Ct Ifta Form

What is the Ct Ifta

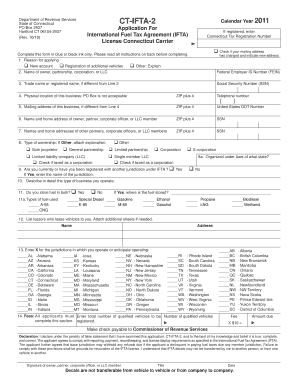

The Ct IFTA, or Connecticut International Fuel Tax Agreement, is a tax reporting system designed for motor carriers operating in multiple jurisdictions. This agreement simplifies the fuel tax payment process for interstate commercial vehicles by allowing carriers to file a single tax return for all member jurisdictions. It is essential for ensuring compliance with fuel tax regulations across states while promoting fair competition among carriers.

How to use the Ct Ifta

Using the Ct IFTA involves several steps to ensure accurate reporting and compliance. First, motor carriers must register with the Connecticut Department of Revenue Services to obtain an IFTA license. Once registered, carriers can track their fuel purchases and mileage traveled in each jurisdiction. At the end of each reporting period, typically quarterly, carriers complete the Ct IFTA form, detailing their fuel consumption and mileage. This information is then submitted to the appropriate state authority along with any taxes owed.

Steps to complete the Ct Ifta

Completing the Ct IFTA form requires careful attention to detail. Here are the steps:

- Gather necessary information: Collect records of fuel purchases and mileage for each jurisdiction.

- Fill out the form: Input the total miles driven and fuel purchased in each state.

- Calculate taxes owed: Use the rates established by each jurisdiction to determine the total tax liability.

- Review for accuracy: Double-check all entries to ensure compliance and avoid penalties.

- Submit the form: File the completed Ct IFTA form with the Connecticut Department of Revenue Services by the deadline.

Legal use of the Ct Ifta

The legal use of the Ct IFTA is governed by regulations that require accurate reporting of fuel usage and mileage. Carriers must adhere to the guidelines set forth by the IFTA to avoid legal repercussions. This includes maintaining detailed records of fuel purchases and travel logs. Non-compliance can lead to penalties, including fines and potential audits by state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Ct IFTA are crucial for maintaining compliance. Typically, the Ct IFTA form is due on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form is due by April 30. It is important for carriers to mark these dates on their calendars to avoid late fees and penalties associated with late filings.

Required Documents

To complete the Ct IFTA form, carriers must have several documents on hand:

- Fuel purchase receipts

- Mileage logs detailing travel in each jurisdiction

- Previous IFTA returns for reference

- Any correspondence from the Connecticut Department of Revenue Services

Quick guide on how to complete ct ifta

Effortlessly Prepare Ct Ifta on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents quickly and without interruptions. Manage Ct Ifta on any platform using airSlate SignNow Android or iOS applications, and simplify any document-related process today.

How to Modify and eSign Ct Ifta with Ease

- Obtain Ct Ifta and click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of your documents or redact sensitive information with the tools designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct Ifta to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IFTA and how does it relate to IFTA CT?

IFTA stands for the International Fuel Tax Agreement, which is an agreement between U.S. states and Canadian provinces to simplify fuel tax reporting for interstate and international carriers. In the context of IFTA CT, it refers to Connecticut's specific regulations and requirements for fuel tax reporting, helping businesses efficiently manage their tax obligations.

-

How can airSlate SignNow help with IFTA CT reporting?

airSlate SignNow offers a streamlined solution for eSigning documents related to IFTA CT reporting. With its user-friendly interface, businesses can easily prepare, send, and sign essential documents, ensuring compliance and reducing time spent on administrative tasks linked to fuel tax reporting.

-

What features does airSlate SignNow provide for managing IFTA CT documents?

airSlate SignNow includes features such as document templates, real-time collaboration, and customizable workflows, which are ideal for IFTA CT documentation management. These tools help businesses quickly generate necessary forms and keep track of submissions to ensure accurate reporting.

-

Is there a cost associated with using airSlate SignNow for IFTA CT?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including options specifically tailored for users managing IFTA CT documents. The cost-effective solution ensures that businesses can choose a plan that fits their budget while benefiting from essential features.

-

Can airSlate SignNow integrate with other tools for IFTA CT management?

Absolutely! airSlate SignNow integrates with a range of applications commonly used for managing IFTA CT and other business processes. This seamless integration ensures that your fuel tax reporting and documentation workflows can connect with your existing systems, improving efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for IFTA CT compliance?

Using airSlate SignNow for IFTA CT compliance provides numerous benefits, such as reducing the risk of errors in documentation and speeding up the eSignature process. Additionally, it allows businesses to maintain proper records and stay organized, which is crucial for meeting compliance requirements effectively.

-

Is airSlate SignNow user-friendly for IFTA CT newcomers?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for newcomers to navigate IFTA CT processes. The intuitive interface and comprehensive support resources assist users in quickly learning how to manage their documentation and streamline their reporting tasks.

Get more for Ct Ifta

Find out other Ct Ifta

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament