Fire Insurance Policy Sample Form

What is the Fire Insurance Policy Sample

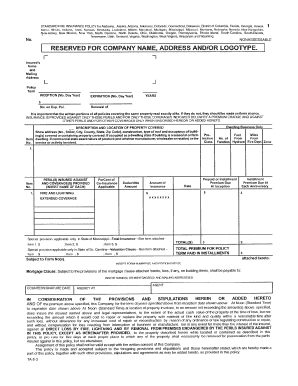

A fire insurance policy sample serves as a template or example of the documentation that outlines the terms and conditions of fire insurance coverage. This type of insurance protects property owners from financial losses due to fire damage. The sample typically includes essential details such as the insured property description, coverage limits, deductibles, and the rights and responsibilities of both the insurer and the insured. Understanding this document is crucial for policyholders to ensure they have adequate coverage and to know what to expect in the event of a claim.

Key Elements of the Fire Insurance Policy Sample

Several key elements are essential in a fire insurance policy sample. These include:

- Insured Property Description: A detailed description of the property covered under the policy, including its location and any specific features.

- Coverage Limits: The maximum amount the insurer will pay for damages resulting from a fire incident.

- Deductibles: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Exclusions: Specific situations or types of damage that are not covered by the policy.

- Claims Process: Instructions on how to file a claim, including necessary documentation and timelines.

How to Use the Fire Insurance Policy Sample

Using a fire insurance policy sample involves several steps to ensure that you understand the coverage and can effectively communicate your needs to an insurance provider. Start by reviewing the sample carefully to familiarize yourself with the terminology and structure. Identify the coverage limits and deductibles that align with your needs. When discussing with an insurance agent, use the sample as a reference point to ask specific questions about coverage options, exclusions, and the claims process. This proactive approach can help ensure you select the right policy for your property.

Steps to Complete the Fire Insurance Policy Sample

Completing a fire insurance policy sample involves several important steps:

- Gather Information: Collect all necessary details about the property, including its value, location, and any unique features.

- Review Coverage Options: Analyze different coverage options available in the sample to determine what best suits your needs.

- Fill Out the Sample: Complete the sample document with accurate information, ensuring all fields are filled out correctly.

- Consult with an Agent: Discuss the completed sample with an insurance agent to clarify any uncertainties and make necessary adjustments.

- Finalize the Policy: Once satisfied with the terms, proceed to finalize your insurance policy with the chosen provider.

Legal Use of the Fire Insurance Policy Sample

The legal use of a fire insurance policy sample is crucial for ensuring that the document meets state and federal regulations. Each state may have specific requirements regarding fire insurance policies, including mandatory disclosures and coverage minimums. It is essential to ensure that the sample adheres to these regulations to avoid potential legal issues. Additionally, the policy must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) if signed electronically, ensuring its validity in a legal context.

How to Obtain the Fire Insurance Policy Sample

Obtaining a fire insurance policy sample can be done through various means. Many insurance companies provide sample policies on their websites, allowing potential customers to review the terms and conditions before purchasing. Additionally, insurance agents can provide samples tailored to specific needs, offering insights into coverage options and exclusions. Online resources and legal websites may also offer downloadable samples for educational purposes. Always ensure that the sample you are reviewing is up-to-date and relevant to your state’s regulations.

Quick guide on how to complete fire insurance policy sample

Effortlessly prepare Fire Insurance Policy Sample on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the required form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fire Insurance Policy Sample on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Fire Insurance Policy Sample with ease

- Find Fire Insurance Policy Sample and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Fire Insurance Policy Sample to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fire insurance policy sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a fire insurance policy sample and why is it important?

A fire insurance policy sample is a template that outlines the coverage provided for damages caused by fire to your property. It is essential because it helps you understand the terms, conditions, and exclusions associated with fire insurance, ensuring you make informed decisions when selecting a policy for your needs.

-

How can I use a fire insurance policy sample to compare different policies?

You can use a fire insurance policy sample to identify key features and coverage options to compare different insurance providers effectively. By examining multiple samples, you'll be able to see the similarities and differences, allowing you to choose the best policy that fits your specific requirements and budget.

-

Are fire insurance policy samples generally customizable?

Yes, fire insurance policy samples are often customizable to meet individual needs. Whether you need additional coverage for personal belongings or specific exclusions, using a sample can help you communicate your requirements clearly to insurance agents for better-tailored options.

-

What factors affect the pricing of a fire insurance policy?

The pricing of a fire insurance policy is influenced by several factors, including the value of the property, location, and the coverage amount selected. Additionally, insurance companies may also consider your claims history and the type of materials used in your property when determining the overall cost.

-

What are the benefits of using a fire insurance policy sample?

Using a fire insurance policy sample provides clarity on coverage terms and helps ensure that you are adequately protected against fire-related incidents. This sample can also save time in the purchasing process by offering guidelines on what to look for and discuss with insurance providers.

-

Can I integrate my fire insurance policy with other types of insurance?

Yes, many insurers allow you to integrate your fire insurance policy with other types such as home, auto, or business insurance. Bundling policies can lead to discounts and simplified management, making it easier to keep track of your coverage and claims.

-

How do I file a claim on my fire insurance policy?

Filing a claim on your fire insurance policy typically involves contacting your insurance provider to report the incident and provide necessary documentation. Using a fire insurance policy sample can prepare you with the essential information needed to expedite the claims process and ensure accurate reporting.

Get more for Fire Insurance Policy Sample

- Administrative procedures us bankruptcy court eastern form

- Local bankruptcy forms united states bankruptcy court for

- This agreement gives up the protection of your bankruptcy discharge for this debt form

- As a result of this agreement the creditor may be able to take your property or wages if you do not pay the agreed form

- Local forms united states bankruptcy court for the western

- Mandatory creditor listmatrix middle district of pennsylvania form

- Judge pimentel crim transcript book 2justicecrime ampamp justice form

- Applies so long as a loan is owed by buyers to any person form

Find out other Fire Insurance Policy Sample

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement