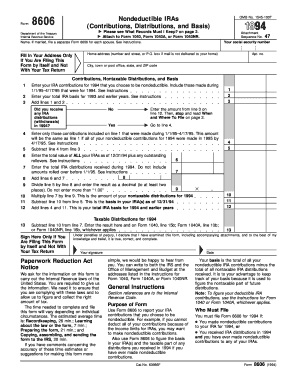

8606 Form

What is the 8606 Form

The 8606 Form, officially known as the Nondeductible IRAs form, is used by taxpayers in the United States to report contributions to traditional IRAs that are not tax-deductible, as well as distributions from these accounts. It is essential for individuals who have made nondeductible contributions to keep track of their basis in the IRA. This form ensures that taxpayers do not pay taxes again on amounts that have already been taxed when they withdraw funds from their IRAs.

How to use the 8606 Form

To use the 8606 Form effectively, taxpayers must fill it out accurately each year they make nondeductible contributions to their IRAs or take distributions. The form requires information about contributions, distributions, and the basis of the IRA. It is important to complete the form even if no tax is owed, as it helps maintain accurate records for future tax filings. Additionally, the completed form must be submitted along with the taxpayer's annual income tax return.

Steps to complete the 8606 Form

Completing the 8606 Form involves several steps:

- Gather necessary information, including prior year forms and records of IRA contributions.

- Fill out Part I to report nondeductible contributions to traditional IRAs.

- Complete Part II if you took distributions from your IRA during the year.

- Ensure that all calculations are accurate, particularly regarding the basis of your IRA.

- Attach the completed form to your federal income tax return.

Legal use of the 8606 Form

The 8606 Form is legally required for taxpayers who make nondeductible contributions to traditional IRAs or take distributions from these accounts. Failing to file the form when required can lead to penalties and complications during tax audits. It is essential to understand the legal implications of the information reported on the form, as inaccuracies can affect tax liability and compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing the 8606 Form, including instructions on who must file and how to report contributions and distributions. Taxpayers should refer to the IRS instructions for the 8606 Form to ensure compliance with the latest tax laws and regulations. It is advisable to review these guidelines annually, as tax laws can change and impact the filing requirements.

Filing Deadlines / Important Dates

The 8606 Form must be filed by the tax return due date, which is typically April 15 of the following year. If the due date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these deadlines to avoid late filing penalties. Additionally, if an extension is filed for the tax return, the 8606 Form must still be submitted by the extended deadline.

Quick guide on how to complete 8606 form

Complete 8606 Form effortlessly on any gadget

Managing documents online has gained traction among companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without issues. Handle 8606 Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to edit and eSign 8606 Form with ease

- Locate 8606 Form and then click Obtain Form to commence.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of your documents or obscure confidential information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Finished button to preserve your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign 8606 Form to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8606 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8606 Form and why is it important?

The 8606 Form is essential for reporting nondeductible contributions to traditional IRAs and tracking the basis in IRAs. It is important because it ensures proper taxation on your IRA distributions, helping you avoid double taxation on retirement funds.

-

How can airSlate SignNow help me with my 8606 Form?

airSlate SignNow allows you to easily prepare, sign, and send your 8606 Form electronically. With its user-friendly interface and eSignature capabilities, you can streamline your tax reporting process and ensure that all necessary documentation is submitted accurately.

-

Is airSlate SignNow a cost-effective solution for managing the 8606 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing your 8606 Form and other documents. Our pricing plans are designed to accommodate various business sizes, making it affordable to manage essential tax forms without sacrificing quality.

-

What features does airSlate SignNow provide for signing tax documents like the 8606 Form?

airSlate SignNow provides features such as electronic signatures, document templates, and secure storage for your tax documents like the 8606 Form. These features simplify the process of filling out and submitting your form while ensuring your information is safeguarded.

-

Can I integrate airSlate SignNow with other applications for my 8606 Form?

Absolutely! airSlate SignNow offers integrations with various applications such as accounting software, email services, and cloud storage solutions. This allows you to efficiently manage your 8606 Form along with your other financial documents seamlessly.

-

What are the benefits of using airSlate SignNow for my 8606 Form?

By using airSlate SignNow for your 8606 Form, you benefit from a streamlined and efficient e-signing process, which saves you time and reduces errors. Additionally, our platform enhances collaboration, making it easier to share and track your tax documents.

-

Is airSlate SignNow secure for handling sensitive information like the 8606 Form?

Yes, airSlate SignNow prioritizes security and ensures that all sensitive information, including your 8606 Form, is protected with advanced encryption and compliance measures. You can trust that your data is safe while using our platform.

Get more for 8606 Form

- Living trust or will qxd foulston siefkin llp form

- Stretch ira trust template form

- Nys 50 t nyc116new york city withholding tax tables and tax ny form

- Sharepoint access request emails form

- Wa doh 347 102 form

- Utility exception request form

- Forced betterment approval form austin district forms

- Pharmacist visit summary and referral template form

Find out other 8606 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors