Form 4720 Return of Certain Excise Taxes under Chapters 41 and 42 of the Internal Revenue Code 2019

Understanding the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

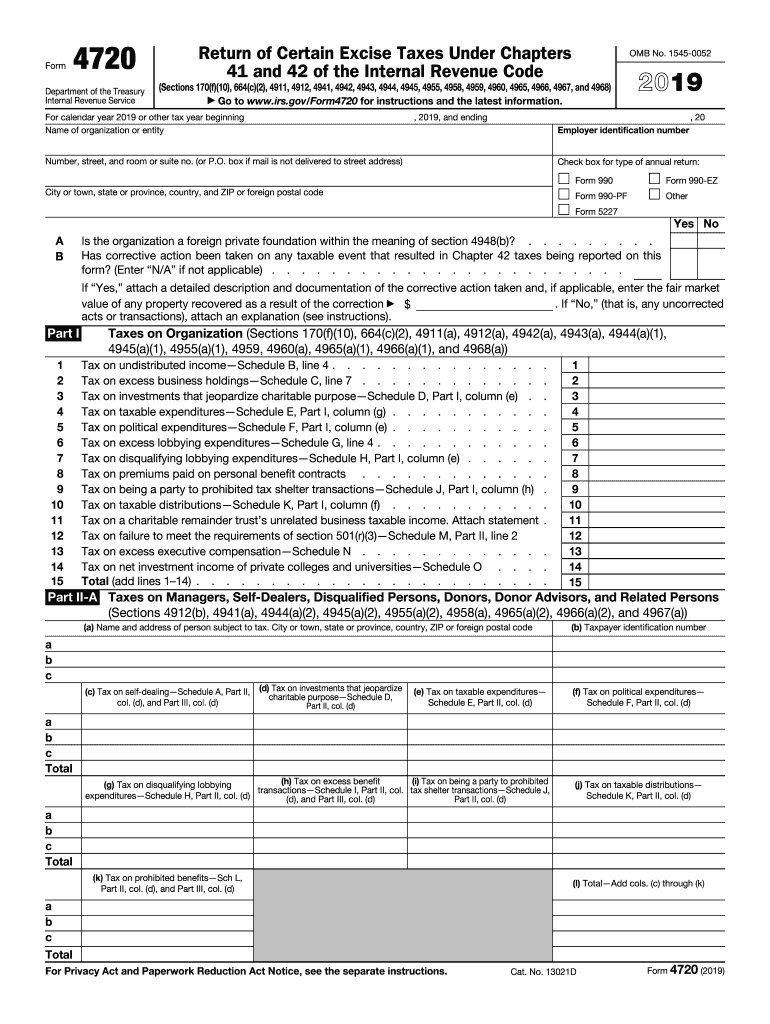

The Form 4720 is a tax form used to report certain excise taxes imposed under Chapters 41 and 42 of the Internal Revenue Code. These chapters primarily address taxes related to excess benefit transactions, private foundation excise taxes, and other specific transactions that may trigger additional tax liabilities for certain organizations. Understanding this form is crucial for entities subject to these excise taxes to ensure compliance with federal tax regulations.

Steps to Complete the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

Completing Form 4720 involves several steps to ensure accurate reporting of applicable excise taxes. First, gather all necessary financial information related to the transactions that may incur excise taxes. Next, fill out the identification section, providing the organization’s name, address, and Employer Identification Number (EIN). Then, report the specific excise taxes applicable to your organization, including any calculations required to determine the tax amount owed. Finally, review the completed form for accuracy before submission.

How to Obtain the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

The Form 4720 can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out manually, or it can be completed electronically using tax software that supports IRS forms. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Filing Deadlines for the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

Filing deadlines for Form 4720 vary depending on the organization's tax year. Generally, the form must be filed by the 15th day of the fifth month following the end of the tax year. If the organization is on a calendar year, this typically means the deadline is May 15. It is important to be aware of these deadlines to avoid penalties for late filing or non-compliance.

Penalties for Non-Compliance with the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

Failure to file Form 4720 or to pay the associated excise taxes can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of non-compliance. Additionally, organizations may face interest charges on unpaid taxes, which can accumulate over time. Understanding these penalties emphasizes the importance of timely and accurate filing.

Legal Use of the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

The legal use of Form 4720 is essential for organizations subject to excise taxes under the specified chapters of the Internal Revenue Code. Proper filing of this form not only ensures compliance with federal tax laws but also protects the organization from potential legal issues related to tax evasion or negligence. Organizations should maintain accurate records and documentation to support the information reported on the form.

Quick guide on how to complete form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code

Complete Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code effortlessly on any device

Online document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to modify and eSign Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code with ease

- Obtain Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight key sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code

Create this form in 5 minutes!

How to create an eSignature for the form 4720 return of certain excise taxes under chapters 41 and 42 of the internal revenue code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

The Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code is used by organizations to report and pay excise taxes related to excess benefits and other transactions. This form assists in ensuring compliance with tax regulations and helps organizations avoid penalties associated with incorrect filings.

-

How can airSlate SignNow assist in completing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow provides a streamlined solution for filling out and eSigning the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. With customizable templates and intuitive workflows, users can efficiently prepare their tax documentation, ensuring accuracy and compliance before submission.

-

What are the pricing options for using airSlate SignNow for Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it affordable to manage the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. With options suitable for individuals and larger organizations alike, customers can choose a plan that fits their signing frequency and document volume.

-

What features does airSlate SignNow offer to simplify the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

airSlate SignNow features electronic signatures, document templates, and audit trails, which simplify the management of the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. These tools enhance efficiency, ensure compliance, and provide easy tracking of signed documents for future reference.

-

What benefits does airSlate SignNow provide for filing the Form 4720 Return Of Certain Excise Taxes?

Using airSlate SignNow to file the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code brings numerous benefits, including faster document turnaround and reduced paperwork. The platform enhances collaboration among departments, streamlining the review and approval processes necessary for timely submissions.

-

Can airSlate SignNow integrate with other software for managing the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code?

Yes, airSlate SignNow can integrate seamlessly with various accounting and tax preparation software to enhance the management of the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. This integration helps in automatically populating data, reducing the risk of errors and ensuring a smooth filing process.

-

Is airSlate SignNow secure for handling sensitive documents like the Form 4720 Return Of Certain Excise Taxes?

Absolutely, airSlate SignNow prioritizes the security of your documents, including the Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code. With advanced encryption, secure data storage, and compliance with industry standards, you can trust that your sensitive information remains protected throughout the signing process.

Get more for Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- Uc 9a department of labor and workforce development form

- Fa 4109 fillable form

- Fifth grade weekly homework sheet 2 form

- Dlink migrate word form

- Kansas state processed vehcicle refunds tr 86 state processed vehcicle refunds 16m 5 year trailer registration ksrevenue form

- Social security administration 0 form

- Pr 20 voucher for work form

- Shelby county schools vendor application mcsk12 form

Find out other Form 4720 Return Of Certain Excise Taxes Under Chapters 41 And 42 Of The Internal Revenue Code

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed