Form 315

What is the Form 315

The Form 315 is a document used primarily for tax purposes in the United States. It is utilized by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal tax regulations and helps the IRS assess an entity's tax obligations accurately. Understanding the purpose and requirements of the Form 315 is crucial for anyone who needs to file it.

How to use the Form 315

Using the Form 315 involves several key steps. First, gather all necessary financial documents and information relevant to the reporting period. This may include income statements, expense records, and any other pertinent financial data. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once completed, the form can be submitted electronically or via traditional mail, depending on the preferences and requirements of the IRS.

Steps to complete the Form 315

Completing the Form 315 requires attention to detail to ensure accuracy and compliance. Follow these steps:

- Review the instructions provided with the form to understand the specific requirements.

- Collect all necessary financial documents, such as income and expense records.

- Fill out each section of the form, providing accurate information as required.

- Double-check the form for any errors or omissions before submission.

- Submit the completed form by the deadline, either online or by mail.

Legal use of the Form 315

The legal use of the Form 315 is governed by IRS regulations. When filled out correctly, it serves as a legally binding document that reflects an individual's or business's financial activities for the reporting period. Ensuring compliance with all applicable laws and regulations is essential to avoid penalties or legal issues. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 315 can vary based on the type of entity submitting the form. Typically, individuals must file their forms by April 15 of the following tax year, while businesses may have different deadlines depending on their fiscal year. It is important to stay informed about these dates to avoid late fees and ensure compliance with IRS regulations.

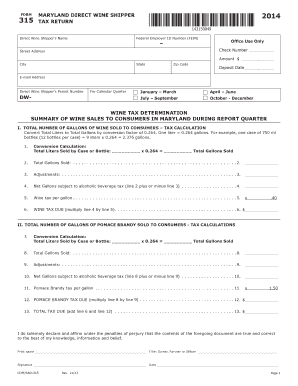

Key elements of the Form 315

The Form 315 includes several key elements that must be completed accurately for it to be valid. These elements typically consist of:

- Personal identification information, such as name and Social Security number.

- Details regarding income sources and amounts.

- Information on deductions and credits claimed.

- Signature and date to certify the accuracy of the information provided.

Who Issues the Form

The Form 315 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the form along with detailed instructions on how to complete and file it. It is crucial for individuals and businesses to use the most current version of the form to ensure compliance with the latest tax laws.

Quick guide on how to complete form 315

Effortlessly Prepare Form 315 on Any Device

Digital document management has gained signNow traction among enterprises and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly and without any delays. Handle Form 315 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

Steps to Modify and eSign Form 315 with Ease

- Obtain Form 315 then click Get Form to start.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Form 315 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 315

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of form 315?

Form 315 is designed to streamline the process of sending and eSigning important documents. It allows users to efficiently manage forms and contracts, ensuring that all necessary approvals are obtained swiftly and securely.

-

How does airSlate SignNow simplify the use of form 315?

airSlate SignNow simplifies the handling of form 315 by offering an intuitive interface that allows users to easily upload, customize, and send documents for eSignature. The platform also provides templates to expedite the setup process and maintain consistency.

-

What features does airSlate SignNow offer for form 315 management?

With airSlate SignNow, users get features such as document templates, real-time tracking, reminders, and secure storage for form 315. These tools enhance the user experience by ensuring that every document is managed efficiently and securely.

-

Is there a free trial available for using airSlate SignNow with form 315?

Yes, airSlate SignNow offers a free trial that allows users to explore its functionalities, including those related to form 315. This trial period lets prospective customers test the platform’s features without any commitment.

-

What integrations does airSlate SignNow support for form 315?

airSlate SignNow seamlessly integrates with various third-party applications such as Google Drive, Salesforce, and more, enhancing the workflow associated with form 315. These integrations help users to streamline their document management processes within their existing systems.

-

Can I customize form 315 using airSlate SignNow?

Absolutely, airSlate SignNow allows for extensive customization of form 315 to suit individual business needs. Users can add logos, change colors, and modify fields to ensure that the form aligns with their branding.

-

What are the pricing plans for airSlate SignNow for managing form 315?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, starting from basic to advanced features for managing form 315. Each plan is designed to provide a cost-effective solution based on the features required and the volume of documents processed.

Get more for Form 315

- Tr1 ft tax registration form

- Northwest notes office of public housing form

- 8 usc 1157 annual admission of refugees and form

- Doctors return to work form links

- Form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code

- Radiation exposure compensation act downwinder claim form

- Contact usva houston health care veterans affairs form

- Line list form

Find out other Form 315

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy

- eSignature Texas Roommate Contract Easy

- eSignature Arizona Sublease Agreement Template Free

- eSignature Georgia Sublease Agreement Template Online

- eSignature Arkansas Roommate Rental Agreement Template Mobile