T5018 2012

What is the T5018?

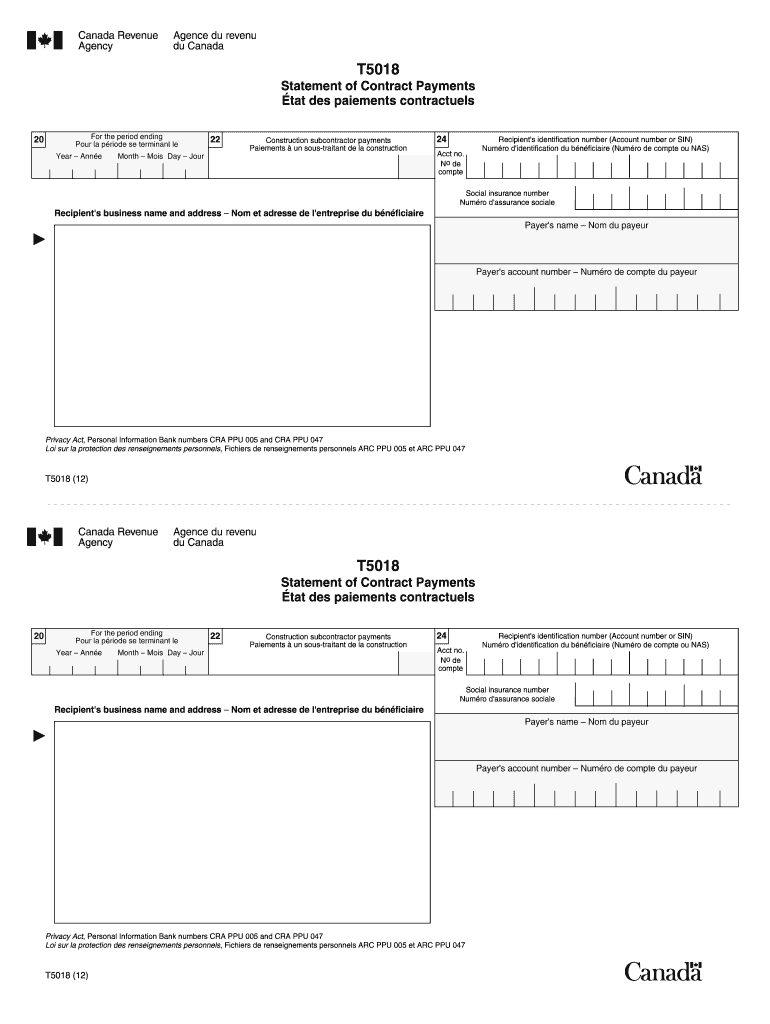

The T5018 form, also known as the T5018 fillable, is a tax document used in Canada primarily for reporting payments made to subcontractors in the construction industry. The Canada Revenue Agency (CRA) requires businesses to issue this form to ensure accurate reporting of income for tax purposes. This form is essential for contractors who hire subcontractors, as it helps to track payments and ensures compliance with tax regulations.

Steps to complete the T5018

Completing the T5018 fillable form involves several key steps to ensure accuracy and compliance with CRA requirements. Here is a structured approach:

- Gather necessary information about the subcontractors, including their legal names, addresses, and Social Insurance Numbers (SIN).

- List all payments made to each subcontractor during the tax year. Ensure that the amounts are accurate and reflect the total payments made.

- Fill out the T5018 form by entering the collected information in the designated fields. Ensure that all sections are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed T5018 form to the CRA by the designated deadline, ensuring that copies are provided to the subcontractors as well.

Legal use of the T5018

The T5018 form serves a critical legal function in the construction industry. It is legally binding when filled out correctly and submitted on time. Compliance with the CRA's requirements ensures that businesses avoid potential penalties. The form also assists subcontractors in accurately reporting their income, thereby supporting their tax obligations. Using a reliable digital tool to complete the T5018 fillable form can enhance its legal standing by ensuring that all necessary information is captured and stored securely.

Filing Deadlines / Important Dates

Filing deadlines for the T5018 form are crucial for compliance. The CRA typically requires that the T5018 be filed by the end of February of the year following the tax year in which payments were made. For example, if payments were made in 2023, the form must be submitted by February 29, 2024. It is important to keep track of these dates to avoid late filing penalties and ensure that subcontractors receive their copies in a timely manner.

Form Submission Methods

The T5018 fillable form can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online: Businesses can file the T5018 electronically through the CRA's online services, which allows for quicker processing.

- Mail: The completed form can be printed and mailed to the CRA. Ensure that it is sent well before the deadline to account for any postal delays.

- In-Person: Some businesses may choose to submit the form in person at a local CRA office, although this method is less common.

Who Issues the Form

The T5018 form is issued by the Canada Revenue Agency (CRA). It is the responsibility of businesses that engage subcontractors in the construction industry to complete and file this form. The CRA provides guidelines and resources to assist businesses in understanding their obligations regarding the T5018, ensuring that all parties involved are compliant with tax regulations.

Quick guide on how to complete t5018 agence du revenu du canada cra arc gc

Complete T5018 seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents quickly and without holdups. Manage T5018 across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The easiest way to modify and eSign T5018 effortlessly

- Find T5018 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the concern of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign T5018 to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t5018 agence du revenu du canada cra arc gc

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

In the beginning, how many forms do we have to fill out at DU?

Actually, an individual can fill only one form for delhi university. If anyone fill more than one then it would be automatically rejected. So concluding that ur question is not correct.

-

We got our 12th results after filling out the form of DU. Do we have to upload it now? If yes, how?

Yes you have to upload it now.You can do it easily by logging in DU websiteTHERE WILL BE OPTION OF UPLOADING MARKSHEET UPLOAD YOUR PHOTO COPY OF MARKSHEET.A SIMPLE AS THAT.

Create this form in 5 minutes!

How to create an eSignature for the t5018 agence du revenu du canada cra arc gc

How to make an electronic signature for the T5018 Agence Du Revenu Du Canada Cra Arc Gc online

How to make an eSignature for your T5018 Agence Du Revenu Du Canada Cra Arc Gc in Chrome

How to generate an electronic signature for signing the T5018 Agence Du Revenu Du Canada Cra Arc Gc in Gmail

How to generate an electronic signature for the T5018 Agence Du Revenu Du Canada Cra Arc Gc right from your mobile device

How to generate an eSignature for the T5018 Agence Du Revenu Du Canada Cra Arc Gc on iOS devices

How to create an electronic signature for the T5018 Agence Du Revenu Du Canada Cra Arc Gc on Android

People also ask

-

What is a T5018 fillable form?

A T5018 fillable form is a digital document used by businesses to report payments made to subcontractors in Canada. This form can be easily completed and submitted online, making it efficient for users. By utilizing the airSlate SignNow platform, you can quickly create and manage your T5018 fillable forms.

-

How can I create a T5018 fillable form in airSlate SignNow?

Creating a T5018 fillable form in airSlate SignNow is straightforward. Simply choose the T5018 template, fill in the necessary details, and customize it as needed. Once ready, you can send it out for eSigning directly through the platform, ensuring a smooth and secure process.

-

Is airSlate SignNow suitable for businesses of all sizes for T5018 fillable forms?

Yes, airSlate SignNow is designed to be scalable and user-friendly, making it suitable for businesses of all sizes. Whether you run a small business or a large corporation, you can effectively manage your T5018 fillable forms. The platform's features ensure that all users can streamline their document processes.

-

What are the benefits of using airSlate SignNow for T5018 fillable forms?

Using airSlate SignNow for T5018 fillable forms offers several benefits, such as improved efficiency and reduced paperwork. The platform allows for real-time collaboration and ensures secure eSignature options, which signNowly speeds up the filing process. This makes it easier for businesses to meet deadlines and maintain compliance.

-

Can I integrate airSlate SignNow with other software for managing T5018 fillable forms?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, including popular accounting and CRM platforms. This capability allows you to automate your workflow and manage T5018 fillable forms more effectively. You can easily synchronize data and streamline processes across different tools.

-

What is the pricing model for using airSlate SignNow for T5018 fillable forms?

airSlate SignNow offers various pricing plans tailored to fit different business needs and budgets. The plans are designed to provide flexibility and value, with options for pay-per-use or monthly subscriptions. You can choose a plan that best suits your needs for managing T5018 fillable forms.

-

How secure is airSlate SignNow for handling T5018 fillable forms?

Security is a top priority for airSlate SignNow, especially when handling T5018 fillable forms. The platform utilizes advanced encryption methods and complies with industry standards to protect your data. You can have peace of mind knowing that your documents and personal information are secure throughout the signing process.

Get more for T5018

Find out other T5018

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement