Financial Criteria Form Return This Form along with Your Completed

What is the Financial Criteria Form Return This Form Along With Your Completed

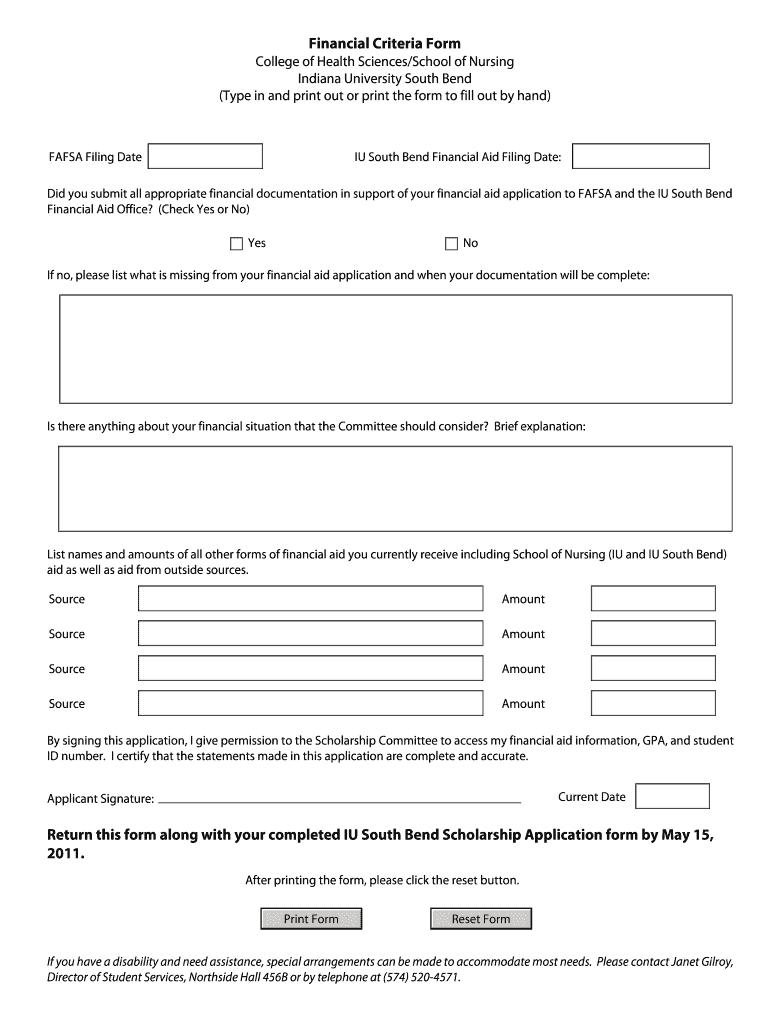

The Financial Criteria Form is a document used primarily to assess an individual's or entity's financial standing. This form is often required in various applications, including loan approvals, government assistance programs, and financial aid requests. By filling out this form, applicants provide necessary financial information that helps institutions evaluate eligibility based on specific criteria.

Steps to complete the Financial Criteria Form Return This Form Along With Your Completed

Completing the Financial Criteria Form involves several key steps:

- Gather necessary financial documents, such as income statements, tax returns, and bank statements.

- Fill out personal information, including your name, address, and Social Security number.

- Provide detailed information about your income sources, expenses, and assets.

- Review the form for accuracy and completeness before submission.

- Sign and date the form to certify that the information provided is true and accurate.

Required Documents

When completing the Financial Criteria Form, certain documents are typically required to support your application. These may include:

- Recent pay stubs or income verification letters.

- Tax returns for the past two years.

- Bank statements for the last three months.

- Documentation of any additional income, such as rental income or alimony.

Form Submission Methods (Online / Mail / In-Person)

The Financial Criteria Form can usually be submitted through various methods, depending on the institution's requirements:

- Online: Many institutions offer a secure online portal for submitting forms electronically.

- Mail: You can print the completed form and send it via postal service to the designated address.

- In-Person: Some applicants may choose to deliver the form directly to the institution's office.

Eligibility Criteria

Eligibility for programs requiring the Financial Criteria Form often depends on specific financial thresholds. Common criteria may include:

- Income limits based on household size.

- Asset limits, which may include savings and property values.

- Specific circumstances, such as employment status or educational enrollment.

Legal use of the Financial Criteria Form Return This Form Along With Your Completed

The Financial Criteria Form serves a legal purpose in verifying financial information for various applications. It is essential that the information provided is accurate, as any discrepancies may lead to legal repercussions or denial of benefits. Institutions may use this form to comply with federal and state regulations regarding financial assistance and eligibility assessments.

Quick guide on how to complete financial criteria form return this form along with your completed

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications, and streamline any document-related process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Financial Criteria Form Return This Form Along With Your Completed

Create this form in 5 minutes!

How to create an eSignature for the financial criteria form return this form along with your completed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Financial Criteria Form Return This Form Along With Your Completed process?

The Financial Criteria Form Return This Form Along With Your Completed is a streamlined process designed to help businesses submit necessary financial documentation efficiently. By utilizing airSlate SignNow, you can easily fill out and eSign this form, ensuring that all required information is accurately captured and submitted in a timely manner.

-

How does airSlate SignNow ensure the security of my Financial Criteria Form Return This Form Along With Your Completed?

airSlate SignNow prioritizes the security of your documents, including the Financial Criteria Form Return This Form Along With Your Completed. We implement advanced encryption protocols and secure cloud storage to protect your sensitive information, ensuring that only authorized users have access to your documents.

-

Are there any costs associated with submitting the Financial Criteria Form Return This Form Along With Your Completed?

While submitting the Financial Criteria Form Return This Form Along With Your Completed through airSlate SignNow is cost-effective, there may be subscription fees depending on the features you choose. We offer various pricing plans to accommodate different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for the Financial Criteria Form Return This Form Along With Your Completed?

airSlate SignNow provides a range of features for the Financial Criteria Form Return This Form Along With Your Completed, including customizable templates, automated workflows, and real-time tracking. These features enhance efficiency and ensure that your documents are processed quickly and accurately.

-

Can I integrate airSlate SignNow with other software for the Financial Criteria Form Return This Form Along With Your Completed?

Yes, airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the Financial Criteria Form Return This Form Along With Your Completed alongside your existing tools. This integration capability enhances your workflow and improves overall productivity.

-

What are the benefits of using airSlate SignNow for the Financial Criteria Form Return This Form Along With Your Completed?

Using airSlate SignNow for the Financial Criteria Form Return This Form Along With Your Completed offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, allowing you to focus on your core business activities.

-

Is there customer support available for issues related to the Financial Criteria Form Return This Form Along With Your Completed?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any issues related to the Financial Criteria Form Return This Form Along With Your Completed. Our support team is available via chat, email, or phone to ensure you receive timely assistance.

Get more for Financial Criteria Form Return This Form Along With Your Completed

Find out other Financial Criteria Form Return This Form Along With Your Completed

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed