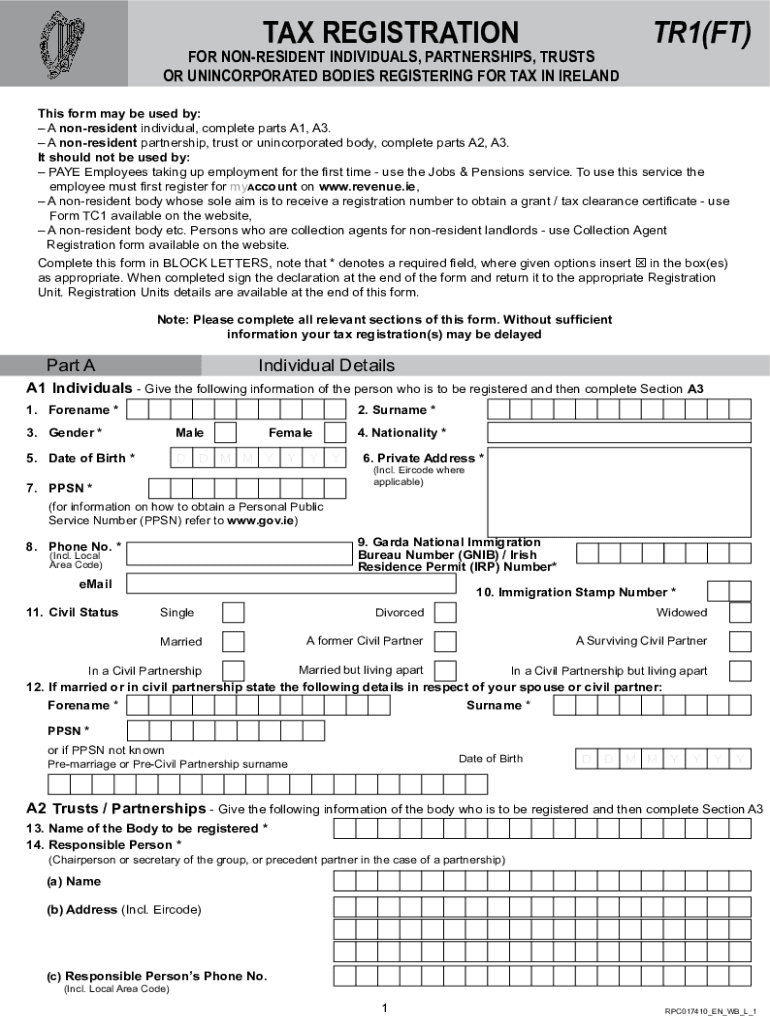

TR1 FT Tax Registration Form

What is the TR1 FT Tax Registration

The TR1 FT Tax Registration is a crucial form used for tax purposes in the United States. It is primarily designed for businesses and individuals who need to register for tax identification numbers or to report specific tax-related information. This form helps ensure compliance with federal and state tax regulations, allowing the Internal Revenue Service (IRS) and state tax authorities to accurately track tax obligations. Understanding the purpose and requirements of the TR1 FT Tax Registration is essential for maintaining good standing with tax authorities.

How to Obtain the TR1 FT Tax Registration

To obtain the TR1 FT Tax Registration, individuals or businesses must follow a straightforward process. The form can typically be acquired from the IRS website or through state tax agency offices. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted. Once you have the form, carefully review the instructions provided to understand the specific information required for completion.

Steps to Complete the TR1 FT Tax Registration

Completing the TR1 FT Tax Registration involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the instructions provided, either online, by mail, or in person.

Taking the time to complete each step thoroughly can help avoid delays in processing your registration.

Required Documents for TR1 FT Tax Registration

When completing the TR1 FT Tax Registration, certain documents may be required to support your application. Commonly needed documents include:

- Proof of identity, such as a driver's license or Social Security card.

- Business formation documents, if applicable, like articles of incorporation or partnership agreements.

- Any previous tax registration forms, if you are updating or amending your registration.

Having these documents ready can streamline the registration process and ensure compliance with regulatory requirements.

Filing Deadlines for TR1 FT Tax Registration

Filing deadlines for the TR1 FT Tax Registration can vary based on the specific circumstances of the applicant. Generally, it is advisable to submit the registration as early as possible to avoid penalties. Key deadlines may include:

- Initial registration deadlines for new businesses.

- Annual renewal deadlines, if applicable.

- Deadlines related to specific tax reporting periods.

Staying informed about these deadlines is critical to maintaining compliance and avoiding late fees.

Penalties for Non-Compliance with TR1 FT Tax Registration

Failure to comply with the requirements of the TR1 FT Tax Registration can result in significant penalties. These may include:

- Fines imposed by the IRS or state tax authorities.

- Increased scrutiny on future tax filings.

- Potential legal action for persistent non-compliance.

Understanding these penalties can motivate timely and accurate completion of the registration process.

Quick guide on how to complete tr1 ft tax registration

Complete TR1 FT Tax Registration effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as it allows you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly and without hassle. Manage TR1 FT Tax Registration on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign TR1 FT Tax Registration without fuss

- Obtain TR1 FT Tax Registration and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet signature.

- Review the details and click the Done button to save your changes.

- Choose your method of delivering the form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign TR1 FT Tax Registration to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tr1 ft tax registration

Create this form in 5 minutes!

How to create an eSignature for the tr1 ft tax registration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is TR1 FT Tax Registration?

TR1 FT Tax Registration refers to the process of registering for tax purposes in certain jurisdictions. It is crucial for businesses that plan to operate within specific regulatory frameworks. Understanding TR1 FT Tax Registration can help ensure compliance and ease of doing business.

-

How does airSlate SignNow assist with TR1 FT Tax Registration?

airSlate SignNow provides a streamlined solution for businesses looking to manage their TR1 FT Tax Registration documents efficiently. With our platform, users can easily create, send, and eSign necessary forms, ensuring a hassle-free registration process. This can save time and reduce errors associated with manual submissions.

-

What are the pricing options for using airSlate SignNow for TR1 FT Tax Registration?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, including those focused on TR1 FT Tax Registration. Our pricing is competitive and transparent, ensuring you pay only for what you need. Interested users can explore subscription options starting with a free trial to assess our features.

-

What features of airSlate SignNow are beneficial for TR1 FT Tax Registration?

Key features of airSlate SignNow that support TR1 FT Tax Registration include secure eSigning, document templates, and workflow automation. These functionalities ensure that all necessary forms are completed correctly and efficiently, which is essential for tax compliance. Additionally, our platform is user-friendly and accessible from any device.

-

Are there integrations available for TR1 FT Tax Registration with airSlate SignNow?

Yes, airSlate SignNow offers various integrations that enhance the TR1 FT Tax Registration process. Our platform can connect with popular applications like Google Drive, Dropbox, and CRM systems to streamline document management. This integration capability boosts productivity by allowing users to manage their documents from a single platform.

-

How can airSlate SignNow improve my experience with TR1 FT Tax Registration?

Using airSlate SignNow for TR1 FT Tax Registration can simplify document preparation and submission. Our service minimizes time spent on paperwork through automation and ensures that all signers have easy access to necessary documents. As a result, you can focus more on your business rather than the administrative tasks.

-

Is airSlate SignNow secure for handling TR1 FT Tax Registration documents?

Absolutely, airSlate SignNow prioritizes security for all documents, including those related to TR1 FT Tax Registration. We employ industry-standard encryption and secure storage to protect sensitive information. Your documents are safe with us, giving you peace of mind during the registration process.

Get more for TR1 FT Tax Registration

- Absenceformbths 03 21 14 brooklyn technical high school bths

- Application for employment remlinger farms form

- Minnesota health care directive printable 100283775 form

- Hart workpermitcom form

- Visual text comprehension worksheets form

- Field trip release form

- Ontario ministry of training form 34 1677e

- Director service agreement template form

Find out other TR1 FT Tax Registration

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application