Vat 41 Form

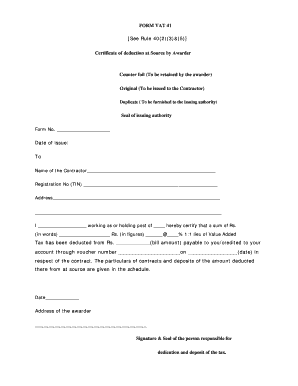

What is the VAT 41 Form

The VAT 41 form is a crucial document used primarily for tax purposes in the United States. It serves as a vehicle for taxpayers to claim refunds on sales tax paid on purchases made for business use. This form is essential for businesses that wish to recover sales tax costs associated with their operations. Understanding the purpose and significance of the VAT 41 form can help ensure compliance with tax regulations while maximizing potential refunds.

How to Use the VAT 41 Form

Using the VAT 41 form involves several key steps. First, gather all relevant documentation that supports your claim for a refund. This includes receipts and invoices that detail the sales tax paid on purchases. Next, accurately fill out the form, ensuring that all required fields are completed. It's important to double-check your entries for accuracy to avoid delays in processing. Once the form is completed, it can be submitted according to the guidelines provided by the tax authority.

Steps to Complete the VAT 41 Form

Completing the VAT 41 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documentation, including receipts and invoices.

- Fill in your business information, including name, address, and tax identification number.

- List the items purchased and the corresponding sales tax paid.

- Calculate the total refund amount you are claiming.

- Review the form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal Use of the VAT 41 Form

The legal use of the VAT 41 form is governed by tax regulations that require accurate reporting of sales tax claims. To ensure compliance, it is essential to maintain proper records and documentation that substantiate your claims. Failure to adhere to these regulations can result in penalties or denial of your refund request. It is advisable to consult with a tax professional if you have questions regarding the legal aspects of using the VAT 41 form.

Key Elements of the VAT 41 Form

Several key elements must be included in the VAT 41 form to ensure its validity. These elements include:

- Taxpayer identification information, such as name and address.

- A detailed list of purchases, including dates and amounts.

- The total amount of sales tax paid on these purchases.

- Signature and date to certify the accuracy of the information provided.

Form Submission Methods

The VAT 41 form can be submitted through various methods, depending on the guidelines set by the tax authority. Common submission methods include:

- Online submission through the tax authority's website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices.

Quick guide on how to complete vat 41 form 15896888

Easily Prepare Vat 41 Form on Any Gadget

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage Vat 41 Form on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Effortlessly Edit and eSign Vat 41 Form

- Locate Vat 41 Form and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools designed by airSlate SignNow specifically for this purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form navigation, and errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Vat 41 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 41 form 15896888

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT 41 and how does it relate to airSlate SignNow?

VAT 41 refers to a specific value-added tax rate that can impact transactions in various industries. With airSlate SignNow, businesses can manage their documents to ensure compliance with VAT regulations, including VAT 41. This helps ensure that your electronic signatures and agreements are legally binding and reflect accurate tax obligations.

-

How does airSlate SignNow help with VAT 41 compliance?

airSlate SignNow offers features that streamline the document signing process while ensuring compliance with VAT 41 and other regulations. By using our platform, businesses can generate electronic documents that automatically include VAT 41 calculations, helping to reduce errors and improve efficiency.

-

What are the pricing options available in airSlate SignNow for businesses factoring in VAT 41?

airSlate SignNow provides flexible pricing plans that can accommodate businesses looking to manage VAT 41 transactions. Each plan is designed to deliver value while ensuring compliance with tax regulations. For detailed pricing and features regarding VAT 41, you can visit our pricing page for specific options.

-

Can I integrate airSlate SignNow with other software to manage VAT 41 documents?

Yes, airSlate SignNow integrates seamlessly with various software solutions to facilitate efficient management of VAT 41 documents. Our integrations allow you to connect with accounting and finance tools, enabling automatic updates and ensuring that your VAT 41 obligations are up-to-date.

-

What benefits does airSlate SignNow offer for handling documents requiring VAT 41?

The primary benefit of using airSlate SignNow for documents requiring VAT 41 is the reduction of administrative burden. Our solution automates the signing process, enhances security, and ensures that all document versions remain compliant with VAT 41 regulations, ultimately saving time and reducing legal risks.

-

Is airSlate SignNow user-friendly for handling VAT 41 documentation?

Absolutely! airSlate SignNow is designed with user experience in mind, making it straightforward for anyone to create, send, and sign documents that involve VAT 41. Our intuitive interface ensures that businesses can quickly adapt to the software without extensive training or technical expertise.

-

What types of documents can I manage with airSlate SignNow related to VAT 41?

With airSlate SignNow, you can manage a variety of documents that relate to VAT 41, including invoices, contracts, and purchase agreements. Our platform supports multiple file formats and allows for easy customization to ensure all VAT 41 details are accurately captured and documented.

Get more for Vat 41 Form

Find out other Vat 41 Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation