Painting Contract Form

What is the painting contract?

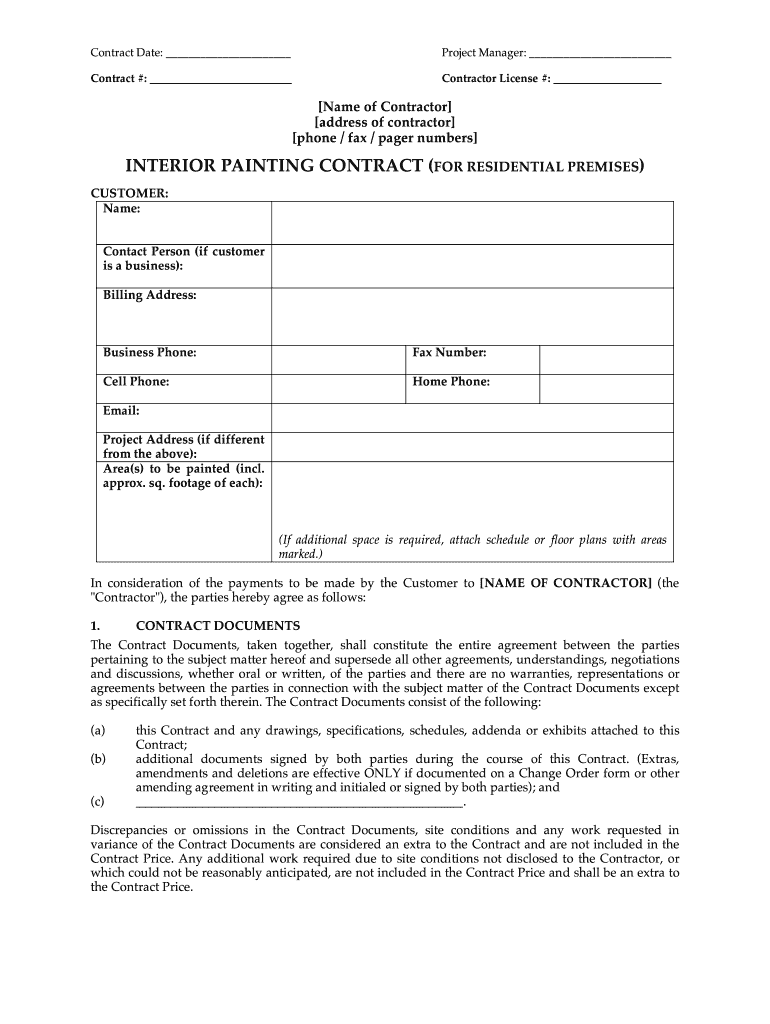

A painting contract is a legally binding agreement between a client and a painting contractor. This document outlines the scope of work, including specific details about the project, such as the type of painting services to be performed, the materials to be used, and the timeline for completion. It serves to protect both parties by clearly defining expectations and responsibilities, thereby minimizing misunderstandings. A well-structured painting contract can also include payment terms, warranties, and conditions for termination, ensuring that all aspects of the project are covered.

Key elements of the painting contract

Understanding the essential components of a painting contract is crucial for both clients and contractors. Key elements typically include:

- Scope of Work: A detailed description of the tasks to be completed, including surface preparation, painting techniques, and any additional services.

- Timeline: A clear schedule outlining start and completion dates, as well as any milestones throughout the project.

- Payment Terms: Information regarding the total cost, payment schedule, and acceptable payment methods.

- Materials: Specifications on the types and brands of paint and other materials to be used, ensuring quality and durability.

- Warranties: Any guarantees regarding the work performed, including touch-ups or repairs within a specified timeframe.

- Termination Conditions: Criteria under which either party may terminate the contract, protecting both sides in case of disputes.

Steps to complete the painting contract

Completing a painting contract involves several important steps to ensure clarity and legal validity. These steps typically include:

- Drafting the Contract: Use a painting contract template to create a draft, ensuring all key elements are included.

- Reviewing the Details: Both parties should carefully review the contract to confirm that all information is accurate and comprehensive.

- Negotiating Terms: Discuss any changes or adjustments needed to meet both parties' expectations.

- Signing the Contract: Once agreed upon, both parties should sign the document, ideally in the presence of a witness or notary for added legal protection.

- Storing the Document: Keep a copy of the signed contract in a secure location for future reference.

Legal use of the painting contract

To ensure the painting contract is legally enforceable, it must comply with state and federal laws. This includes adhering to regulations regarding electronic signatures, as outlined in the ESIGN and UETA acts. It is essential to include all necessary elements and to ensure that both parties have the legal capacity to enter into the agreement. Additionally, having a clear dispute resolution process within the contract can help address any issues that arise during the project.

