Pt Reduction Form

What is the PT Reduction Form

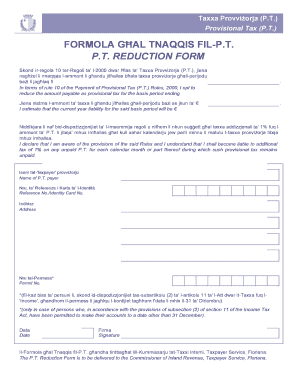

The PT reduction form is a document used primarily in the context of tax and financial reporting. It allows individuals or businesses to request a reduction in the assessed value of property or to adjust tax obligations based on specific criteria. This form is essential for ensuring that taxpayers are not overburdened by taxes that do not accurately reflect their financial situation or property value.

How to Use the PT Reduction Form

Using the PT reduction form involves a few straightforward steps. First, gather all necessary information, including property details and any relevant financial documents. Next, fill out the form accurately, ensuring that all fields are completed. Once filled, review the form for any errors before submission. Finally, submit the form according to the guidelines provided, whether online, by mail, or in person, depending on your local regulations.

Steps to Complete the PT Reduction Form

Completing the PT reduction form requires careful attention to detail. Follow these steps:

- Gather necessary documentation, such as property tax assessments and financial statements.

- Fill out the form, ensuring all required fields are completed accurately.

- Double-check your entries for any mistakes or missing information.

- Submit the form through the correct channel, ensuring you meet any deadlines.

Legal Use of the PT Reduction Form

The legal use of the PT reduction form is crucial for compliance with tax regulations. To be considered valid, the form must be completed according to state laws and submitted within specified timeframes. Additionally, it should be signed by the appropriate parties, ensuring that all claims made on the form are supported by documentation. Using a reliable electronic signature tool can enhance the form's legality and provide a secure method of submission.

Key Elements of the PT Reduction Form

Key elements of the PT reduction form typically include:

- Taxpayer identification information, such as name and address.

- Details about the property, including location and current assessed value.

- Justification for the requested reduction, supported by documentation.

- Signatures of the taxpayer or authorized representatives.

Who Issues the Form

The PT reduction form is generally issued by local or state tax authorities. Depending on the jurisdiction, the specific agency responsible for property assessments will provide the form and any accompanying instructions. It is essential to obtain the correct version of the form from the appropriate source to ensure compliance with local regulations.

Required Documents

When submitting the PT reduction form, certain documents are typically required to support your request. These may include:

- Current property tax assessment notices.

- Financial statements or appraisals that justify the reduction.

- Any prior correspondence with tax authorities regarding the property.

Quick guide on how to complete pt reduction form

Complete Pt Reduction Form effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Pt Reduction Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Pt Reduction Form with ease

- Locate Pt Reduction Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Put aside concerns about lost or mislaid documents, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your preference. Edit and eSign Pt Reduction Form and maintain outstanding communication at any point in your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt reduction form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a PT reduction form online?

A PT reduction form online is a digital document that enables users to request a reduction in personal training fees. With airSlate SignNow, you can easily create, customize, and send this form to clients, facilitating efficient communication and record-keeping.

-

How secure is the PT reduction form online when using airSlate SignNow?

airSlate SignNow prioritizes security for all documents, including the PT reduction form online. We use advanced encryption and authentication methods to ensure that your sensitive information remains protected throughout the signing process.

-

Can I integrate my PT reduction form online with other software?

Yes, airSlate SignNow allows seamless integrations with various platforms, making it easy to connect your PT reduction form online with CRM systems, payment processors, and more. This helps streamline your workflow and enhance efficiency.

-

What features does airSlate SignNow offer for the PT reduction form online?

airSlate SignNow offers numerous features for managing your PT reduction form online, including customizable templates, electronic signatures, automated reminders, and real-time tracking. These features simplify the process of obtaining client approvals and managing documentation.

-

Is there a cost associated with using the PT reduction form online via airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit your business needs. Our plans are designed to be cost-effective while providing essential features for managing your PT reduction form online efficiently.

-

How can I customize my PT reduction form online?

Customizing your PT reduction form online is easy with airSlate SignNow. You can add your branding, modify text fields, and adjust the layout to suit your specific requirements before sending it to clients.

-

What are the benefits of using airSlate SignNow for the PT reduction form online?

Using airSlate SignNow for the PT reduction form online offers numerous benefits, including increased efficiency, reduced paper usage, and the ability to track document statuses in real time. This leads to faster approvals and improved client satisfaction.

Get more for Pt Reduction Form

- Labor order form inform or request labor from iatse

- Oklahoma wage claim form

- Terry neese form

- Maui behavioral health resources p aloha house form

- Client list form

- Poronol form

- Kauai veterans memorial hospital samuel mahelona memorial hospital form

- Medical expense flex hra reimbursement request f form

Find out other Pt Reduction Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy