Il 8633 B Form

What is the IL 8633 B?

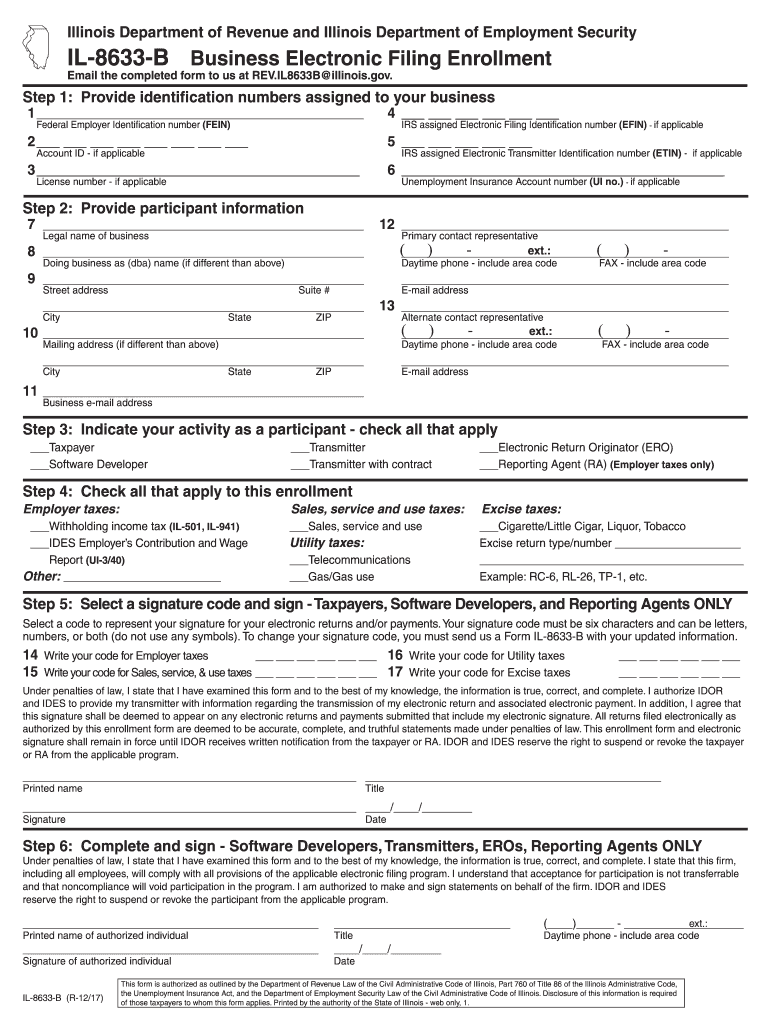

The IL 8633 B form, officially known as the Illinois Department of Revenue Form IL 8633 B, is used primarily for the purpose of tax exemption claims for certain organizations. This form allows qualifying entities to apply for a sales tax exemption in Illinois, ensuring they can conduct their operations without incurring unnecessary tax liabilities. Understanding the specific requirements and eligibility criteria for this form is essential for organizations seeking to benefit from tax exemptions in the state.

How to Use the IL 8633 B

Using the IL 8633 B form involves several steps to ensure accurate completion and submission. First, organizations must determine their eligibility based on the criteria set forth by the Illinois Department of Revenue. Once eligibility is confirmed, the form can be filled out with the necessary information, including the organization’s details and the specific exemption being claimed. After completing the form, it should be reviewed for accuracy before submission to ensure compliance with state regulations.

Steps to Complete the IL 8633 B

Completing the IL 8633 B form requires careful attention to detail. Here are the steps to follow:

- Gather required documentation that supports your exemption claim, such as proof of nonprofit status.

- Fill out the form with accurate organizational details, including name, address, and tax identification number.

- Specify the type of exemption being requested and provide any necessary explanations or justifications.

- Review the completed form for any errors or omissions.

- Submit the form to the Illinois Department of Revenue through the appropriate method, either online or via mail.

Legal Use of the IL 8633 B

The legal use of the IL 8633 B form is governed by state tax laws and regulations. It is crucial for organizations to adhere to these laws to ensure that their claims for tax exemption are valid. Submitting the form without proper justification or eligibility can lead to penalties or denial of the exemption claim. Understanding the legal implications and maintaining compliance with the Illinois Department of Revenue's guidelines is essential for all applicants.

Key Elements of the IL 8633 B

Several key elements must be included when completing the IL 8633 B form to ensure its validity:

- Organization Information: Accurate details about the organization, including its legal name and address.

- Tax Identification Number: The organization's EIN or other tax ID must be provided.

- Exemption Type: Clearly indicate the type of exemption being sought.

- Supporting Documentation: Attach any necessary documents that substantiate the exemption claim.

Form Submission Methods

The IL 8633 B form can be submitted through various methods, depending on the preferences of the organization. Options include:

- Online Submission: Many organizations prefer to submit forms electronically for convenience and speed.

- Mail: The completed form can be printed and mailed to the Illinois Department of Revenue.

- In-Person Submission: Organizations may also choose to deliver the form directly to a local office of the Department of Revenue.

Quick guide on how to complete il 8633 b

Effortlessly prepare Il 8633 B on any device

Managing documents online has gained signNow traction among businesses and individuals. It presents an ideal environmentally-friendly substitute to traditional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly without delays. Handle Il 8633 B on any device through airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Il 8633 B without hassle

- Locate Il 8633 B and click Get Form to begin.

- Utilize our tools to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Il 8633 B and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 8633 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 8633 B form and why is it important?

The IL 8633 B form is a crucial document used for authorizing electronic signatures in the state of Illinois. Understanding this form is essential for businesses looking to streamline their document signing processes while ensuring compliance with state regulations.

-

How can airSlate SignNow help me with the IL 8633 B form?

airSlate SignNow offers a user-friendly platform to electronically sign and manage the IL 8633 B form. With our solution, you can complete, send, and store your documents securely, making it effortless to handle this critical paperwork.

-

What are the pricing options for using airSlate SignNow for the IL 8633 B form?

airSlate SignNow provides various pricing plans that cater to different business needs, allowing you to handle the IL 8633 B form efficiently. Whether you are a solo entrepreneur or a large organization, our competitive pricing ensures you get the best value for your document signing needs.

-

Are there any specific features in airSlate SignNow that assist with the IL 8633 B form?

Yes, airSlate SignNow includes features like customizable templates, automated workflows, and tracking tools specifically designed to simplify the processing of the IL 8633 B form. These functionalities ensure that you can manage your documents seamlessly and efficiently.

-

Can I integrate airSlate SignNow with other software when working with the IL 8633 B form?

Absolutely! airSlate SignNow offers integrations with a variety of popular platforms, making it easy to manage the IL 8633 B form alongside your existing tools. Whether you use CRM systems, document storage solutions, or other software, our seamless integrations enhance your workflow.

-

What are the benefits of using airSlate SignNow for the IL 8633 B form?

Using airSlate SignNow for the IL 8633 B form brings numerous benefits, including increased efficiency, reduced paper waste, and faster turnaround times. By transitioning to digital signatures, you can streamline your processes and enhance overall productivity.

-

Is the IL 8633 B form legally binding when signed with airSlate SignNow?

Yes, the IL 8633 B form signed through airSlate SignNow is legally binding and compliant with Illinois laws regarding electronic signatures. This ensures that your electronically signed documents hold up in court, providing you with peace of mind.

Get more for Il 8633 B

- Guardianship petition application the following in form

- Notice of hearing fillablepdf fayette county georgia form

- Civil court of the city of new york county of part index no nycourts form

- Guardian ad litem certification form

- Chanceryclerkandmaster nashville gov wp contentstate of tennessee case file number 2q1h nashville form

- Application for marriage license party not appearing form

- Ala int 001 fileable online form

- Superior court of california county of contra cos form

Find out other Il 8633 B

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template