64 8 Form

What is the 64 8 form

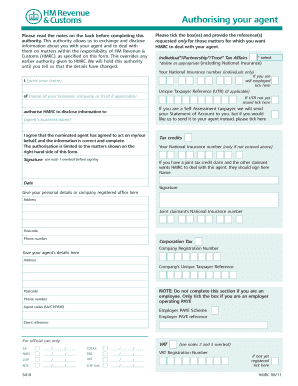

The 64 8 form is a document utilized primarily for tax purposes in the United States. It is used by individuals or entities to request a change in the responsible party for an Employer Identification Number (EIN). This form is essential for ensuring that the IRS has accurate information regarding who is responsible for tax obligations associated with a business entity. Understanding the purpose and function of the 64 8 form is crucial for maintaining compliance with IRS regulations.

How to use the 64 8

Using the 64 8 form involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the IRS website. Next, fill out the required fields, including the name and address of the new responsible party and their Taxpayer Identification Number (TIN). It is important to provide accurate information to avoid delays in processing. After completing the form, submit it to the IRS either by mail or electronically, depending on your preference and the guidelines provided by the IRS.

Steps to complete the 64 8

Completing the 64 8 form requires careful attention to detail. Here are the key steps to follow:

- Obtain the latest version of the 64 8 form from the IRS.

- Provide the current responsible party's information, including their name and TIN.

- Enter the new responsible party's details, ensuring accuracy in their name and address.

- Sign and date the form to certify the information provided.

- Submit the completed form to the IRS through the appropriate channel.

Legal use of the 64 8

The legal use of the 64 8 form is governed by IRS regulations. This form must be filled out accurately to ensure that the change of responsible party is recognized by the IRS. Failure to comply with the legal requirements can lead to penalties or complications with tax filings. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of this form.

Who Issues the Form

The 64 8 form is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and tax law enforcement in the United States. The IRS provides the necessary forms and guidelines to assist taxpayers in fulfilling their tax obligations, including the 64 8 form for changing the responsible party for an EIN.

Form Submission Methods (Online / Mail / In-Person)

The 64 8 form can be submitted to the IRS through various methods. Taxpayers have the option to file the form online, which is often the quickest method. Alternatively, the form can be mailed to the appropriate IRS address, as indicated in the form instructions. In-person submission is generally not available for this specific form, making online and mail submissions the primary options for taxpayers.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 64 8 form. These guidelines outline the necessary information required, the proper channels for submission, and any deadlines that may apply. It is important to review these guidelines carefully to ensure compliance and to avoid any potential issues with the IRS regarding the change of responsible party.

Quick guide on how to complete 64 8 87068484

Complete 64 8 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage 64 8 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign 64 8 with ease

- Obtain 64 8 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Purge any concerns over lost or incorrectly filed documents, cumbersome form searching, or mistakes that require new copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign 64 8 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 64 8 87068484

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 64 8 form and why is it important for my business?

The 64 8 form is a crucial document for businesses as it allows you to authorize a tax agent or advisor to act on your behalf. By utilizing the 64 8 form, you ensure that your tax-related communications and submissions are handled efficiently, allowing your business to focus on its core operations.

-

How does airSlate SignNow simplify the process of completing the 64 8 form?

airSlate SignNow streamlines the completion of the 64 8 form with its intuitive interface, allowing users to easily fill out and sign documents electronically. This simplifies the process, reduces time spent on paperwork, and minimizes the risk of errors that can arise from manual completion.

-

Is there a cost associated with using airSlate SignNow for the 64 8 form?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs. You can choose a plan that fits your budget while accessing features that enhance your ability to handle the 64 8 form and other important documents.

-

What features does airSlate SignNow offer for managing the 64 8 form?

With airSlate SignNow, you can electronically sign, send, and manage the 64 8 form with ease. Additional features include document templates, real-time tracking, and secure cloud storage, which make document management more efficient and accessible.

-

Can I integrate airSlate SignNow with other platforms for handling the 64 8 form?

Absolutely! airSlate SignNow offers integrations with various accounting and document management systems, providing a seamless workflow for handling the 64 8 form and other related documents. This enables you to enhance productivity while keeping all your important documents in one place.

-

How secure is the information I submit through the 64 8 form using airSlate SignNow?

Your security is our priority. airSlate SignNow uses state-of-the-art encryption and authentication methods to protect all data submitted through the 64 8 form, ensuring that sensitive information remains confidential and secure throughout the process.

-

Can multiple users collaborate on the 64 8 form with airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on the 64 8 form in real-time. With features like shared links and collaborative signing, your team can work together efficiently, ensuring that everyone stays on the same page.

Get more for 64 8

- Policyholder disclosure notice of terrorism insurance coverage form

- Business idd 0080 change of service form hgc

- Commitment of land bformb my woodlot

- Letter of medical necessity golden state medical goldenstatemedical form

- Form ssa 10 06 uf

- Borrow money contract template form

- Borrow money from a friend contract template form

- Boudoir contract template form

Find out other 64 8

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation