Cbt 100 Form

What is the Cbt 100 Form

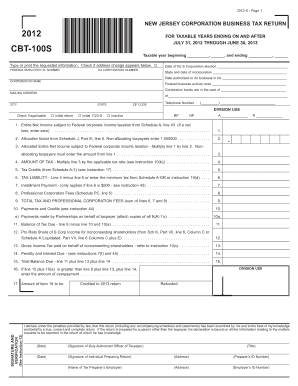

The Cbt 100 Form is a tax document used by corporations in the United States to report their income, deductions, and credits to the state. This form is essential for ensuring compliance with state tax laws and is typically required for corporations doing business within a specific state. It provides a comprehensive overview of the corporation's financial activities during the tax year, allowing tax authorities to assess the corporation's tax liability accurately.

How to use the Cbt 100 Form

Using the Cbt 100 Form involves several steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect the corporation's financial situation. It is crucial to review the completed form for any errors before submission. Finally, submit the form to the appropriate state tax authority by the designated deadline to avoid penalties.

Steps to complete the Cbt 100 Form

Completing the Cbt 100 Form requires careful attention to detail. The following steps outline the process:

- Gather all relevant financial documents, such as income statements and balance sheets.

- Access the Cbt 100 Form from the state's tax authority website or obtain a physical copy.

- Fill in the corporation's name, address, and identification number at the top of the form.

- Report total income, deductions, and credits in the designated sections.

- Double-check all calculations for accuracy.

- Sign and date the form, ensuring that it is submitted by the deadline.

Legal use of the Cbt 100 Form

The Cbt 100 Form serves a legal purpose in the corporate tax filing process. It is a formal declaration of a corporation's financial activities and must be completed accurately to comply with state tax laws. Failure to properly use this form can result in legal repercussions, including fines and penalties. Therefore, it is essential for corporations to understand the legal implications of their filings and ensure that all information provided is truthful and complete.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Cbt 100 Form to avoid late fees and penalties. Typically, the form is due on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. It is advisable to check with the state tax authority for any specific deadlines or extensions that may apply.

Who Issues the Form

The Cbt 100 Form is issued by the state tax authority where the corporation is registered. Each state may have its own version of the form, tailored to its specific tax laws and regulations. Corporations should ensure they are using the correct form for their state to ensure compliance and accurate reporting. It is important to verify the issuing authority and any updates to the form that may occur annually.

Quick guide on how to complete cbt 100 form

Complete Cbt 100 Form effortlessly on any device

Managing documents online has become widely accepted by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely keep it on the internet. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Cbt 100 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest way to modify and eSign Cbt 100 Form without hassle

- Obtain Cbt 100 Form and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent portions of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to finalize your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Cbt 100 Form and ensure excellent communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cbt 100 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cbt 100 Form and how does it work?

The Cbt 100 Form is a critical document used for various business purposes, including tax compliance. With airSlate SignNow, you can seamlessly create, send, and eSign this form, ensuring that it's accurately completed and securely managed.

-

How much does it cost to use airSlate SignNow for Cbt 100 Forms?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. You can efficiently manage Cbt 100 Forms and other documents at competitive rates, making it a cost-effective solution for your needs.

-

What features does airSlate SignNow provide for managing Cbt 100 Forms?

With airSlate SignNow, you can take advantage of features like customizable templates, secure cloud storage, and electronic signatures for Cbt 100 Forms. These features help streamline your document workflow and ensure compliance.

-

Can I integrate airSlate SignNow with other software for managing Cbt 100 Forms?

Yes, airSlate SignNow provides integrations with various software applications, allowing you to enhance your workflow. This capability ensures that you can easily incorporate the Cbt 100 Form into your existing business processes.

-

What benefits can I expect from using airSlate SignNow for Cbt 100 Forms?

Using airSlate SignNow for Cbt 100 Forms offers numerous benefits, including reduced processing time, improved accuracy, and enhanced security. By digitizing your documentation process, you can focus on growing your business.

-

Is it easy to eSign Cbt 100 Forms with airSlate SignNow?

Absolutely! airSlate SignNow simplifies the eSigning process for Cbt 100 Forms with its intuitive interface. Users can sign documents from any device, making it quick and hassle-free.

-

What security measures are in place for Cbt 100 Form processing with airSlate SignNow?

airSlate SignNow implements advanced security protocols to protect your Cbt 100 Forms. Features such as encryption, secure access, and audit trails ensure that your documents remain safe and compliant.

Get more for Cbt 100 Form

- Civil restraing orders form

- How to find account number on midfirst bank app form

- Members update form picpa picpa com

- Notice of appearance 111955 form

- 1st quarter payroll tax booklet the city of newark new jersey ci newark nj form

- Claim form ofce stamp royal mail

- 50 down payment contract template form

- 50 50 business contract template form

Find out other Cbt 100 Form

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple