Cg 20 37 04 13 2013-2026

What is the Cg 20 10 04 13

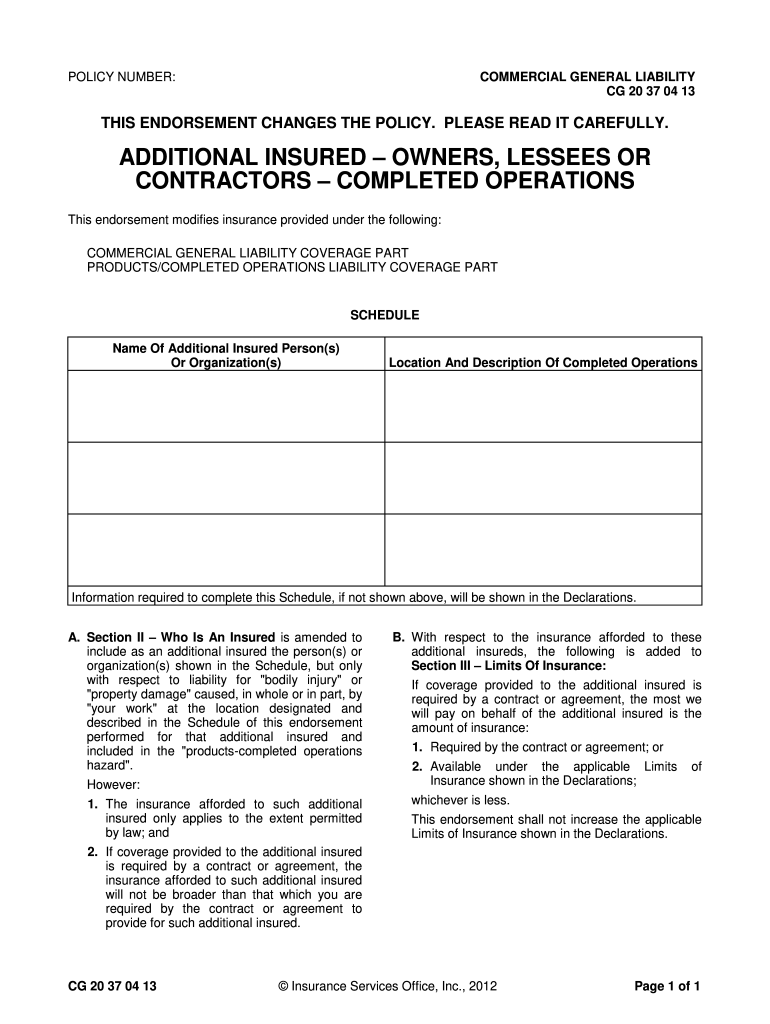

The Cg 20 10 04 13 is a specific endorsement form used in the insurance industry, particularly related to liability coverage. This form is designed to add additional insured parties to an insurance policy, ensuring they are protected under the terms of the policy. It is commonly utilized in various contractual agreements where one party requires coverage under another party's insurance policy. Understanding this form is essential for businesses to ensure compliance with contractual obligations and to mitigate potential liability risks.

How to use the Cg 20 10 04 13

Using the Cg 20 10 04 13 involves several key steps to ensure it is completed accurately. First, identify the parties involved, including the primary insured and the additional insured. Next, fill out the necessary details on the form, such as the names and addresses of the involved parties. It is crucial to ensure that all information is accurate and matches the existing insurance policy. After completing the form, it should be signed by the authorized representative of the primary insured to validate the endorsement. Finally, distribute copies of the completed form to all relevant parties for their records.

Steps to complete the Cg 20 10 04 13

Completing the Cg 20 10 04 13 requires a systematic approach. Follow these steps:

- Gather necessary information about the primary insured and additional insured parties.

- Access the form and fill in the required fields, ensuring accuracy in names, addresses, and policy numbers.

- Review the form for any errors or missing information before finalizing it.

- Obtain the signature of the primary insured to authenticate the endorsement.

