Eg 13 B Form

What is the Eg 13 B

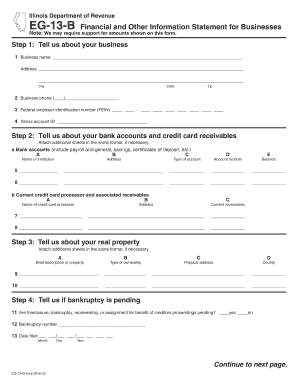

The Eg 13 B form is an official document used in Illinois, primarily for specific legal and administrative purposes. It is essential for individuals and businesses to understand the function of this form within the context of their operations. The form serves as a means to provide necessary information to state authorities, ensuring compliance with local regulations. Understanding its purpose helps users navigate the requirements effectively.

Steps to complete the Eg 13 B

Completing the Eg 13 B form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and any relevant financial data. Next, carefully fill out each section of the form, making sure to follow the provided instructions for clarity. After completing the form, review it for any errors or omissions before submitting it. This attention to detail is crucial for avoiding delays or complications in processing.

Legal use of the Eg 13 B

The legal use of the Eg 13 B form is significant, as it must adhere to specific regulations to be considered valid. When filled out correctly, it can serve as a legally binding document, provided it meets the requirements set forth by Illinois law. This includes obtaining necessary signatures and ensuring that the information provided is truthful and accurate. Users should be aware of the legal implications of submitting this form and ensure compliance with all relevant laws.

How to obtain the Eg 13 B

Obtaining the Eg 13 B form is a straightforward process. Individuals can access it through the official Illinois state website or relevant government offices. It is essential to ensure that the most current version of the form is used to avoid any issues during submission. Users should also familiarize themselves with any specific requirements or conditions that may apply to their situation when obtaining the form.

Key elements of the Eg 13 B

The Eg 13 B form includes several key elements that are crucial for its completion and validity. These elements typically consist of personal identification information, details pertaining to the purpose of the form, and any necessary declarations or certifications. Understanding these components helps users fill out the form accurately and ensures that all required information is provided for processing.

Form Submission Methods

Submitting the Eg 13 B form can be done through various methods, depending on the preferences of the user and the requirements of the issuing authority. Common submission methods include online submission through designated state portals, mailing the completed form to the appropriate office, or delivering it in person. Each method has its own set of guidelines and timelines, so users should choose the one that best fits their needs while ensuring compliance with submission deadlines.

Examples of using the Eg 13 B

There are several scenarios where the Eg 13 B form is commonly utilized. For instance, it may be required when applying for certain licenses or permits, or when submitting documentation for regulatory compliance. Understanding these examples can help users recognize when the form is necessary and how it fits into their broader administrative or legal processes. This knowledge can enhance preparedness and ensure timely submissions.

Quick guide on how to complete eg 13 b

Complete Eg 13 B seamlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can acquire the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Eg 13 B on any device using the airSlate SignNow Android or iOS applications and enhance any document-based operation today.

The easiest method to modify and eSign Eg 13 B with ease

- Locate Eg 13 B and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with features provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and eSign Eg 13 B and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eg 13 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is eg 13 b and how does it relate to airSlate SignNow?

Eg 13 b is a specific reference within the airSlate SignNow platform that highlights our commitment to providing advanced eSigning capabilities. This feature enables users to streamline their document management, making signing and sending documents more efficient. When you use airSlate SignNow, you can experience the benefits of eg 13 b firsthand.

-

How much does airSlate SignNow cost for businesses interested in eg 13 b?

The pricing for airSlate SignNow varies based on the plan chosen by the business. Our plans are designed to be cost-effective and scalable for any organization, providing excellent value for features related to eg 13 b. For detailed pricing, you can visit our pricing page or contact our sales team.

-

What features does airSlate SignNow offer related to eg 13 b?

AirSlate SignNow includes features like secure eSignature, document templates, and real-time collaboration that enhance the eg 13 b functionality. These features ensure that your document workflow is not only seamless but also fully compliant with legal standards. Discover how eg 13 b can optimize your processes.

-

How can eg 13 b benefit my business?

Utilizing eg 13 b within the airSlate SignNow platform allows your business to reduce paperwork and increase efficiency in document handling. This benefit translates to faster turnaround times and greater accuracy in your transactions. Embracing eg 13 b means fewer delays and more productivity for your team.

-

Does airSlate SignNow integrate with other applications for eg 13 b?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing the functionality of eg 13 b. You can connect it with CRMs, cloud storage, and productivity tools to ensure a smooth workflow. This integration capability makes it easy to incorporate eg 13 b into your existing systems.

-

Is airSlate SignNow secure for handling sensitive documents related to eg 13 b?

Absolutely! airSlate SignNow employs top-tier security measures to protect your sensitive documents when using features like eg 13 b. We use encryption and compliance with industry standards to ensure that your data remains safe and private throughout the signing process.

-

What types of businesses can benefit from using eg 13 b?

Businesses of all sizes and industries can benefit from using eg 13 b with airSlate SignNow. Whether you're in real estate, healthcare, or finance, our platform is adaptable to your needs. Eg 13 b enhances document processes for any organization looking to modernize their approach to eSigning.

Get more for Eg 13 B

- Targobank duisburg postfach 21 02 54 form

- This lease the quotleasequot dated this 19th day of november memoryproject form

- Parkpavilion rental agreement the city of newnan form

- Georgia residential lease agreement landlord lease forms

- Private dance lesson contract template 787753891 form

- Private event contract template 787753892 form

- Private home sale contract template form

- Private house sale contract template form

Find out other Eg 13 B

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF