Louisiana Tax Form R 1393

What is the Louisiana Tax Form R 1393

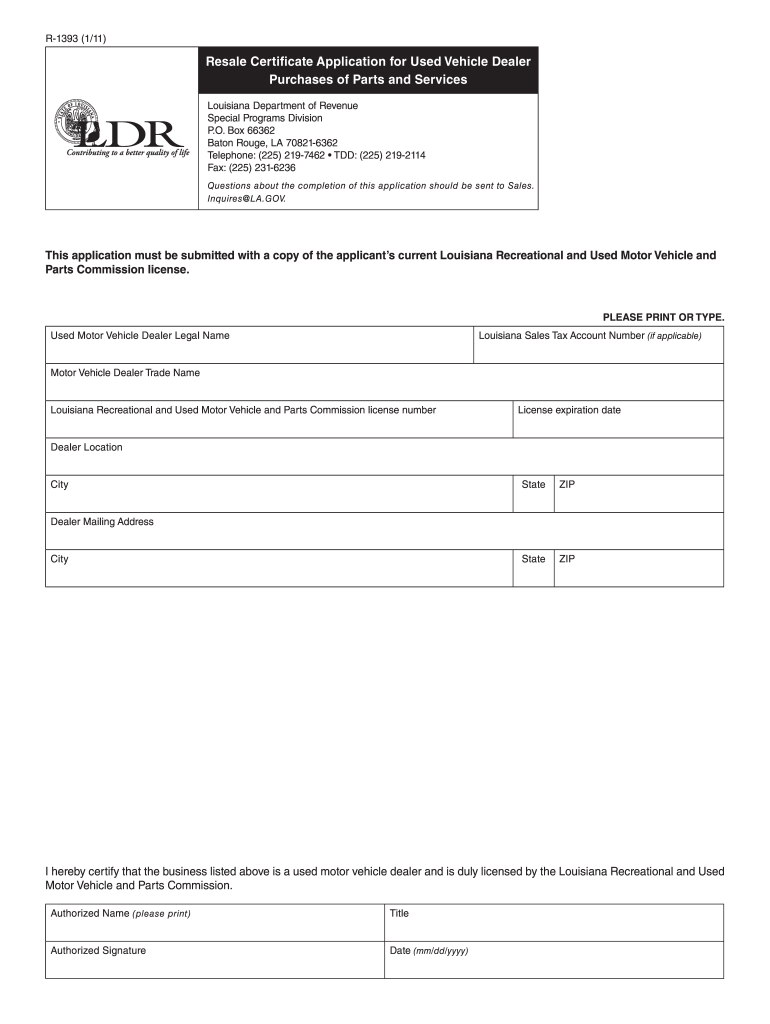

The Louisiana Tax Form R 1393 is a crucial document used for tax purposes in the state of Louisiana. This form is typically required for various tax-related filings, including income tax returns. It serves to collect essential information from taxpayers, ensuring compliance with state tax laws. Understanding the purpose and requirements of this form is essential for accurate and timely filing.

How to use the Louisiana Tax Form R 1393

Using the Louisiana Tax Form R 1393 involves several steps to ensure that all necessary information is accurately provided. Taxpayers should first gather all relevant financial documents, such as income statements and previous tax returns. Once the form is obtained, individuals can fill it out by entering their personal details, income information, and any applicable deductions or credits. It is important to review the completed form for accuracy before submission to avoid any issues with the tax authority.

Steps to complete the Louisiana Tax Form R 1393

Completing the Louisiana Tax Form R 1393 requires careful attention to detail. Follow these steps for successful completion:

- Obtain the form from the official Louisiana Department of Revenue website or authorized sources.

- Fill in personal information, including name, address, and Social Security number.

- Provide details about income sources, including wages, self-employment income, and other earnings.

- Include any deductions or credits that apply to your situation, ensuring you have supporting documentation.

- Review the form thoroughly for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Louisiana Tax Form R 1393

The Louisiana Tax Form R 1393 is legally binding when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must adhere to specific guidelines regarding signatures and the submission process. Utilizing a reputable electronic signature platform can enhance the legal standing of the form, as it provides a secure method for signing and storing documents while ensuring compliance with applicable laws.

Filing Deadlines / Important Dates

Staying informed about filing deadlines is crucial for taxpayers using the Louisiana Tax Form R 1393. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is April fifteenth each year. However, it is advisable to check for any state-specific extensions or changes that may affect the due date. Marking these important dates on a calendar can help ensure timely submission and avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Louisiana Tax Form R 1393 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Louisiana Department of Revenue’s e-filing system, which allows for quick processing.

- Mailing the completed form to the appropriate address provided by the state tax authority.

- In-person submission at designated tax offices, which may offer assistance in completing the form.

Quick guide on how to complete louisiana tax form r 1393

Effortlessly Prepare Louisiana Tax Form R 1393 on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Louisiana Tax Form R 1393 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

Easiest Method to Modify and eSign Louisiana Tax Form R 1393 with Ease

- Obtain Louisiana Tax Form R 1393 and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Alter and eSign Louisiana Tax Form R 1393 and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the louisiana tax form r 1393

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Louisiana Tax Form R 1393?

The Louisiana Tax Form R 1393 is a state-specific form used for various tax purposes, including reporting and remittance of sales tax. Understanding this form is essential for businesses operating in Louisiana to comply with state tax regulations.

-

How does airSlate SignNow help with Louisiana Tax Form R 1393?

airSlate SignNow provides an efficient platform to complete and eSign Louisiana Tax Form R 1393. Our seamless document management system allows users to fill out, sign, and submit the form electronically, ensuring compliance and saving valuable time.

-

What are the pricing options for using airSlate SignNow for Louisiana Tax Form R 1393?

airSlate SignNow offers affordable pricing plans tailored to different business needs. You can choose from monthly or yearly subscriptions, which allow you to access features specific to managing Louisiana Tax Form R 1393 at a competitive rate.

-

What features does airSlate SignNow offer for handling Louisiana Tax Form R 1393?

With airSlate SignNow, you can easily fill, sign, and share the Louisiana Tax Form R 1393. Additional features include cloud storage, templates for recurring forms, and automated workflows to ensure timely filing and compliance.

-

Can I integrate airSlate SignNow with my existing tax software for Louisiana Tax Form R 1393?

Absolutely! airSlate SignNow offers integrations with various tax software and business applications, making it easy to manage Louisiana Tax Form R 1393 along with your other financial solutions. This ensures a streamlined process and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for Louisiana Tax Form R 1393?

Using airSlate SignNow for Louisiana Tax Form R 1393 offers several benefits, including increased efficiency, reduced paper clutter, and streamlined compliance. With electronic signatures, you can expedite the approval process and keep your tax filing timely.

-

Is airSlate SignNow secure for submitting Louisiana Tax Form R 1393?

Yes, airSlate SignNow prioritizes security and employs high-level encryption protocols to protect your sensitive information. Your Louisiana Tax Form R 1393 will be safe throughout the eSigning process, ensuring compliance with legal and regulatory standards.

Get more for Louisiana Tax Form R 1393

- Dc dental treatment consent form thedentalconnection

- Feeling faces cube template form

- Vectren revert to owner rto form

- Reinforcement worksheet form

- Interoffice memo template form

- Board of trustees grant application delta college form

- Fillable post completion optional practical training opt regulatory form

- Attach your current i 20 or ds2019 with this form when requesting a travel signature

Find out other Louisiana Tax Form R 1393

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation