Rct 101 Form Fillable

What is the Rct 101 Form Fillable

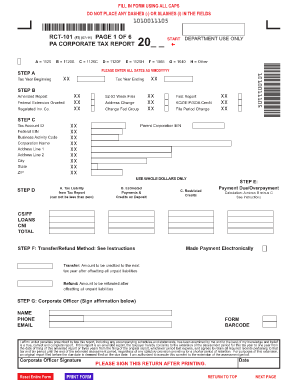

The Rct 101 Form Fillable is a tax form used primarily in the United States for reporting specific financial information to the relevant tax authorities. It is essential for individuals and businesses to accurately complete this form to ensure compliance with federal and state tax regulations. The form may include various sections that require detailed information about income, deductions, and tax credits, depending on the taxpayer's situation.

How to use the Rct 101 Form Fillable

Using the Rct 101 Form Fillable involves several steps to ensure that all required information is accurately provided. First, gather all necessary financial documents, such as income statements, receipts for deductions, and any relevant tax documents. Next, access the fillable form through a reliable digital platform. Fill in the required fields, ensuring that all information is accurate and complete. After completing the form, review it for any errors or omissions before submitting it to the appropriate tax authority.

Steps to complete the Rct 101 Form Fillable

Completing the Rct 101 Form Fillable involves a systematic approach:

- Gather all necessary documentation, including income records and deduction receipts.

- Access the fillable form online through a trusted platform.

- Fill in personal information, including name, address, and Social Security number.

- Provide detailed financial information as required by the form.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or print it for mailing, depending on the submission method chosen.

Legal use of the Rct 101 Form Fillable

The Rct 101 Form Fillable is legally binding when completed and submitted according to the guidelines set forth by the tax authorities. To ensure its legal standing, it is important to comply with all relevant regulations, including those related to eSignatures if the form is submitted electronically. Properly completing the form and providing accurate information helps prevent potential legal issues and penalties.

Who Issues the Form

The Rct 101 Form Fillable is typically issued by the state tax authority or the Internal Revenue Service (IRS), depending on the specific context in which it is used. It is essential to ensure that you are using the correct version of the form as issued by the relevant authority to avoid complications during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Rct 101 Form Fillable can vary based on the taxpayer's specific circumstances and the tax year in question. Generally, individuals and businesses should be aware of key dates, such as the annual tax filing deadline, which is typically April 15 for federal taxes. It is important to check for any extensions or specific deadlines set by state tax authorities to ensure timely submission.

Quick guide on how to complete rct 101 form fillable

Effortlessly Prepare Rct 101 Form Fillable on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage Rct 101 Form Fillable on any platform with airSlate SignNow mobile applications for Android or iOS and enhance any document-focused process today.

How to Modify and eSign Rct 101 Form Fillable with Ease

- Obtain Rct 101 Form Fillable and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Rct 101 Form Fillable to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rct 101 form fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Rct 101 Form Fillable?

The Rct 101 Form Fillable is a customizable document template that enables users to easily fill out and sign forms electronically. This feature is particularly useful for streamlining tax-related processes, ensuring compliance and accuracy while saving time.

-

How can I create a Rct 101 Form Fillable using airSlate SignNow?

To create an Rct 101 Form Fillable, simply upload your document to airSlate SignNow and use our intuitive form editor to add fillable fields. You can customize the layout and styles according to your needs, making it easy for users to complete the form quickly.

-

Is there a cost associated with using the Rct 101 Form Fillable?

Yes, airSlate SignNow offers various pricing plans that include access to the Rct 101 Form Fillable feature. Each plan is designed to be cost-effective, allowing businesses of all sizes to benefit from electronic signatures and form filling without breaking the bank.

-

What are the benefits of using an Rct 101 Form Fillable?

Using an Rct 101 Form Fillable signNowly enhances efficiency by reducing paperwork, minimizing errors, and facilitating fast processing. Additionally, users can track document statuses in real-time, providing peace of mind and improving response times.

-

Can I integrate the Rct 101 Form Fillable with other software?

Yes, airSlate SignNow allows seamless integration with various software applications, making it easy to import and export your Rct 101 Form Fillable. This interoperability streamlines workflows and enhances productivity across multiple platforms.

-

Is the Rct 101 Form Fillable compliant with legal standards?

Absolutely! The Rct 101 Form Fillable created using airSlate SignNow is compliant with all applicable electronic signature laws, ensuring that your documents are legally binding and secure. This compliance is crucial for maintaining trust in your business operations.

-

What devices can I use to fill out the Rct 101 Form Fillable?

You can fill out the Rct 101 Form Fillable on any device with internet access, including smartphones, tablets, and computers. This flexibility allows users to complete important forms anytime and anywhere, boosting productivity and convenience.

Get more for Rct 101 Form Fillable

- Stalking permanent protective order pursuant to criminal form

- High productivity chemistry metal ctp nyc gov form

- Order amending form 2a of the hawaii rules of civil procedure

- Application for suspension of prosecution violation of firearm laws form

- Texas department of public safety form

- Civil union divorce decree with minor andor dependent children form

- Motion for continuance juvenile matters form

- Discrimination complaintfederal grants form

Find out other Rct 101 Form Fillable

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form