How to obtain the painting contract

Obtaining a painting contract can be done through several methods. Many contractors provide their own templates, which can be customized to fit specific project needs. Alternatively, clients can find free or paid templates online that adhere to legal standards. When selecting a template, it is important to ensure it includes all necessary components and is suitable for the specific type of painting services required. Consulting with a legal professional can also provide valuable insights into creating a contract that meets all legal requirements.

Examples of using the painting contract

Examples of how a painting contract can be utilized include:

- Residential Projects: Homeowners can use a painting contract when hiring a contractor for interior or exterior painting, ensuring that all details are agreed upon.

- Commercial Contracts: Businesses may require a more detailed contract for larger projects, including specifications for multiple locations or specialized services.

- Specialty Services: Contracts can be tailored for unique projects, such as murals or decorative finishes, outlining specific artistic requirements.

Quick guide on how to complete painting contractor forms

The simplest method to obtain and sign Painting Contract

When considering an entire organization, ineffective workflows concerning document authorization can consume a signNow amount of productive hours. Signing documents such as Painting Contract is an integral component of operations across all sectors, which is why the productivity of each agreement’s timeline greatly impacts the business’s overall effectiveness. With airSlate SignNow, signing your Painting Contract can be as straightforward and speedy as possible. This platform offers you the most recent version of practically any form. Even better, you can sign it immediately without the need to install additional software on your computer or print out physical copies.

Steps to obtain and sign your Painting Contract

- Explore our collection by category or utilize the search bar to find the required form.

- View the form preview by clicking on Learn more to verify it’s the correct one.

- Select Get form to start editing right away.

- Fill out your form and input any essential information using the toolbar.

- Once completed, click the Sign tool to affix your signature to the Painting Contract.

- Choose the signature method that works best for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything necessary to manage your documents effectively. You can locate, complete, edit, and even send your Painting Contract all in one tab with minimal effort. Simplify your workflows by adopting a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the painting contractor forms

How to create an eSignature for the Painting Contractor Forms in the online mode

How to make an eSignature for the Painting Contractor Forms in Google Chrome

How to make an electronic signature for signing the Painting Contractor Forms in Gmail

How to make an electronic signature for the Painting Contractor Forms straight from your smart phone

How to generate an electronic signature for the Painting Contractor Forms on iOS devices

How to make an electronic signature for the Painting Contractor Forms on Android OS

People also ask

-

What is a Painting Contract?

A Painting Contract is a legal agreement between a painter and a client that outlines the scope of work, pricing, and terms for a painting job. It ensures that both parties have a clear understanding of the project requirements and expectations. Using airSlate SignNow, you can easily create and eSign a Painting Contract to streamline the process.

-

How does airSlate SignNow simplify creating a Painting Contract?

airSlate SignNow provides a user-friendly platform that allows you to draft and customize your Painting Contract quickly. With its drag-and-drop document editor, you can easily add specific terms, conditions, and pricing details that suit your needs. Plus, the eSigning feature ensures that your contract is signed promptly and securely.

-

What features does airSlate SignNow offer for managing Painting Contracts?

airSlate SignNow offers several features tailored for managing Painting Contracts, including document templates, automated reminders for contract renewals, and secure storage. These features help you keep track of multiple contracts and ensure timely execution. Additionally, you can integrate it with other tools, enhancing your workflow.

-

Is there a cost associated with using airSlate SignNow for a Painting Contract?

Yes, airSlate SignNow offers flexible pricing plans based on your business needs. You can choose between monthly or annual subscriptions, which provide access to essential features for drafting and managing Painting Contracts. The investment is cost-effective, especially when considering the time saved in contract management and eSigning.

-

Can I integrate airSlate SignNow with other applications for my Painting Contract needs?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Salesforce, and Dropbox. This allows you to import necessary documents and manage your Painting Contracts alongside other business processes, enhancing productivity and organization.

-

What are the benefits of using airSlate SignNow for Painting Contracts?

Using airSlate SignNow for Painting Contracts offers numerous benefits, including reduced paperwork, faster contract turnaround times, and improved client communication. The eSigning feature eliminates the need for physical signatures, making the whole process more efficient. Plus, digital storage keeps your contracts secure and accessible.

-

How can I ensure my Painting Contract is legally binding with airSlate SignNow?

When you eSign a Painting Contract using airSlate SignNow, it is legally binding as long as all parties involved agree to the terms. The platform complies with electronic signature laws, ensuring that your signed documents hold up in court. Always ensure that all details are accurate and all parties have signed before starting the painting project.

Get more for Painting Contract

Find out other Painting Contract

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation