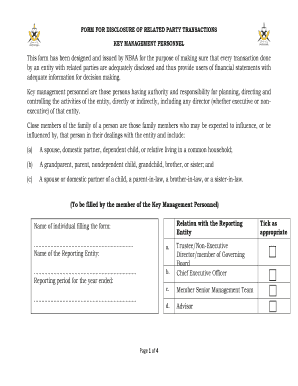

FORM for DISCLOSURE of RELATED PARTY TRANSACTIONS

What is the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

The FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS is a crucial document used by businesses to report transactions between related parties. Related parties may include individuals or entities with a close relationship, such as family members, business partners, or entities under common control. This form ensures transparency and compliance with regulatory requirements, helping to prevent conflicts of interest and maintain the integrity of financial reporting.

Key elements of the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

Understanding the key elements of the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS is essential for accurate completion. Key components typically include:

- Identification of parties: Names and relationships of all related parties involved in the transactions.

- Description of transactions: Detailed accounts of the nature and purpose of each transaction.

- Financial details: Amounts involved in the transactions and any terms or conditions that apply.

- Disclosure of potential conflicts: Any potential conflicts of interest that may arise from the transactions.

Steps to complete the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

Completing the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS involves several steps to ensure accuracy and compliance:

- Gather necessary information about all related parties and the transactions.

- Fill in the identification section with the names and relationships of involved parties.

- Provide a detailed description of each transaction, including its purpose.

- Include financial details, such as transaction amounts and terms.

- Review the form for completeness and accuracy before submission.

Legal use of the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

The FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS is legally binding when completed correctly and submitted to the appropriate regulatory bodies. Compliance with relevant laws, such as the Sarbanes-Oxley Act, is essential to avoid legal repercussions. Organizations must ensure that the form is filled out honestly and accurately, as any misrepresentation can lead to penalties or legal action.

How to use the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

Using the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS effectively involves understanding its purpose and the context in which it is required. This form is typically used during financial audits, annual reports, or when seeking approval for transactions involving related parties. It is important to keep a copy of the completed form for your records and to ensure that all relevant parties are informed of the disclosures made.

Disclosure Requirements

Disclosure requirements for the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS may vary based on jurisdiction and the nature of the business. Generally, businesses must disclose any transactions that exceed a certain monetary threshold or that may influence financial decisions. It is advisable to consult with legal or financial advisors to understand specific disclosure obligations and ensure compliance with applicable regulations.

Quick guide on how to complete form for disclosure of related party transactions

Complete FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can locate the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS without hassle

- Locate FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form for disclosure of related party transactions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS?

The FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS is a vital document used by organizations to report any financial dealings with related parties. This form ensures transparency and compliance with financial regulations, helping stakeholders understand potential conflicts of interest.

-

How can airSlate SignNow help me with the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS?

airSlate SignNow provides a streamlined platform for creating, signing, and managing the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS. Our user-friendly interface allows you to generate this essential document quickly and efficiently, ensuring compliance and saving you valuable time.

-

Is the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS customizable?

Yes, the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS can be fully customized within airSlate SignNow. You can adjust the content to meet your specific requirements, ensuring that all relevant details and disclosures are included for your organization's needs.

-

What are the pricing options for using airSlate SignNow to manage the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS?

airSlate SignNow offers a range of pricing plans tailored to various business needs, starting from a free trial to premium subscriptions. With competitive pricing, you can access all features necessary for effective management of the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS without breaking the bank.

-

Can I eSign the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS using airSlate SignNow?

Absolutely! airSlate SignNow allows you to eSign the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS with just a few clicks. This feature enhances efficiency, ensuring that your documents are signed and securely stored in no time.

-

What integrations does airSlate SignNow offer for managing the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS?

airSlate SignNow integrates seamlessly with various tools like Google Drive, Microsoft Office, and CRM platforms. These integrations allow for a more streamlined process when managing the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS, saving you time and reducing manual input.

-

How secure is my data when using airSlate SignNow for the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and security protocols to ensure that all data, including the FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS, is protected and remains confidential.

Get more for FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

- Rpc 7 5a mjp firm applicationrenewal state bar of nevada form

- Childrens camp additional staff qualifications doh 367a childrens camp additional staff qualifications health ny form

- Employment application part 1pre interview form

- Form dc 418 affidavit default judiciary of virginia

- D 3 political party form

- Civil action answer appendix xi f nj courts form

- Maine judicial branch page 1 of 3 www courts maine gov fm form

- Application for continuance norrycopanet form

Find out other FORM FOR DISCLOSURE OF RELATED PARTY TRANSACTIONS

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document