- Make copies of the signed form for all parties involved.

Legal use of the Cg 20 10 04 13

The legal use of the Cg 20 10 04 13 is governed by the terms of the insurance policy and relevant state laws. This form serves as a legally binding document that extends coverage to additional insured parties, provided it is executed correctly. It is essential to ensure that the form complies with any specific state regulations regarding insurance endorsements. Failure to use the form properly may result in gaps in coverage or legal disputes, making it crucial for businesses to understand its implications fully.

Key elements of the Cg 20 10 04 13

Several key elements define the Cg 20 10 04 13, including:

- Parties Involved: Clearly identifies the primary insured and additional insured parties.

- Coverage Details: Specifies the nature and extent of coverage provided to the additional insured.

- Policy Information: Includes relevant policy numbers and effective dates.

- Signature Requirement: Must be signed by an authorized representative of the primary insured.

Examples of using the Cg 20 10 04 13

There are various scenarios where the Cg 20 10 04 13 may be utilized. For instance, a contractor may require a subcontractor to be added as an additional insured on their general liability policy to protect against claims arising from the subcontractor's work. Similarly, a property owner may request that a tenant be named as an additional insured on the owner's policy to cover potential liabilities during the lease period. These examples illustrate how the form is essential in managing risk and ensuring adequate coverage in business relationships.

Quick guide on how to complete form additional insured

The optimal method to obtain and authenticate Cg 20 37 04 13

Across the entirety of your organization, ineffective procedures regarding document approval can use up considerable working time. Signing documents such as Cg 20 37 04 13 is an inherent aspect of operations in any establishment, which is why the productivity of each agreement's lifecycle signNowly impacts the company's overall effectiveness. With airSlate SignNow, signing your Cg 20 37 04 13 can be as straightforward and rapid as possible. You’ll discover on this platform the most recent version of virtually any form. Even better, you can sign it immediately without the necessity of installing external software on your device or printing out any hard copies.

Steps to acquire and sign your Cg 20 37 04 13

- Explore our library by category or utilize the search bar to find the form you require.

- View the form preview by selecting Learn more to confirm it is the correct one.

- Click Get form to start editing instantly.

- Fill out your form and include any necessary details using the toolbar.

- When finished, select the Sign tool to authenticate your Cg 20 37 04 13.

- Pick the signature method that suits you best: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to complete editing and move on to document-sharing options as required.

With airSlate SignNow, you possess everything you need to manage your documentation effectively. You can locate, complete, modify, and even share your Cg 20 37 04 13 all in one tab without any inconveniences. Enhance your workflows by adopting a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

Why does the healthcare system in Canada have such a long wait?

I used to write software to help hospitals keep track of their efficiency, and wait times was one of the things measured. (So were unnecessary tests, length of stay in Hospital, re-admission rates and much more)If you are interested in wait times and getting reports, the Canadian Institute for Health Information CIHI is a valuable resource.There are some things to consider.Triage: Some thing are important (Breathing before Bleeding before Broken) than others, so wait times should be sorted by diagnosis before making claims.Past results show that when Canada sets a target, the system responds to meet it, but you can't optimize everything. Triage as a concept is about setting priorities.Also, consider that workload on the health system is not uniformly spread out. I once broke a bone on Dec 23. I was out of the hospital with everything done, after having an X-ray, (including a copy of my x-rays on CD because they knew I was going to travel after Christmas), my physician talking to a specialist about the results deciding not to do surgery. All done in 3 hours from the time I got *injured*. Yes, that includes getting up, going home, finding a babysitter for my kid, waiting for my wife to come home and bring me to the hospital, limping across the parking lot, going home afterwards, etc. Everything. Apparently Canadians aren't getting sick or injured the Thursday before Christmas Eve. There are other days of the week or year where the emergency rooms are overwhelmed, and wait times skyrocket for a short period. Disease or cultural patterns can make some days have a sudden surge in need for health service.One important indicator that we track is the time from arrival to triage. If we can quickly sort out whom is going to die and whom can apply ice while waiting for the critical cases to go first, we get a preferable trade of higher wait times for non-emergency care and low overall mortality.Some Doctor's practices are better at managing appointments than others. So beware making conclusions about overall performance from a few samples, a classic logical fallacy. With my family Doctor, if you are sick or injured, you see him that day. If you just want an allergy shot or to follow up on a chronic condition, then it is next day or day after scheduled appointment. My wife's doctor (different practice) is nowhere near such schedule control and punctuality. [Any statements about why given the data I have would be purely speculative.]Population Density and Size. It is easier to achieve economies of scale and the efficiencies of specialization with high population and density. It is also easier to reallocate patients to another hospital with available capacity if it is nearby. Those whom compare Canada to France or the UK have to remember those countries have double Canada's population stuffed into less space than Manitoba, just 1 province. If those countries can't run a more efficient health care system, there is something very wrong with them.Pay by Taxes? Well that is a 2 sided coin.Canadian political parties both left and right claim to have plans to have balanced budgets. (This should be taken to mean that the Canadian voters expect the parties to at least claim they have a plan to eventually do so, and is not a partisan endorsement or prescription of how that is to be achieved.)This may come as a surprise to some readers, but a sizable number of Canadians want to keep their taxes low, and sometimes vote in governments with Tax Cuts as their agenda. This often does result in cuts to health care service, such as the Ontario Liberals removing annual eye exams from coverage (around 2004) . So while we do have taxpayer funded health care, it should not be read as unlimited money. We are trying to get value for money. Moving to a public system and away from a private one is sustained by being better value for money. Even those wanting to expand the public health care system are expected to bargain hard to control costs.Here is a hypothetical to make a point: Suppose you have to buy expensive diagnostic equipment, do to 48 "tests" a day. One unit can do one test an hour. As the purchasing manager, do you buy 2 of them, and run 24 hours a day, or 4 and let the techs sleep at night? If you buy 4, you have spent twice the money to achieve the same speed of service. If you can't line up the people needing the test to fill that queue 24 hours a day, you can't get away with buying only 2. Idle capacity costs money. If there is always 1 new person in line to get service as a test begins, you can maximize throughput and eliminate down-time. To a certain extent, wait times are about minimizing idle capacity.Next time you are in a hospital ward and there is no nurse at the station, remember that admins want their nurses doing patient care over 80% of the time. So 80% of the time they are out doing rounds and actively taking care of people instead of being available at the station. One will eventually return to the station, and one will definitely respond to the emergency button.Cuts that remove idle capacity are often called 'trimming the fat' and don't impact wait times. Other cuts do eliminate capacity or fail to provide service, so there are other issues. In some ways, this is dumping costs off the taxpayer and onto the sick, privatization by stealth.This is to illustrate that there is a tension between financial efficiency and speed of service. Sometimes we make good choices to achieve both. There are also cases where improving patient throughput at a lower cost per patient raises total costs because more people can get service faster. In the spirit of a non-partisan forum, I'll leave it to the Canadian readers to decide which politicians at a particular moment are cutting services to achieve budget targets and which ones are finding efficiencies and yielding real savings.Then there is something to consider: How much surplus capacity is needed in case of emergency, seasonal variance, or a crisis that can quarantine hospitals, such as SARS?In part America is paying for surplus capacity, UN-required tests, profit margins, massive administration, advertising, billing collection and bad debts, and other business overheads. Unlike America, other countries try to do bulk purchasing to negotiate better deals for drugs. This is part of how other countries can spend a lot less per citizen on health and get comparable or better results.In general Canada does quite well at giving priority to doing things to save lives faster rather than elective procedures. Remember when comparing health care systems you have to use %of GDP as a measure, since a government dumping a cost off the Taxpayer and onto the taxpayers whom happen to need care helps the Government's bottom line and reduces taxes, but does not make the national system more financially efficient.

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How much money does a doctor make for prescribing you an antidepressant?

Doctors are not paid for writing prescriptions.Doctors are not paid for ordering tests.Doctors are not paid for making referrals.Doctors ARE paid for the time they spend evaluating patients in their office. But only while the patient is actually, physically in the office. The amount that the doctor gets paid to treat you while you are physically in the office depends on how complex the problem was, and whether the doctor needed to do something additional in the office such as get an EKG.Doctors are not paid for answering your phone calls.Doctors are not paid for evaluating your test results.Doctors are not paid for refilling your prescriptions.Doctors are not paid for filling out forms for you.Doctors are not paid for the time they spend on the phone with your FFFFING insurance company trying to get your tests and medications paid for.If you have further questions, be sure to ask.

-

How does a lawyer and the legal profession, in general, justify its ridiculously high fees?

I have a friend who is a graphic designer, and she also gets this question all the time. Angry clients that ask, “It took you 30 minutes to do this! How can you justify charging me $100 for that?!”Her response: it took ten years to learn how to do that in 30 minutes. That’s what you’re paying for.It took me the years spent to get an undergraduate degree. The years spent in law school. The months studying for the bar exam 12 hours a day. The days continuing legal education I need to stay current in the field. The hours I need to spend doing legal research for your specific case.That’s what it takes to do what I do, and at the high level at which I do it.You’re paying for my experience, my knowledge, my skills, and my professionalism. You’re paying for me to do something relatively few people are capable of doing, and to do it right with no mistakes.If it seems easy, it’s because I’ve done my job right.Addendum: Attorneys are ethically prohibited from charging unreasonable fees, and a good attorney will always make clear what the fee arrangement is before taking the case. If you feel that an attorney has charged excessively high or unreasonable fees, there is an ethics board in every state that will hear those complaints. If you’ve tried going to several different attorneys and you discover they’re all in about the same ballpark fees, that’s a good sign that the fees are appropriate to your case, expensive as that may be.

-

How do I buy a car in Dubai?

Knowing how to buy a car in Dubai will allow you to access a market full of luxury cars at affordable prices or, at least, lower than in Europe and other neighboring countries.5 Tips When Buying a Used Car in Dubai, UAEThe city of Dubai in the United Arab Emirates attracts people from all over the world due, in part, to the income of non-tax residents. Owning a car in Dubai is a must, because the city's residential center is quite distant from the commercial and business areas.There is not much in the way of public transport. Dubai residents will find that they can buy either new or used vehicles with relative ease, but they will have to follow a series of points and steps to do so.Eight Steps to follow:Step 1:The first thing is to locate the car model that you are interested in, what you can do through the Internet, thus searching between new and used cars. It is also very common to hold auctions in Dubai with second-hand luxury cars that their previous owners have not been able to pay. Although as a general rule they are much cheaper than in Europe, find out how much the same model costs in this country.Step 2:Once you have made the decision, you should know that you have to meet two very important requirements to buy a car in Dubai:Have a residence visa.Dubai requires vehicle buyers to own a residence visa. Residents of Dubai can obtain the required documentation for residence visas through their employers.Possess a driver's license from the UAE or an international license. Anyone who buys a car in the UAE must have a valid UAE driver's license. Citizens of other countries can use their driver's licenses to obtain a license from the UAE without a driving test. They have to fill out an authorization form in Arabic, pass an eye exam in Dubai, have a passport from their country of origin and pay a fee.Step 3:You can find used cars for sale published in newspaper ads or on the Internet. They can also buy a used car from car dealerships. In addition, you can bid on a used car at an auction.Step 4:Car retailers of new and used cars offer buyers the opportunity to finance their purchase. The terms of the car loans are between one and four years.Step 5:Car buyers who need financing could also get a loan through their bank. The bank will offer the loanee with a series of deferred payment checks that must be given to the dealer once a month.Step 6:The buyer of a used car in Dubai must transfer ownership. The current and previous owner of the car must fill out an application in the Traffic Police, and present the car license plates, registration card, insurance certificate and proof the previous owner has no outstanding debt in the car in order to transfer ownership.Step 7:Any person who owns a car in Dubai should have it insured. The owner can purchase insurance through an insurance company for approximately four to six percent of the value of the vehicle. Car owners must have a driver's license from the UAE, a passport and a car test registered with the previous owner or car dealer to buy insurance in Dubai.Step 8:Once the car is insured, it must be registered. The car dealers will help the new owner with this process for new and used cars.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

How do I hire an off duty law enforcement?

Outside observation: I would suggest contacting your local police or sheriff’s department and asking for the officer in charge of off duty employment assignments. Failing that, if you go to the department’s headquarters, someone should be able to either direct you to the right person or schedule an appointment for you.The department almost certainly has tight regulations about the type of businesses at which an office can work off duty, so it’s best to make certain that yours is not one which violates those regulations. Also, it almost goes without saying, but if you employ an off-duty police officer, then you have to fill out the all of legal employment documentation (I-8, W-4, etc) and you’ll have to pay all of the appropriate employment taxes and fees along with issuing either a 1099 or a W-2 form to them at/around the annual tax time.Additionally, I would suggest that you discuss hiring a law enforcement person with your insurance carrier. If something occurs and someone is injured or even killed in your place of business, you might be liable. If you have not informed your carrier in advance, if or when a claim is submitted, you may find your policy pays slowly or that your carrier will dispute the claim in court.Finally…and this seems to be missed a great deal…if you employ a law enforcement officer, you cannot break the law or talk about friends or family members who do. A police officer is sworn to uphold the laws of the local, state and federal governments. If you are violating any of those laws, you may wish to rethink your decision to hire a law enforcement person.

Create this form in 5 minutes!

How to create an eSignature for the form additional insured

How to create an eSignature for your Form Additional Insured online

How to generate an eSignature for your Form Additional Insured in Chrome

How to create an electronic signature for putting it on the Form Additional Insured in Gmail

How to create an electronic signature for the Form Additional Insured right from your smart phone

How to create an electronic signature for the Form Additional Insured on iOS

How to make an electronic signature for the Form Additional Insured on Android OS

People also ask

-

What is Cg 20 37 04 13 and how does it relate to airSlate SignNow?

Cg 20 37 04 13 refers to a specific configuration or feature set within the airSlate SignNow platform. This powerful solution empowers businesses to send and eSign documents seamlessly, ensuring compliance and security in digital transactions.

-

What are the pricing options for airSlate SignNow under Cg 20 37 04 13?

airSlate SignNow offers flexible pricing plans tailored to fit various business needs under Cg 20 37 04 13. You can choose from individual plans, team plans, or enterprise solutions, all designed to provide cost-effective eSigning capabilities.

-

What features does Cg 20 37 04 13 include in airSlate SignNow?

Cg 20 37 04 13 encompasses a range of features in airSlate SignNow, including document templates, advanced eSignature options, and real-time tracking. These features enhance user experience and streamline the document signing process for businesses.

-

How can Cg 20 37 04 13 benefit my business?

Implementing Cg 20 37 04 13 with airSlate SignNow can signNowly improve your business efficiency. It simplifies the document signing process, reduces turnaround time, and enhances collaboration among team members.

-

Can I integrate Cg 20 37 04 13 with other software?

Yes, Cg 20 37 04 13 allows for seamless integration with various software solutions. airSlate SignNow supports integrations with CRM systems, cloud storage, and other business applications to streamline workflows.

-

Is Cg 20 37 04 13 secure for handling sensitive documents?

Absolutely, Cg 20 37 04 13 is designed with security in mind. airSlate SignNow employs industry-standard encryption and compliance measures to ensure that all documents and signatures are protected from unauthorized access.

-

What support options are available for Cg 20 37 04 13 users?

Users of Cg 20 37 04 13 can access comprehensive support through airSlate SignNow, including online resources, tutorials, and dedicated customer service. Our support team is ready to assist with any questions or issues you may encounter.

Get more for Cg 20 37 04 13

Find out other Cg 20 37 04 13

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free