Printable Salvation Army Donation Receipt Form

What is the Printable Salvation Army Donation Receipt

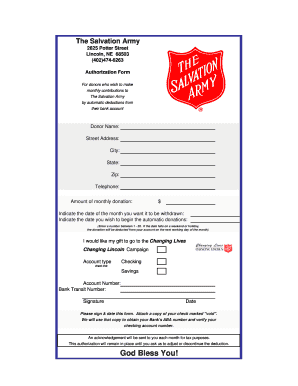

The Printable Salvation Army Donation Receipt serves as an official document acknowledging donations made to the Salvation Army. This receipt is essential for donors as it provides proof of charitable contributions, which can be used for tax deduction purposes. The receipt typically includes details such as the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. Having this receipt is crucial for individuals who wish to claim their donations on their tax returns, ensuring compliance with IRS regulations.

How to use the Printable Salvation Army Donation Receipt

Using the Printable Salvation Army Donation Receipt is straightforward. Donors should fill out the receipt with accurate information regarding their donation. This includes entering their name, the date of the donation, and a detailed list of items donated along with their estimated values. Once completed, the donor should keep a copy for their records and provide the original to the Salvation Army. This process not only helps in maintaining transparency but also ensures that the donor can substantiate their charitable contributions when filing taxes.

Steps to complete the Printable Salvation Army Donation Receipt

Completing the Printable Salvation Army Donation Receipt involves several key steps:

- Gather Information: Collect all necessary details about the donation, including the date, items donated, and their estimated values.

- Fill Out the Receipt: Accurately enter your name, the date of the donation, and a description of the items. Be sure to estimate the value of each item donated.

- Sign and Date: After filling out the receipt, sign and date it to confirm the authenticity of the information provided.

- Keep a Copy: Retain a copy of the completed receipt for your records, which is essential for tax purposes.

- Submit the Original: Provide the original receipt to the Salvation Army at the time of donation.

Legal use of the Printable Salvation Army Donation Receipt

The Printable Salvation Army Donation Receipt is legally recognized as a valid document for tax purposes in the United States. According to IRS guidelines, donors can claim deductions for charitable contributions if they have proper documentation. This receipt serves as proof of the donation, which is necessary for tax filings. It is important that donors accurately complete the receipt and retain it for their records to comply with tax laws and regulations.

Key elements of the Printable Salvation Army Donation Receipt

Several key elements must be included in the Printable Salvation Army Donation Receipt to ensure its validity:

- Donor Information: The full name and address of the donor.

- Date of Donation: The exact date when the donation was made.

- Description of Items: A detailed list of items donated, including their condition.

- Estimated Value: The fair market value of each item, which is crucial for tax purposes.

- Signature: The donor's signature to authenticate the receipt.

IRS Guidelines

The IRS has specific guidelines regarding charitable contributions and the documentation required for tax deductions. Donors must ensure that their Printable Salvation Army Donation Receipt meets these guidelines to claim deductions successfully. Key points include:

- Donations exceeding $250 require written acknowledgment from the charity.

- Donors should keep receipts for all contributions, regardless of the amount.

- For non-cash donations, such as clothing or household items, the IRS requires a description and estimated value.

Quick guide on how to complete printable salvation army donation receipt 38775548

Complete Printable Salvation Army Donation Receipt easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Printable Salvation Army Donation Receipt on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Printable Salvation Army Donation Receipt with ease

- Find Printable Salvation Army Donation Receipt and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically developed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing additional copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Alter and eSign Printable Salvation Army Donation Receipt to ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable salvation army donation receipt 38775548

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Salvation Army donation receipt?

A Salvation Army donation receipt is a document given to donors who contribute goods or cash to the organization. This receipt serves as proof of your charitable donation, allowing for tax deduction claims on your income tax return. Utilizing tools like airSlate SignNow can help you digitally sign and manage these receipts efficiently.

-

How can I obtain my Salvation Army donation receipt?

You can obtain your Salvation Army donation receipt by requesting it during the donation process or by contacting your local Salvation Army branch. To streamline your documentation, airSlate SignNow allows you to digitally request and sign these receipts, ensuring quick access to records of your charitable contributions.

-

Is there a fee associated with getting a Salvation Army donation receipt?

There is no fee associated with obtaining a Salvation Army donation receipt. It's a complimentary service provided to donors as a thank you for their generosity. With airSlate SignNow, you can manage your donation receipts without incurring extra costs, making the process simple and efficient.

-

Can I use the Salvation Army donation receipt for tax deductions?

Yes, you can use the Salvation Army donation receipt to claim tax deductions on your income tax return. It's important to keep this receipt as it validates your charitable contributions. With airSlate SignNow, you can securely store and access your receipts for easy reference when filing your taxes.

-

What information is included in a Salvation Army donation receipt?

A Salvation Army donation receipt typically includes details such as the donor's name, address, date of donation, and a description of the donated items or cash amount. This information is crucial for your tax records. Using airSlate SignNow can simplify the process of generating and managing these detailed receipts seamlessly.

-

Are Salvation Army donation receipts available in digital format?

Yes, Salvation Army donation receipts can be provided in digital format, making it easier for donors to keep track of their contributions. With airSlate SignNow, you can receive, sign, and manage your digital receipts from anywhere, enhancing convenience and organization.

-

How can airSlate SignNow facilitate my management of Salvation Army donation receipts?

airSlate SignNow can help you efficiently manage your Salvation Army donation receipts by allowing you to digitally sign, track, and store these important documents. This user-friendly platform streamlines the process, ensuring you have quick access to your donation history for both personal and tax purposes.

Get more for Printable Salvation Army Donation Receipt

- Remark in application form

- Open photobooth booking form

- Instructions complete the forms to ask the court to appoint a

- Stipulation to set settlement conference and trial dates order form

- Court reporter information form

- Bidder declaration form california courts

- Homesuperior court of californiacounty of kern ca gov form

- Name change petition packet judicial council forms

Find out other Printable Salvation Army Donation Receipt

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online