Vat Return Form PDF

What is the VAT Return Form PDF?

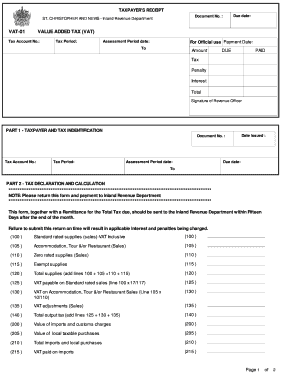

The VAT return form PDF is an official document used by businesses to report their value-added tax (VAT) liabilities to the relevant tax authorities. This form captures essential information regarding sales, purchases, and the amount of VAT owed or reclaimed. It is crucial for ensuring compliance with tax regulations and for maintaining accurate financial records. The form is designed to provide a clear and structured way for businesses to summarize their VAT transactions over a specific period.

Steps to Complete the VAT Return Form PDF

Completing the VAT return form PDF involves several important steps to ensure accuracy and compliance. First, gather all relevant financial documents, including sales invoices, purchase receipts, and previous VAT returns. Next, fill in the required sections of the form, detailing your total sales, total purchases, and the VAT collected and paid. Be sure to double-check your calculations to avoid errors. Finally, sign the form digitally and submit it according to the guidelines provided by your local tax authority.

Legal Use of the VAT Return Form PDF

The VAT return form PDF is legally binding when completed and submitted according to the regulations set forth by tax authorities. To ensure its validity, it must be signed using a reliable eSignature solution that complies with relevant laws such as the ESIGN Act and UETA. These laws establish the legal framework for electronic signatures, ensuring that the signed document is recognized as valid in a court of law. It is essential to understand these legal requirements to avoid potential issues with tax compliance.

Form Submission Methods (Online / Mail / In-Person)

Submitting the VAT return form PDF can be done through various methods, depending on the preferences of the business and the requirements of the tax authority. Common submission methods include:

- Online Submission: Many tax authorities allow businesses to submit their VAT returns electronically through secure online portals.

- Mail: Alternatively, businesses can print the completed form and send it via postal mail to the designated tax office.

- In-Person: Some jurisdictions may permit in-person submissions at local tax offices, providing an opportunity for immediate confirmation of receipt.

Filing Deadlines / Important Dates

Filing deadlines for the VAT return form PDF vary by jurisdiction and can significantly impact a business's compliance status. Typically, businesses must submit their VAT returns on a quarterly or annual basis. It is crucial to be aware of specific due dates to avoid penalties. Marking these deadlines on a calendar and setting reminders can help ensure timely submissions and maintain good standing with tax authorities.

Key Elements of the VAT Return Form PDF

The VAT return form PDF contains several key elements that must be accurately completed. These include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Data: Total sales and VAT collected during the reporting period.

- Purchase Data: Total purchases and VAT paid that can be reclaimed.

- Net VAT Payable or Refundable: Calculation of the final VAT liability or refund amount.

Quick guide on how to complete vat return form pdf 49648248

Complete Vat Return Form Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any delays. Handle Vat Return Form Pdf on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Vat Return Form Pdf with ease

- Locate Vat Return Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent parts of your documents or obscure sensitive information using the tools specially offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Vat Return Form Pdf and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat return form pdf 49648248

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a VAT returns form, and why is it important?

A VAT returns form is a document that businesses use to report their value-added tax to the tax authorities. It's essential for ensuring compliance with tax regulations and helps businesses track their VAT obligations effectively.

-

How can airSlate SignNow assist with VAT returns form submissions?

airSlate SignNow streamlines the process of filling out and submitting your VAT returns form. With our easy-to-use eSigning features, you can complete your form electronically, reducing the time spent on administrative tasks.

-

Is there a cost associated with using airSlate SignNow for VAT returns form?

Yes, there is a cost for using airSlate SignNow, but we offer a range of pricing plans tailored to different business needs. These plans are designed to be cost-effective, ultimately saving you time and resources when handling your VAT returns form.

-

What features does airSlate SignNow offer for managing VAT returns form?

airSlate SignNow provides multiple features to manage your VAT returns form efficiently, including customizable templates, automated reminders, and secure document storage. These tools enhance your workflow and ensure accuracy in your submissions.

-

Can I integrate airSlate SignNow with other accounting software for VAT returns form?

Absolutely! airSlate SignNow supports integrations with various accounting software, making it easier to manage your VAT returns form alongside your financial data. This seamless integration helps minimize errors and improves efficiency.

-

What benefits does airSlate SignNow offer for VAT returns form handling?

Using airSlate SignNow for your VAT returns form offers numerous benefits such as reduced paperwork, faster processing times, and enhanced security for sensitive data. Our platform simplifies the eSigning process, ensuring a smooth experience.

-

Is airSlate SignNow compliant with VAT regulations when handling VAT returns form?

Yes, airSlate SignNow is designed to comply with relevant VAT regulations. Our platform ensures that your VAT returns form is handled according to legal standards, providing peace of mind for your business.

Get more for Vat Return Form Pdf

Find out other Vat Return Form Pdf

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free