Gate pass format 428131290

- How to write a fee waiver request letter sample for journal form

- Forms georgia tax tribunal

- Wb 15 commercial offer to purchase fill online printable form

- Midwife form 5 office of the professions

Find out other Application For Direct Trustee To Trustee Transfer Non Taxable RS5531 N To Request The Direct Transfer Of A Deceased NYSLRS Memb

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself