Form PT 350 I 2022

What is the Form PT 350 I

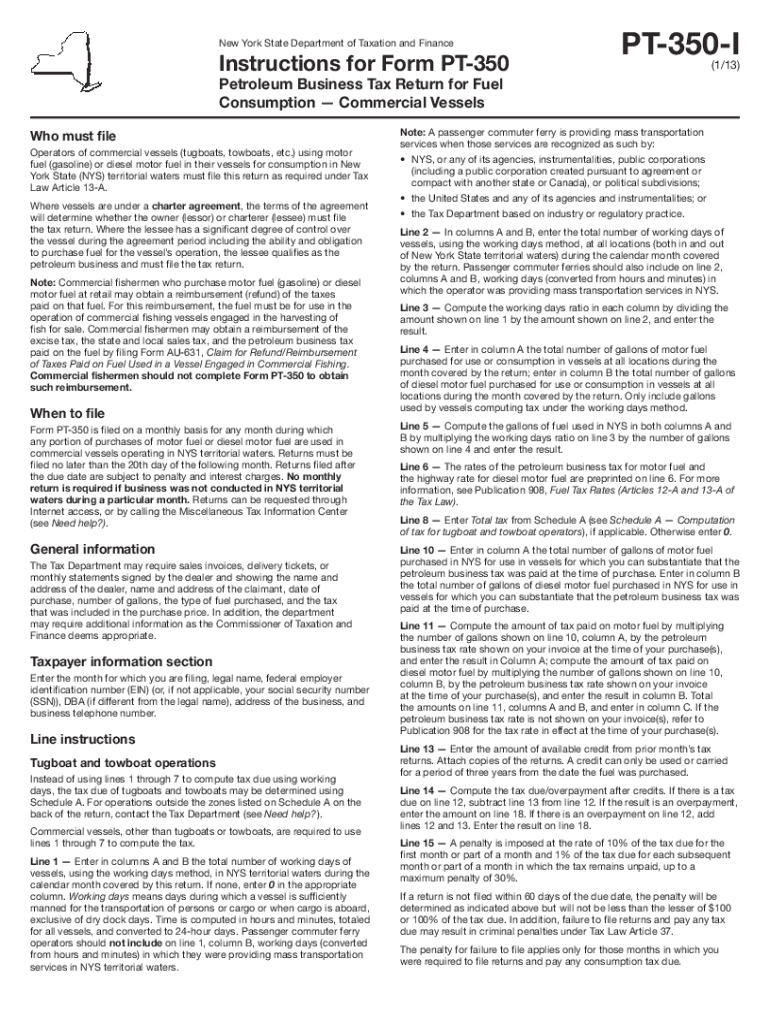

The Form PT 350 I is a specific tax form used in the United States for reporting certain financial information to the appropriate state authorities. This form is primarily utilized by individuals or entities engaged in particular business activities that require disclosure of income, expenses, and other relevant financial data. Understanding the purpose and requirements of Form PT 350 I is essential for compliance with state tax regulations.

How to use the Form PT 350 I

To effectively use the Form PT 350 I, individuals or businesses must first determine if they are required to file it based on their financial activities. Once it is established that the form is necessary, users should carefully fill out each section, ensuring that all information is accurate and complete. It may be beneficial to consult with a tax professional to ensure proper usage and compliance with state laws.

Steps to complete the Form PT 350 I

Completing the Form PT 350 I involves several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out each section of the form, providing accurate information as required.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Form PT 350 I

The legal use of Form PT 350 I is governed by state tax laws. It is crucial for filers to ensure that they are using the form in accordance with these regulations to avoid potential legal issues. Misuse or failure to file the form when required can result in penalties, including fines or additional taxes owed. Understanding the legal implications of this form is vital for compliance.

Key elements of the Form PT 350 I

Key elements of the Form PT 350 I typically include sections for reporting income, detailing expenses, and providing identifying information about the filer. Each section is designed to capture specific financial data that state authorities require for accurate tax assessment. Ensuring that all key elements are filled out correctly is essential for the form's acceptance.

Form Submission Methods

The Form PT 350 I can be submitted through various methods, including online filing, mailing a paper copy, or delivering it in person to the appropriate state office. Each submission method may have different processing times and requirements, so it is important to choose the method that best suits the filer’s needs while ensuring compliance with state deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Form PT 350 I vary by state and can depend on the type of business activity being reported. It is essential for filers to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to the form can help ensure timely submission and compliance with all legal requirements.

Quick guide on how to complete form pt 350 i

Effortlessly prepare Form PT 350 I on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents swiftly without any delays. Manage Form PT 350 I on any device using the airSlate SignNow Android or iOS applications and streamline any document-focused tasks today.

How to modify and electronically sign Form PT 350 I effortlessly

- Obtain Form PT 350 I and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Form PT 350 I and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form pt 350 i

Create this form in 5 minutes!

How to create an eSignature for the form pt 350 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form PT 350 I and how can it benefit my business?

Form PT 350 I is a crucial document for businesses that need to manage their tax obligations efficiently. By utilizing airSlate SignNow, you can easily fill out, send, and eSign Form PT 350 I, streamlining your workflow and ensuring compliance with tax regulations.

-

How much does it cost to use airSlate SignNow for Form PT 350 I?

airSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage Form PT 350 I effectively.

-

What features does airSlate SignNow provide for managing Form PT 350 I?

With airSlate SignNow, you can access features like customizable templates, secure eSigning, and document tracking specifically for Form PT 350 I. These features enhance your document management process, making it more efficient and reliable.

-

Can I integrate airSlate SignNow with other software for Form PT 350 I?

Yes, airSlate SignNow offers seamless integrations with various software applications, allowing you to manage Form PT 350 I alongside your existing tools. This integration capability enhances your productivity and ensures a smooth workflow.

-

Is airSlate SignNow secure for handling Form PT 350 I?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including Form PT 350 I. Your data is encrypted and stored securely, ensuring that your sensitive information remains confidential.

-

How can airSlate SignNow improve the efficiency of processing Form PT 350 I?

By using airSlate SignNow, you can automate the process of filling out and signing Form PT 350 I, signNowly reducing the time spent on manual tasks. This efficiency allows your team to focus on more critical aspects of your business.

-

What support options are available for users of Form PT 350 I on airSlate SignNow?

airSlate SignNow provides comprehensive support options, including tutorials, FAQs, and customer service representatives to assist you with Form PT 350 I. Whether you have a question about features or need technical assistance, help is readily available.

Get more for Form PT 350 I

Find out other Form PT 350 I

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word