Irs Letter 12c Response Template Form

What is the IRS Letter 12C Response Template

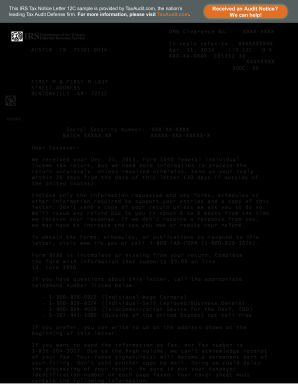

The IRS Letter 12C is a communication sent by the Internal Revenue Service to taxpayers regarding discrepancies or additional information needed for their tax returns. The response template serves as a structured format for taxpayers to address the issues raised in the letter. It typically includes sections for identifying the taxpayer, detailing the specific concerns outlined by the IRS, and providing the necessary documentation or explanations to resolve those concerns. This template ensures that responses are clear, organized, and compliant with IRS requirements.

How to Use the IRS Letter 12C Response Template

Using the IRS Letter 12C response template involves several steps to ensure that your response is complete and accurate. First, carefully read the letter to understand the specific issues the IRS has highlighted. Next, fill out the template by entering your personal information, including your name, address, and Social Security number. Address each point raised in the letter, providing clear explanations or attaching supporting documents where required. Finally, review your response for accuracy and completeness before submitting it to the IRS.

Steps to Complete the IRS Letter 12C Response Template

Completing the IRS Letter 12C response template involves a systematic approach:

- Read the Letter Thoroughly: Understand the issues raised by the IRS.

- Gather Required Documents: Collect any necessary paperwork that supports your response.

- Fill Out the Template: Provide your personal information and address each concern raised in the letter.

- Review Your Response: Ensure all information is accurate and all required documents are attached.

- Submit the Response: Send your completed response to the IRS via the method specified in the letter.

Key Elements of the IRS Letter 12C Response Template

The IRS Letter 12C response template includes several key elements that are essential for a complete response:

- Taxpayer Information: Your name, address, and Social Security number.

- IRS Letter Reference: The date and reference number of the IRS letter.

- Issue Description: A summary of the discrepancies or requests made by the IRS.

- Response Section: Detailed explanations or documentation addressing each issue.

- Signature: A signature to validate the response.

Legal Use of the IRS Letter 12C Response Template

The IRS Letter 12C response template is legally recognized as a formal communication to the IRS. When filled out correctly, it serves as an official record of your response to the IRS's inquiries. It is important to ensure that all information provided is truthful and accurate, as any misrepresentation can lead to penalties or further legal issues. Using this template helps maintain compliance with IRS regulations and provides a clear record of your correspondence.

Examples of Using the IRS Letter 12C Response Template

There are various scenarios in which the IRS Letter 12C response template can be utilized effectively:

- Discrepancies in Income Reporting: If the IRS indicates that your reported income does not match their records, you can use the template to clarify the differences.

- Missing Documentation: If the IRS requests additional documents to support deductions or credits claimed, the template allows you to outline what you are providing.

- Clarification of Tax Status: If there are questions regarding your filing status or exemptions, the template provides a structured way to address these points.

Quick guide on how to complete irs letter 12c response template

Complete Irs Letter 12c Response Template easily on any device

Digital document management has become widely adopted by companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents quickly and without delays. Handle Irs Letter 12c Response Template on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The easiest way to modify and eSign Irs Letter 12c Response Template effortlessly

- Obtain Irs Letter 12c Response Template and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, text (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irs Letter 12c Response Template and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs letter 12c response template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an IRS letter 12C response template?

An IRS letter 12C response template is a pre-formatted document designed to help individuals respond to IRS notifications regarding missing information for their tax returns. This template simplifies the process of compiling necessary information, making it quicker and more efficient to address the IRS's concerns.

-

How can airSlate SignNow help with IRS letter 12C responses?

AirSlate SignNow provides users with an efficient platform to create, sign, and send IRS letter 12C response templates. With features like eSignature and document tracking, users can ensure their responses are submitted timely and securely, aiding in faster resolution of IRS inquiries.

-

Is there a cost associated with using the IRS letter 12C response template on airSlate SignNow?

AirSlate SignNow offers various pricing plans, allowing users to choose one that fits their budget and needs. While the platform may have subscription costs, the efficiency gained from using the IRS letter 12C response template can ultimately save time and reduce stress in the tax response process.

-

What features are included in the IRS letter 12C response template?

The IRS letter 12C response template on airSlate SignNow includes customizable fields for personal information along with pre-written content that guides users on what to include in their response. This ensures that all necessary details are addressed, making compliance with IRS requirements easier.

-

Can I integrate airSlate SignNow with other tools for handling IRS letter 12C responses?

Yes, airSlate SignNow offers integrations with various applications and platforms, enhancing the process of managing IRS letter 12C response templates. Users can connect with popular CRM or document management systems, optimizing workflow and ensuring seamless data transfer.

-

What are the benefits of using airSlate SignNow for IRS letter 12C responses?

Using airSlate SignNow to manage IRS letter 12C responses provides numerous benefits, including increased efficiency, better compliance, and streamlined communication with the IRS. The intuitive interface and robust features make it easy for users to navigate the requirements and respond promptly.

-

How secure is my information when using the IRS letter 12C response template?

AirSlate SignNow prioritizes user security, employing advanced encryption measures to protect sensitive information within the IRS letter 12C response template. Users can confidently handle their tax documents, knowing that their data is safeguarded against unauthorized access.

Get more for Irs Letter 12c Response Template

Find out other Irs Letter 12c Response Template

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP