Housing Works Donation Form

What is the Housing Works Donation Form

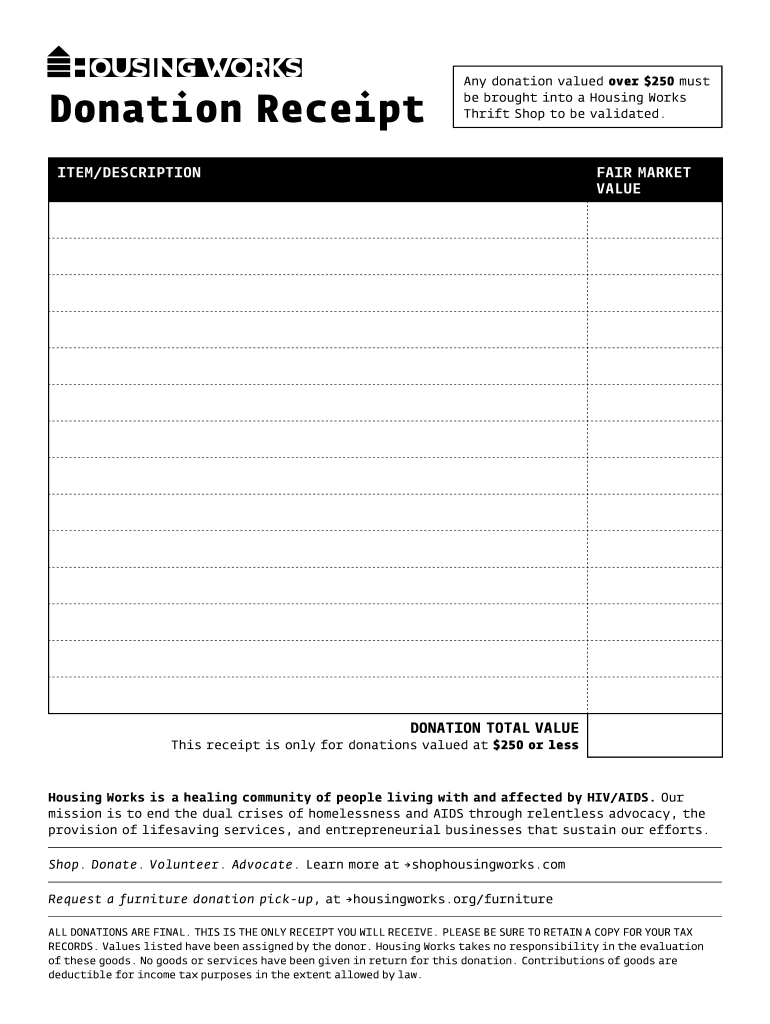

The Housing Works donation form is a crucial document used by individuals wishing to donate items to Housing Works, a nonprofit organization that supports people affected by homelessness and HIV/AIDS. This form serves as a record of the donation, providing both the donor and the organization with essential information regarding the items donated. It typically includes details such as the donor's name, address, and a description of the items being donated. This documentation is vital for tax purposes, as it can be used to substantiate charitable contributions when filing taxes.

How to use the Housing Works Donation Form

Using the Housing Works donation form is a straightforward process. First, you need to obtain the form, which can often be found on the Housing Works website or requested directly from the organization. Once you have the form, fill in your personal details, including your name and contact information. Next, list the items you are donating, ensuring to provide a brief description and the estimated value of each item. After completing the form, keep a copy for your records and submit the original to Housing Works, either in person or via mail, depending on their submission guidelines.

Steps to complete the Housing Works Donation Form

Completing the Housing Works donation form involves several key steps:

- Obtain the form from the Housing Works website or their physical locations.

- Fill in your personal information, including your name, address, and contact details.

- List the items you are donating, providing a brief description and estimated value for each item.

- Sign and date the form to confirm the accuracy of the information provided.

- Keep a copy of the completed form for your records.

- Submit the original form to Housing Works as per their submission instructions.

Legal use of the Housing Works Donation Form

The Housing Works donation form is legally binding when properly completed and signed. For it to be valid, it must include accurate information about the donor and the donated items. This form can be used to claim tax deductions, provided it meets IRS guidelines for charitable contributions. It is essential to retain a copy of the form as proof of the donation, which may be requested by the IRS during tax audits. Compliance with local and federal laws regarding charitable donations is crucial to ensure that the donation is recognized legally.

IRS Guidelines

When using the Housing Works donation form for tax purposes, it is important to adhere to IRS guidelines. The IRS requires that donations of items valued at more than $500 must be substantiated with a written acknowledgment from the charity. The donation form serves as this acknowledgment, provided it includes the necessary details. Donors should also be aware of the IRS rules regarding the valuation of donated items, as well as the requirement to report any significant contributions on Schedule A of their tax return. Familiarizing oneself with these guidelines helps ensure that the donation is processed correctly for tax benefits.

Donation Receipt Template PDF

A donation receipt template PDF can be a useful tool for donors looking to streamline the process of documenting their contributions. This template typically includes sections for the donor's information, a description of the donated items, and a space for the charity's acknowledgment. By using a standardized template, donors can ensure that all necessary information is captured, making it easier to file taxes and maintain accurate records. Additionally, having a template readily available can simplify the donation process, encouraging more people to contribute to charitable causes.

Quick guide on how to complete donation receipt forms nycgov nyc

Effortlessly Prepare Housing Works Donation Form on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and endorsed documentation, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Manage Housing Works Donation Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign Housing Works Donation Form with Ease

- Find Housing Works Donation Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which is quick and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Housing Works Donation Form to ensure outstanding communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What are some of the best places to visit in NYC?

Without a doubt, NYC has some of the best sights and experiences to take enjoy. There is so much to see, and you are never at a loss for something to do. Being “The City That Never Sleeps”, New York City lives up to its name, as it is 24/7 hustle, bustle and excitement. The best way to enjoy NYC to the fullest is to store your baggage, shopping bags and luggage in one of the Knock Knock City host locations for a few hours. Once your bags have been safely dropped off and stored at one of our locations, here are a few ideas and suggestions for where to head next within the city:THESE ARE PERFECT FOR THE TIRELESS AND BRAVE:#1. New York Hop On/Hop Off Sight Seeing Ferry: Explore Manhattan and Brooklyn by land and sea as this convenient ferry tour takes you to some of the most well-known sites in the city. To learn more about these tours visit Gray Line New York#2. Madison Square Garden: Whether you are searching for excitement through a sports game or concert, Madison Square Garden delivers on levels you only imagined possible to create your perfect outing. For events and times visit Madison Square Garden | Official Site | New York City#3. Brooklyn Heights Promenade: Integrate history with beauty as you take in one of the finest views of New York City from the breathtaking Brooklyn Heights Promenade. To experience this photographic masterpiece visit Historical Sign Listings : NYC ParksTHESE ARE PERFECT FOR THE CURIOUS:#1. 9/11 Memorial: Take a moment to reflect and remember that infamous day in September 2001 when the course of history changed forever, and heroism prevailed. For more information visit National September 11 Memorial & Museum#2. The Metropolitan Museum of Art: Take your imagination on a journey through color, beauty, and interpretation as you make your way through this creative cultivation of artistic genius. To learn how you can experience visit Met Audio Guide Online#3. American Museum of Natural History: Take a trip back in time as you find yourself in the midst of dinosaurs, mummies, and presidents in this fantastic presentation of historic proportions. To buy a ticket for this trip visit American Museum of Natural HistoryTHESE ARE PERFECT FOR THE HUNGRY:#1. Daniel: From elegant and exquisite interior decoration to the indulgent European cuisine and wine cellar, Daniel is by far a dining experience of culinary masterpieces. To make your reservation visit Michelin Starred Cuisine by Chef Daniel Boulud#2. Bleecker Street Pizza: A slice of heaven served on a plate, Bleecker Street Pizza offers one of Italy’s most well-known dishes right in the center of NYC. To learn more about their menu visit Best Pizza in New York City#3. Serendipity 3: Satisfy your sweet tooth at this sensationally satisfying and delectable discovery right in the middle of the action. To find the perfection of your choosing visit Serendipity 3

-

How is BetaBeat able to out-scoop TechCrunch in NYC?

BetaBeat is based in NYC, so they have a home-town advantage. FYI, for another source of NY area tech news, see www.nyconvergence.com

-

If you were to live out of a van in NYC, how would you go about doing so?

It's definitely possible, and I'm fairly certain that I saw a few people doing it during my time in NYC. All of the previous tips that were given are great, but I can add to the parking situation a bit. If you have a full-time job with a typical schedule, parking can be tough as everyone else is looking to park around the same time that you do. However, because you're in a van an are mobile, you can literally park anywhere and not have to worry about the trip back to your apartment. From a street sweeping perspective, Washington Heights in Manhattan is great as it only occurs 1x/week. I am unsure about the other boroughs, but I know there is tons of parking in Brooklyn by comparison. In general, you could easily do this in NYC, as you could spend most of your daytime hours at work or in a coffee shop, and only really use the van for sleep. Free street parking in most places throughout the city is also a huge advantage for doing something like this, and as long as you move your van every once in awhile (you have to anyway), no one would likely ever catch on.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the donation receipt forms nycgov nyc

How to make an eSignature for the Donation Receipt Forms Nycgov Nyc online

How to generate an electronic signature for the Donation Receipt Forms Nycgov Nyc in Google Chrome

How to create an eSignature for putting it on the Donation Receipt Forms Nycgov Nyc in Gmail

How to generate an eSignature for the Donation Receipt Forms Nycgov Nyc from your mobile device

How to create an electronic signature for the Donation Receipt Forms Nycgov Nyc on iOS devices

How to make an electronic signature for the Donation Receipt Forms Nycgov Nyc on Android devices

People also ask

-

What is the Housing Works Donation Form and how does it work?

The Housing Works Donation Form is a digital document that allows individuals to easily submit their donations to Housing Works. With airSlate SignNow, you can fill out and eSign the form quickly, ensuring that your contribution is processed without delays. This user-friendly form simplifies the donation process, making it accessible to everyone.

-

How much does it cost to use the Housing Works Donation Form?

Using the Housing Works Donation Form with airSlate SignNow is cost-effective, as our pricing plans are designed to fit various budgets. You can choose from different subscription options that provide access to essential features for managing your donations. This ensures that you can contribute without worrying about excessive costs.

-

What features does the Housing Works Donation Form offer?

The Housing Works Donation Form includes features like eSignature capabilities, secure document storage, and customizable templates. These features ensure that your donation process is not only efficient but also secure. Additionally, you can track the status of your donation in real-time.

-

How can I integrate the Housing Works Donation Form with other applications?

airSlate SignNow allows seamless integration of the Housing Works Donation Form with various applications such as CRM systems and email platforms. This integration helps streamline your donation process and keeps all your data organized. By connecting your tools, you can manage donations more effectively.

-

What are the benefits of using the Housing Works Donation Form for my contributions?

Using the Housing Works Donation Form provides numerous benefits, including convenience, speed, and enhanced security for your donations. With airSlate SignNow, you can complete and eSign your donation forms from any device, ensuring you never miss an opportunity to contribute. Plus, digital signatures provide a secure way to validate your transactions.

-

Is the Housing Works Donation Form secure?

Absolutely! The Housing Works Donation Form is designed with security in mind. airSlate SignNow utilizes advanced encryption protocols to protect your personal and financial information, ensuring that your donations are safe from unauthorized access.

-

Can I access the Housing Works Donation Form on mobile devices?

Yes, the Housing Works Donation Form is fully optimized for mobile devices, allowing you to make donations anytime, anywhere. With airSlate SignNow's mobile-friendly interface, you can fill out and eSign your donation forms on your smartphone or tablet effortlessly.

Get more for Housing Works Donation Form

Find out other Housing Works Donation Form

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer