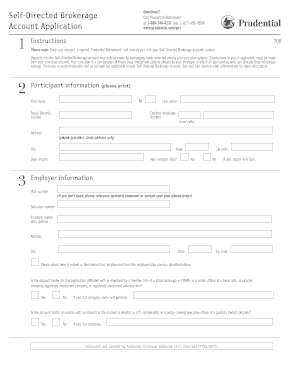

Prudential Self Directed 401k Form

What is the Prudential Self Directed 401k

The Prudential Self Directed 401k is a retirement savings plan that allows participants to have greater control over their investment choices. This plan enables employees to invest their contributions in a variety of investment options, including stocks, bonds, and mutual funds. Unlike traditional 401k plans, which typically offer a limited selection of pre-determined investment choices, the self-directed version empowers individuals to tailor their investment strategies according to their financial goals and risk tolerance.

How to use the Prudential Self Directed 401k

Using the Prudential Self Directed 401k involves several key steps. First, individuals must enroll in the plan through their employer, ensuring they meet any eligibility requirements. Once enrolled, participants can log into their account to access the investment platform. From there, they can select from a wide range of investment options, including individual securities and mutual funds, based on their preferences. Regular monitoring of investments and making adjustments as necessary is crucial to align with changing market conditions and personal financial goals.

Steps to complete the Prudential Self Directed 401k

Completing the Prudential Self Directed 401k involves a series of straightforward steps:

- Enroll in the plan through your employer’s benefits portal.

- Review the available investment options and educational resources provided by Prudential.

- Select your desired investments based on your risk tolerance and retirement goals.

- Monitor your account regularly to track performance and make adjustments as needed.

- Ensure contributions are made consistently to maximize growth potential.

Legal use of the Prudential Self Directed 401k

The legal use of the Prudential Self Directed 401k is governed by federal regulations, including the Employee Retirement Income Security Act (ERISA). To ensure compliance, participants must adhere to contribution limits and withdrawal rules established by the Internal Revenue Service (IRS). Additionally, all investment activities must align with the guidelines set forth by Prudential and applicable laws, ensuring that the plan remains a qualified retirement account.

Key elements of the Prudential Self Directed 401k

Key elements of the Prudential Self Directed 401k include:

- Flexible investment options allowing for a diverse portfolio.

- Employee contributions that can be made on a pre-tax or Roth basis.

- Potential employer matching contributions, enhancing retirement savings.

- Access to educational resources to help participants make informed investment decisions.

- Compliance with IRS regulations to maintain tax advantages.

Required Documents

To enroll in the Prudential Self Directed 401k, participants typically need to provide several documents, including:

- Proof of employment with a participating employer.

- Identification documents, such as a driver’s license or Social Security card.

- Completed enrollment forms, which may include beneficiary designations.

- Financial information to assess risk tolerance and investment preferences.

Quick guide on how to complete prudential self directed 401k

Effortlessly Prepare Prudential Self Directed 401k on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents quickly without delays. Handle Prudential Self Directed 401k on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The Easiest Way to Modify and eSign Prudential Self Directed 401k with Ease

- Obtain Prudential Self Directed 401k and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, boring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Revise and eSign Prudential Self Directed 401k while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prudential self directed 401k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is www prudentialretirement prs?

www prudentialretirement prs is a digital solution offered by Prudential that helps businesses manage retirement plans efficiently. It provides users access to their retirement accounts, allowing for easier document management and eSigning through platforms like airSlate SignNow.

-

How does airSlate SignNow integrate with www prudentialretirement prs?

airSlate SignNow seamlessly integrates with www prudentialretirement prs to facilitate the signing of retirement plan documents. This integration allows users to eSign documents securely and efficiently, ensuring that all paperwork is managed electronically.

-

What are the key features of www prudentialretirement prs?

The key features of www prudentialretirement prs include user-friendly document handling, robust eSigning capabilities, and comprehensive account management tools. Combined with airSlate SignNow, these features provide a streamlined experience for both employees and employers.

-

Is there a cost associated with using www prudentialretirement prs?

The costs associated with www prudentialretirement prs can vary based on the specific services selected. Generally, there may be fees for account management and eSignature services through airSlate SignNow, which is known for providing cost-effective solutions.

-

What benefits does www prudentialretirement prs provide to businesses?

www prudentialretirement prs offers numerous benefits to businesses, including improved efficiency in handling retirement documents and enhanced compliance with regulatory requirements. Using airSlate SignNow further simplifies the process of eSigning and managing contracts.

-

Can small businesses benefit from www prudentialretirement prs?

Yes, small businesses can greatly benefit from www prudentialretirement prs by utilizing its easy-to-use features to manage retirement plans efficiently. The integration with airSlate SignNow allows for quick and cost-effective eSigning, making it accessible for businesses of all sizes.

-

What types of documents can be signed using airSlate SignNow with www prudentialretirement prs?

With airSlate SignNow and www prudentialretirement prs, users can sign a variety of documents including retirement plan enrollment forms, beneficiary designation forms, and fund transfer documents. This functionality ensures that all necessary paperwork can be processed digitally.

Get more for Prudential Self Directed 401k

- How to fill out a mar form

- Gimc affidavit form

- Marriage consent form for applicants 17 years of age

- Firehouse subs menu printable form

- Wife addicted to evony and unable to see the damage its form

- Official policy handbook for production facilities and equipment rohan sdsu form

- Middle school science safety contract page 1 of 2 form

- Fixed price contract template 787751754 form

Find out other Prudential Self Directed 401k

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast