Publication 784 Form

What is the Publication 784

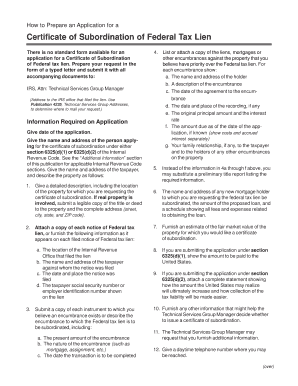

The IRS Publication 784 is a vital resource for taxpayers, providing essential information regarding the tax implications of various transactions. This publication outlines specific guidelines and requirements for taxpayers to ensure compliance with federal tax laws. It serves as a reference for understanding the nuances of tax reporting and obligations, particularly in relation to certain financial activities and transactions that may impact an individual’s or business’s tax situation.

How to use the Publication 784

To effectively utilize the IRS Publication 784, taxpayers should first identify the specific sections that pertain to their financial circumstances. This involves reviewing the guidelines outlined in the publication to determine how they apply to various transactions. Taxpayers can use this publication as a checklist to ensure that they meet all necessary requirements and understand the implications of their actions. It is important to consult the publication regularly, especially during tax preparation seasons, to stay informed about any updates or changes.

Steps to complete the Publication 784

Completing the IRS Publication 784 involves several key steps:

- Review the publication thoroughly to understand the requirements relevant to your situation.

- Gather necessary documentation and information that supports your transactions.

- Follow the guidelines provided in the publication to accurately report your financial activities.

- Ensure that all required signatures and certifications are included to validate the document.

- Submit the completed publication as part of your overall tax filing, if applicable.

Legal use of the Publication 784

The legal use of the IRS Publication 784 is crucial for ensuring compliance with federal tax regulations. This publication provides taxpayers with the necessary information to avoid potential legal issues related to tax reporting. Adhering to the guidelines outlined in the publication helps mitigate the risk of penalties and ensures that transactions are reported accurately. It is essential for taxpayers to understand that failure to comply with the instructions may result in legal repercussions.

Key elements of the Publication 784

Several key elements define the IRS Publication 784, including:

- Detailed descriptions of various tax-related transactions.

- Guidelines on documentation and record-keeping requirements.

- Information on potential tax implications and reporting obligations.

- Clarifications on eligibility criteria for specific tax benefits or deductions.

Examples of using the Publication 784

Examples of using the IRS Publication 784 can vary based on individual circumstances. For instance, a self-employed individual may refer to the publication to understand the tax implications of business expenses. Similarly, a taxpayer selling property may consult the publication to ensure they report the transaction correctly. Each scenario highlights the importance of the publication in guiding taxpayers through complex tax situations.

Quick guide on how to complete publication 784

Effortlessly Prepare Publication 784 on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally-friendly solution to conventional printed and signed documents, allowing you to access the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Publication 784 across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Alter and Electronically Sign Publication 784 with Ease

- Locate Publication 784 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive data using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you want to send your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Publication 784 and maintain effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 784

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 784 and how can it benefit my business?

Publication 784 provides essential guidelines for businesses regarding electronic signatures and document management. By understanding its implications, your business can streamline document processes and enhance compliance with regulations, ultimately saving time and resources.

-

How does airSlate SignNow comply with the guidelines in Publication 784?

airSlate SignNow ensures compliance with Publication 784 by offering secure and legally binding electronic signatures. Our platform adheres to the requirements outlined in this publication, thus helping businesses maintain valid electronic records while enhancing the efficiency of document workflows.

-

What are the pricing options for airSlate SignNow related to Publication 784?

airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides features essential for adhering to Publication 784, so your business can choose the option that best aligns with its document management requirements and budget.

-

Can airSlate SignNow integrate with other software while following Publication 784?

Yes, airSlate SignNow provides seamless integrations with popular software platforms, such as Salesforce and Google Workspace. These integrations enable you to maintain compliance with Publication 784 while enhancing your overall workflow efficiency.

-

What are the main features of airSlate SignNow that support Publication 784 compliance?

Key features of airSlate SignNow that support Publication 784 compliance include secure eSigning, audit trails, and templates for standardized documents. These features help businesses execute document transactions efficiently while ensuring they meet the necessary legal requirements.

-

Is airSlate SignNow suitable for all types of businesses when considering Publication 784?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes and sectors, making it an ideal choice regardless of your industry. By utilizing our solution, organizations can better navigate the compliance landscape dictated by Publication 784.

-

How can airSlate SignNow enhance the efficiency of document signing in light of Publication 784?

Using airSlate SignNow can greatly enhance document signing efficiency by automating workflows and reducing turnaround times. By adhering to Publication 784, our solution not only expedites the signing process but also maintains accuracy and compliance.

Get more for Publication 784

- Flextime request form

- Can you please forward this information to the department

- The future of remote work american psychological form

- Sample completed form its your yale

- Training suggestion form

- Employee satisfaction surveys best practices ampamp questions form

- 1 overall how do you rate your job satisfaction today form

- Workplace romance policy example rules on employee dating form

Find out other Publication 784

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation