Self Employment Ledger 2010-2026

What is the Self Employment Ledger

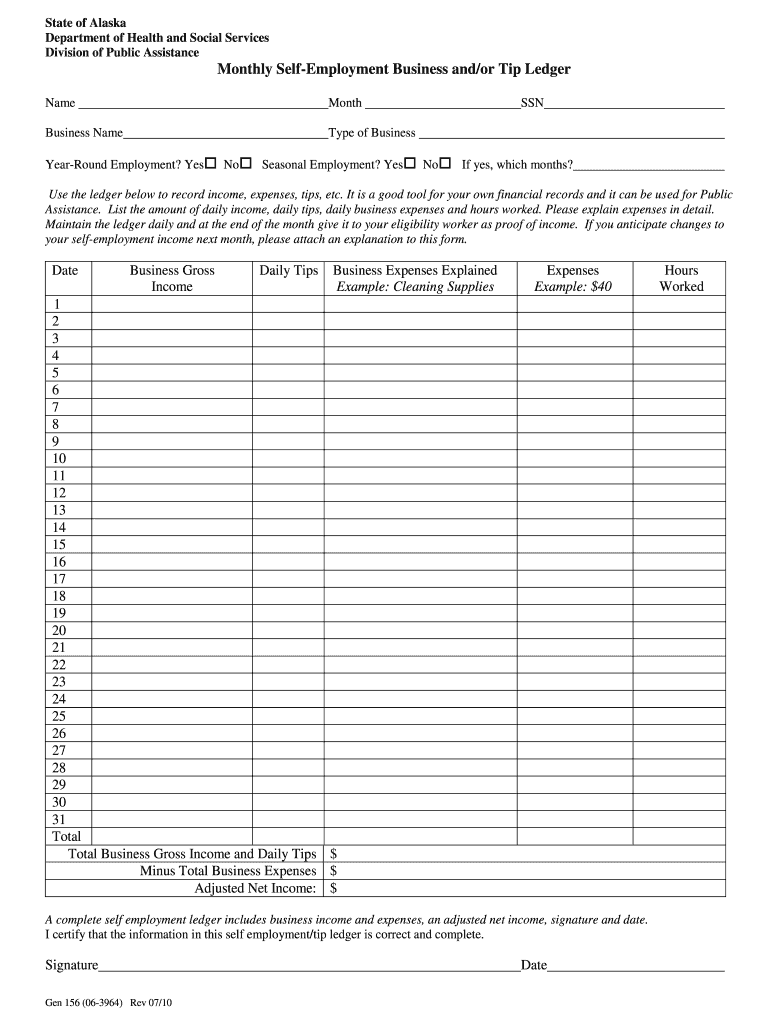

A self employment ledger is a crucial financial document for individuals who are self-employed. It serves as a record of income and expenses related to a business or freelance work. This ledger helps in tracking financial performance and is essential for tax reporting purposes. By maintaining an accurate self employment ledger, individuals can ensure they are compliant with tax regulations and can substantiate their income claims during audits.

How to use the Self Employment Ledger

Using a self employment ledger involves systematically recording all income and expenses related to your self-employment activities. Start by documenting income as it is received, including payments from clients or customers. Next, track all business-related expenses, such as supplies, travel costs, and marketing expenses. It is important to categorize these entries for easier reference and to ensure all deductions are accounted for during tax season. Regularly updating your ledger will provide a clear picture of your financial situation and help in making informed business decisions.

Steps to complete the Self Employment Ledger

Completing a self employment ledger involves several key steps:

- Gather all financial documents, including invoices, receipts, and bank statements.

- Record your income, noting the date, source, and amount for each transaction.

- List all business expenses, categorizing them into appropriate sections such as supplies, utilities, and travel.

- Calculate your total income and total expenses to determine your net profit or loss.

- Review your entries regularly to ensure accuracy and completeness.

Legal use of the Self Employment Ledger

The self employment ledger must comply with IRS guidelines to be considered legally valid. This means that all entries should be accurate and reflect true financial activity. Keeping detailed records can protect you in the event of an audit. The IRS requires self-employed individuals to report their income and expenses accurately, and a well-maintained ledger serves as a reliable source of documentation. Additionally, state-specific regulations may apply, so it is important to be aware of local laws regarding record-keeping for self-employed individuals.

Examples of using the Self Employment Ledger

Examples of using a self employment ledger include tracking income from freelance writing, consulting services, or small business sales. For instance, a freelance graphic designer might record payments from various clients as income while listing software subscriptions and office supplies as expenses. This practice not only aids in tax preparation but also helps the individual analyze their business performance over time. Maintaining a clear record allows for better financial planning and can highlight areas for potential growth or cost-cutting.

IRS Guidelines

The IRS provides specific guidelines for self-employed individuals regarding the maintenance of financial records. According to IRS regulations, self-employed individuals must report all income received, regardless of whether it is in cash or through other means. Expenses must be ordinary and necessary for the business to qualify as deductions. It is essential to keep receipts and documentation for all transactions, as the IRS may require proof of income and expenses during audits. Familiarizing yourself with these guidelines can help ensure compliance and optimize your tax situation.

Quick guide on how to complete self employment ledger documentation form

Manage Self Employment Ledger everywhere, any time

Your everyday business operations may demand additional attention when handling state-specific business documents. Reclaim your work hours and reduce the costs associated with paper-based processes using airSlate SignNow. airSlate SignNow provides you with a variety of preloaded business documents, including Self Employment Ledger, which you can utilize and share with your business associates. Manage your Self Employment Ledger smoothly with powerful editing and eSignature features and send it directly to your recipients.

Steps to obtain Self Employment Ledger in a few clicks:

- Select a document applicable to your state.

- Just click Learn More to open the file and ensure it is accurate.

- Select Get Form to start working on it.

- Self Employment Ledger will automatically appear in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or alter the document.

- Locate the Sign tool to create your personal signature and eSign your document.

- When finished, simply click Done, save changes, and access your file.

- Share the document via email or text message, or use a link-to-fill option with partners or enable them to download the file.

airSlate SignNow signNowly conserves your time managing Self Employment Ledger and enables you to locate essential documents in one location. A comprehensive library of forms is organized and designed to address crucial business processes needed for your enterprise. The advanced editor reduces the likelihood of mistakes, as you can effortlessly correct errors and examine your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business workflows.

Create this form in 5 minutes or less

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

How do I make a ledger for my self-employment?

You can definitely keep a spreadsheet in Google Sheets or Excel with a list of earnings, expenses, transaction details such as date, client, etc…There are plenty of free/freemium apps (free but can pay to unlock premium features) and SaaS products available to use that remove the hassle of designing a spreadsheet and maintaining info on your own.FreshBooks, Xero, and QuickBooks Self-Employed are all examples of mainly desktop services that you can use to powerfully manage your finances. They may be too powerful for your purposes however.Obviously I’m biased, but a free app like ours for freelancers can manage all your earnings and expenses, alert you to available deductions, and give you tax estimates all from your mobile device. You can download it here: Simple Financials for Freelancers and Entrepreneurs

-

What form should I fill out if I am a UK self-employed resident invoicing the EU company?

You question is unclear. Do you mean another company in the EU, or administration of the EU like the Parliament or the Commission.

-

What form do I need to fill out when I’m a self-employee but the business belongs to my sister and mine (IRS question)?

Thanks Bruce. Edited answer below:Ok. It's time you do some reading…and if your business made decent money, get a tax accountant.Self employed / sole proprietor: 1040Self employed / LLC: must file Corp business filing and issue K1 then 1040Self employed / LLC w S Corp option: (you should have been on your own payroll) must file Corp business filing and issue K1, then 1040Self employed / C Corp: (you should have been on your own payroll) must file Corp business filing and issue 1099 DIV, then 1040.Corporate business filing and tax is due March 15. You can extend the filing, but any tax is due the March 15. If you don't pay on or before March 15, fees and interest are applied.Personal filing and tax is due April 15. You can extend the filing, but any tax is due on April 15. If you don't pay on or before April 15, fees and interest are applied.Same for your sister.Don't forget to file/pay the company's sales and use taxes, if applicable (State).You will also have to do corporate and personal filings with your state.

Create this form in 5 minutes!

How to create an eSignature for the self employment ledger documentation form

How to generate an electronic signature for the Self Employment Ledger Documentation Form online

How to create an eSignature for the Self Employment Ledger Documentation Form in Chrome

How to create an electronic signature for putting it on the Self Employment Ledger Documentation Form in Gmail

How to make an electronic signature for the Self Employment Ledger Documentation Form from your smartphone

How to make an eSignature for the Self Employment Ledger Documentation Form on iOS

How to generate an electronic signature for the Self Employment Ledger Documentation Form on Android OS

People also ask

-

What is a Self Employment Ledger and why do I need it?

A Self Employment Ledger is a crucial tool for freelancers and self-employed individuals to track their income and expenses accurately. By maintaining a detailed ledger, you ensure compliance with tax regulations and simplify your financial reporting. Using airSlate SignNow allows you to easily manage your documents related to your Self Employment Ledger in a secure and efficient manner.

-

How does airSlate SignNow help with managing my Self Employment Ledger?

airSlate SignNow streamlines the process of managing your Self Employment Ledger by providing a platform to create, send, and eSign your financial documents effortlessly. You can organize your income statements, invoices, and receipts in one place, making it easier to maintain accurate records and prepare for tax season. The intuitive interface ensures you can focus on your business rather than paperwork.

-

What features does airSlate SignNow offer for Self Employment Ledger users?

With airSlate SignNow, users can enjoy features like document templates, customizable workflows, and secure eSigning, all tailored to enhance the management of your Self Employment Ledger. Additionally, the platform allows easy integration with various accounting software, ensuring that your financial data is always up to date and accessible. These functionalities make it an ideal choice for self-employed individuals.

-

Is airSlate SignNow affordable for freelancers managing a Self Employment Ledger?

Yes, airSlate SignNow offers competitive pricing plans that are budget-friendly for freelancers and self-employed individuals. The cost-effective solution ensures you get comprehensive features to manage your Self Employment Ledger without breaking the bank. You can choose a plan that best fits your needs and scale it as your business grows.

-

Can I integrate airSlate SignNow with my current accounting software for my Self Employment Ledger?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easy to sync your financial data related to your Self Employment Ledger. This integration ensures that all your records are consistent and up to date, allowing you to focus on your work without worrying about manual entries.

-

What are the benefits of using airSlate SignNow for my Self Employment Ledger?

Using airSlate SignNow for your Self Employment Ledger enhances organization, efficiency, and compliance. The platform simplifies document management, reduces administrative burden, and offers advanced security features to protect your sensitive financial information. By streamlining your processes, you can spend more time on your core business activities.

-

How secure is my data when using airSlate SignNow for my Self Employment Ledger?

Security is a top priority for airSlate SignNow. When managing your Self Employment Ledger, your data is protected with robust encryption, secure cloud storage, and compliance with industry standards. This ensures that your financial documents remain confidential and safe from unauthorized access.

Get more for Self Employment Ledger

- Nastf vehicle security professional trp form

- Consent form 301170080

- Answers questionnaire form

- College student self assessment examples form

- Employee training record template word form

- Bezirksregierungdsseldorfbezirksregierung dusseld form

- Bankruptcy questionnaire david m siegel amp associates form

- Sober living contract template 432165378 form

Find out other Self Employment Ledger

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors