W4t Form

What is the W4t Form

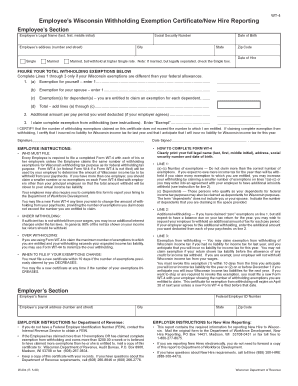

The W4t form, officially known as the IRS Form W-4T, is a tax document used by employees to indicate their tax withholding preferences. This form is specifically designed for employees who are receiving payments from a retirement plan or pension. By filling out the W4t form, individuals can inform their employer about the amount of federal income tax to withhold from their paychecks, ensuring that they meet their tax obligations while potentially avoiding underpayment penalties.

How to use the W4t Form

Using the W4t form involves a few straightforward steps. First, download the form from the IRS website or obtain a copy from your employer. Next, fill out the required personal information, including your name, address, and Social Security number. Indicate your filing status and the number of allowances you wish to claim. Finally, submit the completed form to your employer, who will use this information to adjust your tax withholdings accordingly.

Steps to complete the W4t Form

Completing the W4t form requires careful attention to detail to ensure accurate tax withholding. Follow these steps:

- Download the W4t form from the IRS website or request a copy from your employer.

- Fill in your personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Determine the number of allowances you wish to claim based on your financial situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Legal use of the W4t Form

The W4t form is legally binding once it is signed and submitted to your employer. It is essential to ensure that the information provided is accurate and up to date, as incorrect details can lead to improper tax withholding. Employers are required to keep the form on file and use it to determine the appropriate amount of federal income tax to withhold from employee paychecks. Compliance with IRS regulations is crucial to avoid penalties and ensure proper tax reporting.

Filing Deadlines / Important Dates

While the W4t form itself does not have a specific filing deadline, it is important to submit it to your employer as soon as your employment begins or when your financial situation changes. This allows for accurate tax withholding throughout the year. Additionally, be aware of the annual tax filing deadline, which is typically April 15, when you must file your federal income tax return and reconcile any discrepancies in your withholding.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the W4t form. It is important to refer to the latest IRS instructions to ensure compliance with current tax laws. These guidelines include recommendations on how to determine the number of allowances to claim and how to adjust your withholding if your financial situation changes. Staying informed about IRS updates can help you make the best decisions regarding your tax withholdings.

Quick guide on how to complete w4t form

Complete W4t Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely preserve it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Handle W4t Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign W4t Form easily

- Obtain W4t Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign W4t Form and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W4T form and why is it important?

The W4T form is a crucial document for employees to communicate their tax withholding preferences to their employer. Completing the W4T form accurately ensures that the correct amount of federal income tax is withheld from your paycheck. This form helps avoid underpayment or overpayment of taxes, which can signNowly impact your financial health.

-

How can airSlate SignNow help me with my W4T form?

airSlate SignNow simplifies the process of completing and eSigning your W4T form. With our user-friendly interface, you can fill out the form electronically, ensuring accuracy and reducing the risk of errors. Additionally, our platform allows you to store and manage your documents securely, making it easy to access your W4T form whenever needed.

-

Is airSlate SignNow a cost-effective solution for managing W4T forms?

Yes, airSlate SignNow offers a cost-effective solution for managing W4T forms and other documentation needs. Our competitive pricing plans cater to businesses of all sizes, allowing you to choose a package that fits your budget. By opting for airSlate SignNow, you can save time and money while ensuring compliance with tax regulations.

-

What features does airSlate SignNow provide for W4T form management?

airSlate SignNow comes equipped with a variety of features designed for efficient W4T form management. These include easy document editing, eSigning capabilities, and template creation for recurring use of the W4T form. Our platform also supports collaboration, allowing multiple users to review and sign the form seamlessly.

-

Can I integrate airSlate SignNow with my existing HR software for W4T forms?

Absolutely! airSlate SignNow offers robust integrations with popular HR and payroll software, enabling smooth workflow for processing W4T forms. This integration simplifies data entry, ensuring that information flows seamlessly from your HR system to your W4T form and vice versa. With these integrations, you can enhance operational efficiency and reduce manual errors.

-

What are the benefits of eSigning my W4T form with airSlate SignNow?

eSigning your W4T form with airSlate SignNow brings multiple benefits, including enhanced security and faster processing times. Our platform utilizes encryption technology to ensure your personal information remains safe. Additionally, eSigning eliminates the need for printing and scanning, making it an eco-friendly option that streamlines your workflow.

-

How can I ensure my W4T form is completed correctly with airSlate SignNow?

To ensure your W4T form is completed correctly using airSlate SignNow, make use of our intuitive editing tools and templates that guide you through each section of the form. We also offer helpful tips and support resources to clarify any confusing elements of the W4T form. Moreover, the electronic signing process includes prompts for verifying your entries, reducing the chances of mistakes.

Get more for W4t Form

Find out other W4t Form

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation