Lost Wages Form

What is the Lost Wages Form

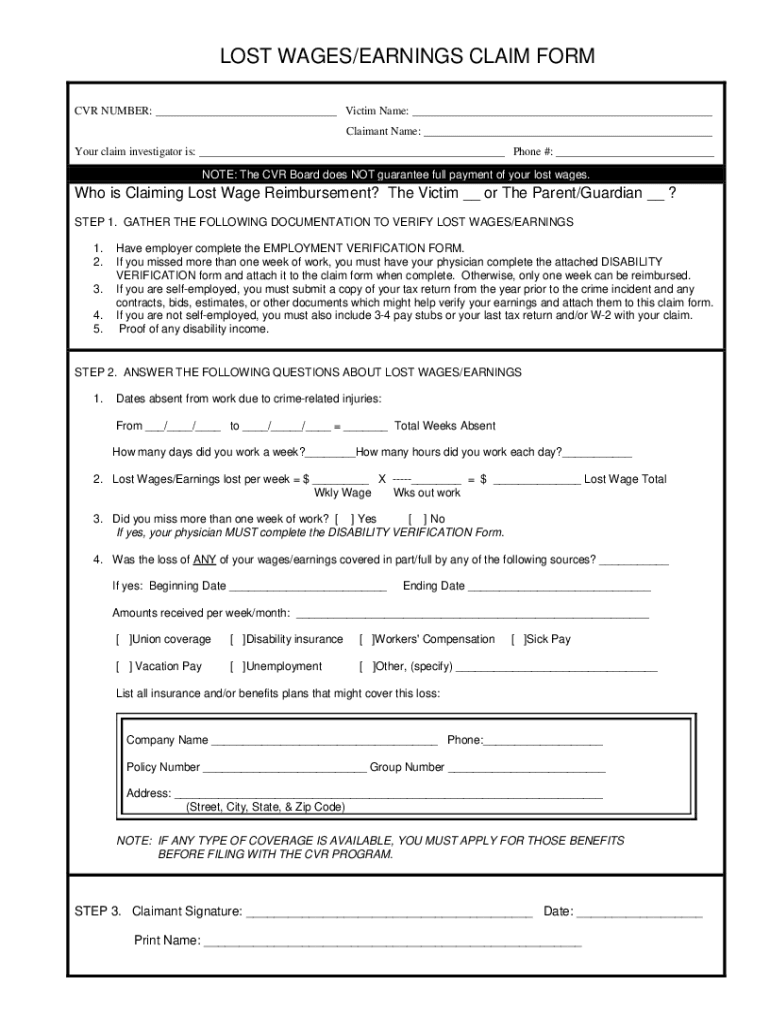

The lost wages form is a document used to report and verify income loss due to various circumstances, such as illness, injury, or unemployment. This form is crucial for individuals seeking compensation from insurance companies or government programs. It typically requires details about the claimant's employment history, the duration of the wage loss, and the amount of income lost. The information provided helps assess the validity of the claim and determines the appropriate compensation amount.

Steps to Complete the Lost Wages Form

Completing the lost wages form involves several key steps to ensure accuracy and compliance. First, gather essential documentation, such as pay stubs, tax returns, and any relevant medical records. Next, fill out the form with precise information regarding your employment status and the reasons for your wage loss. Be sure to include the dates of your absence and the total amount of wages lost. Finally, review the completed form for any errors before submitting it to the appropriate entity for processing.

Legal Use of the Lost Wages Form

The lost wages form must be completed in accordance with legal standards to be considered valid. This includes ensuring that the information is truthful and accurately reflects the loss of income. Many jurisdictions require that the form be signed and dated by the claimant, and in some cases, a witness or notary may be needed. Compliance with these legal requirements is essential for the form to be accepted by insurance companies or courts.

Required Documents

When filling out the lost wages form, certain documents are typically required to substantiate your claim. These may include:

- Recent pay stubs or wage statements

- Tax returns from the previous year

- Medical records or documentation regarding your absence

- A letter from your employer confirming your employment status and income

Having these documents ready will help streamline the process and enhance the credibility of your claim.

Form Submission Methods

The lost wages form can be submitted through various methods, depending on the requirements of the entity receiving the form. Common submission methods include:

- Online submission through a secure portal

- Mailing a printed copy to the appropriate office

- In-person delivery at designated locations

Each method may have specific guidelines, so it is important to follow the instructions provided by the receiving entity to avoid delays in processing.

Eligibility Criteria

Eligibility for using the lost wages form typically depends on the circumstances surrounding the income loss. Common criteria include:

- Employment status at the time of the incident

- Duration of the wage loss

- Reason for the income loss, such as medical conditions or layoffs

Meeting these criteria is essential for a successful claim, as they help determine the legitimacy of the request for compensation.

Quick guide on how to complete lost wages form

Effortlessly Prepare Lost Wages Form on Any Device

Digital document management has become increasingly popular among both companies and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Lost Wages Form on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The simplest way to modify and electronically sign Lost Wages Form seamlessly

- Locate Lost Wages Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Lost Wages Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lost wages form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loss wage form?

A loss wage form is a document used to claim compensation for lost wages due to illness or injury. This form typically outlines the period of absence and the amount of income lost. It is essential for employees seeking financial support during recovery.

-

How do I fill out a loss wage form using airSlate SignNow?

Filling out a loss wage form with airSlate SignNow is simple. Users can upload their form, fill in the necessary information digitally, and save it securely. This process saves time and reduces errors compared to traditional paper-based methods.

-

Is there a cost associated with using airSlate SignNow for a loss wage form?

airSlate SignNow offers several plans that cater to different needs, including flexible pricing options for submitting a loss wage form. Users can choose a plan that fits their budget while enjoying full features. A free trial is also available to test the service before committing.

-

What are the benefits of using airSlate SignNow for a loss wage form?

The primary benefits of using airSlate SignNow for a loss wage form include ease of use, enhanced security, and quick turnaround times for document processing. The platform allows for electronic signatures, making the process more efficient. Additionally, it can help streamline communication with your employer or insurance provider.

-

Can I track the status of my loss wage form with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow users to monitor the status of their loss wage form. You can receive notifications when the document is viewed and signed. This feature enhances transparency and keeps you informed throughout the process.

-

Are there integrations available for managing my loss wage form?

airSlate SignNow offers numerous integrations with popular tools and apps, which can further simplify the management of your loss wage form. Whether you use CRM systems or communication platforms, you can integrate SignNow to streamline document workflows. This interconnectivity enhances productivity and organization.

-

How secure is my information when using a loss wage form in airSlate SignNow?

airSlate SignNow prioritizes the security of your information when handling your loss wage form. The platform employs advanced encryption and secure cloud storage to protect your data. Users can rest assured that their sensitive information remains confidential and protected.

Get more for Lost Wages Form

Find out other Lost Wages Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney