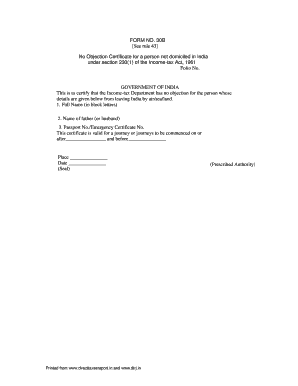

Form 30b Income Tax

What is the Form 30b Income Tax

The Form 30b is a crucial document used in the United States for reporting income tax information. This form is specifically designed for individuals and businesses to declare their income and calculate their tax obligations. It ensures compliance with federal tax regulations and helps taxpayers accurately report their earnings. Understanding the purpose of the Form 30b is essential for meeting legal requirements and avoiding potential penalties.

How to Obtain the Form 30b Income Tax

Obtaining the Form 30b is a straightforward process. Taxpayers can access the form through the official IRS website or other authorized sources. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations. Additionally, many tax preparation software programs offer the option to download and fill out the Form 30b electronically, streamlining the process for users.

Steps to Complete the Form 30b Income Tax

Completing the Form 30b involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with your personal information, income details, and deductions. Double-check all entries for accuracy, as mistakes can lead to delays or penalties. Finally, review the form thoroughly before submitting it to the appropriate tax authority.

Legal Use of the Form 30b Income Tax

The legal use of the Form 30b is governed by federal tax laws. To be considered valid, the form must be completed accurately and submitted within the designated deadlines. Compliance with eSignature laws is also crucial if the form is submitted electronically. Using a reliable eSignature solution can help ensure that the form is executed legally and securely, maintaining its validity in the eyes of the law.

Key Elements of the Form 30b Income Tax

Key elements of the Form 30b include personal identification information, income sources, deductions, and tax credits. Each section must be filled out with precise details to reflect the taxpayer's financial situation accurately. Understanding these elements helps taxpayers provide the necessary information required by the IRS and ensures that they take advantage of available deductions and credits.

Filing Deadlines / Important Dates

Filing deadlines for the Form 30b are critical for ensuring compliance with tax laws. Typically, the form must be filed by April 15 of each year, although extensions may be available under certain circumstances. It is essential to stay informed about any changes to deadlines, as missing them can result in penalties and interest on unpaid taxes. Keeping a calendar of important dates can help taxpayers manage their filing responsibilities effectively.

Quick guide on how to complete form 30b income tax

Effortlessly Prepare Form 30b Income Tax on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and effortlessly. Manage Form 30b Income Tax on any device through the airSlate SignNow applications for Android or iOS, and enhance any document-related task today.

The simplest method to modify and eSign Form 30b Income Tax effortlessly

- Find Form 30b Income Tax and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive data with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information thoroughly and then click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Alter and eSign Form 30b Income Tax while ensuring clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 30b income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 30b?

Form 30b is a legal document used for various purposes, including compliance and reporting. It is essential for businesses to ensure that this form is completed accurately, as it can affect regulatory adherence. Using airSlate SignNow, you can easily fill out and eSign form 30b for seamless processing.

-

How can airSlate SignNow help with form 30b?

airSlate SignNow provides an efficient platform for creating, signing, and managing form 30b documents. With our user-friendly interface, you can quickly navigate the process of filling out this form and getting it eSigned by all necessary parties. This streamlines your workflow and ensures compliance.

-

What are the pricing options for airSlate SignNow when using form 30b?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, whether you're a solo entrepreneur or part of a large organization. Our plans provide access to features that simplify the management of form 30b and other documents. You can choose a plan that fits your budget and operational requirements.

-

Are there any features designed specifically for form 30b in airSlate SignNow?

Yes, airSlate SignNow offers several features specifically designed for handling form 30b. These include customizable templates, the ability to add fields for required information, and options for secure eSigning. These tools enhance collaboration and efficiency when managing this important document.

-

Can I integrate airSlate SignNow with other applications to manage form 30b?

Absolutely! airSlate SignNow supports seamless integration with various applications, allowing you to manage form 30b alongside your existing tools. Integrations with platforms like Google Drive, Dropbox, and CRMs enhance your ability to store, share, and track this form effectively.

-

What benefits does airSlate SignNow provide for eSigning form 30b?

Using airSlate SignNow for eSigning form 30b offers numerous benefits, including speed, security, and convenience. You can sign documents from anywhere, reducing the time spent on paperwork while ensuring that your data is protected through advanced encryption. This enhances both productivity and compliance.

-

Is there a mobile app for managing form 30b in airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that enables users to manage form 30b on the go. With this app, you can create, edit, and eSign documents directly from your smartphone or tablet, ensuring you stay productive even when you are away from your desk.

Get more for Form 30b Income Tax

- Verification of license collection agency hawaii hawaii form

- Usbr design standards form

- C lim download form

- Mini salonshop employee and independent contractor list tdlr form

- Environmental disclosure document indiana form

- 30 day notice to vacate form

- Form 1120me

- Maine electronic filing payment services form

Find out other Form 30b Income Tax

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple