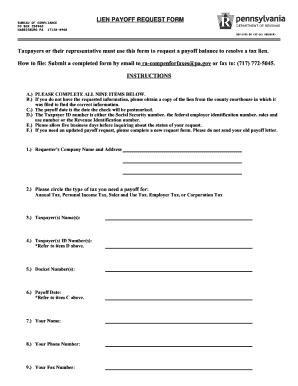

Pa Department of Revenue Bureau of Compliance Lien Section Form

What is the Pa Department of Revenue Bureau of Compliance Lien Section?

The Pa Department of Revenue Bureau of Compliance Lien Section is responsible for managing and enforcing tax liens in Pennsylvania. This bureau plays a crucial role in ensuring that individuals and businesses comply with state tax obligations. By filing a lien, the department secures its interest in the property of taxpayers who have outstanding tax debts. This process helps protect the state's revenue and encourages compliance among taxpayers.

How to Use the Pa Department of Revenue Bureau of Compliance Lien Section

Utilizing the services of the Pa Department of Revenue Bureau of Compliance Lien Section involves understanding the process of tax lien filing and resolution. Taxpayers may need to interact with this bureau if they have received a notice of lien or if they want to resolve outstanding tax liabilities. It is essential to gather all relevant financial documents and tax records before reaching out to the bureau. This preparation can facilitate a smoother resolution process.

Steps to Complete the Pa Department of Revenue Bureau of Compliance Lien Section

Completing the necessary steps for dealing with the Pa Department of Revenue Bureau of Compliance Lien Section typically involves the following:

- Review the lien notice received from the department.

- Gather all relevant financial documents, including tax returns and payment records.

- Contact the bureau for clarification on the lien and available options for resolution.

- Consider making a payment plan or settling the outstanding debt.

- Once resolved, ensure that the lien is formally released by the department.

Legal Use of the Pa Department of Revenue Bureau of Compliance Lien Section

The legal framework governing the Pa Department of Revenue Bureau of Compliance Lien Section is designed to uphold tax compliance and protect state interests. Tax liens are legally binding and serve as a public record of the taxpayer's obligations. Understanding the legal implications of a lien is vital for taxpayers, as it can affect credit ratings and property ownership. Taxpayers have the right to challenge liens if they believe there has been an error in the assessment or filing process.

Required Documents for the Pa Department of Revenue Bureau of Compliance Lien Section

When dealing with the Pa Department of Revenue Bureau of Compliance Lien Section, certain documents are typically required to facilitate the process. These may include:

- Previous tax returns to verify income and tax obligations.

- Payment records showing any previous payments made towards the tax debt.

- Identification documents to confirm the taxpayer's identity.

- Any correspondence received from the department regarding the lien.

Penalties for Non-Compliance with the Pa Department of Revenue Bureau of Compliance Lien Section

Failure to comply with the requirements set forth by the Pa Department of Revenue Bureau of Compliance Lien Section can result in significant penalties. These may include additional fines, interest on unpaid taxes, and further legal action. Taxpayers should be aware that non-compliance can lead to the escalation of the situation, including the potential for property seizure. It is advisable to address any tax liens promptly to avoid these consequences.

Quick guide on how to complete pa department of revenue bureau of compliance lien section

Effortlessly Prepare Pa Department Of Revenue Bureau Of Compliance Lien Section on Any Device

The management of documents online has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to quickly create, modify, and electronically sign your documents without any delays. Handle Pa Department Of Revenue Bureau Of Compliance Lien Section on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Easily Modify and Electronically Sign Pa Department Of Revenue Bureau Of Compliance Lien Section

- Locate Pa Department Of Revenue Bureau Of Compliance Lien Section and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, shareable link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Pa Department Of Revenue Bureau Of Compliance Lien Section to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa department of revenue bureau of compliance lien section

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is REV 1038 and how does it relate to airSlate SignNow?

REV 1038 is a key component of airSlate SignNow that enhances document signing and management efficiency. By incorporating REV 1038, we offer a streamlined process making it easier for users to send and eSign documents securely. This feature ensures compliance and improves workflow for businesses of all sizes.

-

How much does airSlate SignNow cost with the REV 1038 feature?

Pricing for airSlate SignNow varies based on the plan and usage, but all options include the powerful REV 1038 functionality. Each plan is designed to provide value whether for small businesses or large enterprises. For specific pricing, you can check our pricing page or contact our sales team for tailored information.

-

What features does REV 1038 offer in airSlate SignNow?

REV 1038 offers a range of features including advanced eSigning, real-time tracking, and customizable templates. This ensures that users can efficiently manage their documents from sending to signing. Additionally, REV 1038 supports various file types, making it versatile for different documentation needs.

-

Can I integrate other tools with airSlate SignNow featuring REV 1038?

Absolutely! airSlate SignNow with REV 1038 supports integration with various applications including Google Drive, Salesforce, and more. This ensures that users can seamlessly incorporate eSigning into their existing workflows, enhancing productivity and reducing friction in document management.

-

What are the main benefits of using REV 1038 in airSlate SignNow?

The main benefits of REV 1038 include improved efficiency, enhanced security, and user-friendly experience. It simplifies document sending and eSigning, which can save time and reduce the chances of errors. Overall, REV 1038 helps businesses streamline their processes while ensuring compliance and security.

-

Is airSlate SignNow with REV 1038 suitable for all business sizes?

Yes, airSlate SignNow featuring REV 1038 is designed to cater to businesses of all sizes. Whether you are a startup or a large corporation, our platform offers scalable solutions to meet varying needs. The flexibility of REV 1038 allows for customized workflows that can adapt as your business grows.

-

How do I get started with airSlate SignNow and REV 1038?

Getting started with airSlate SignNow featuring REV 1038 is easy! You can sign up for a free trial on our website, allowing you to explore the features firsthand. Once your account is set up, you can immediately start sending and eSigning documents using REV 1038 capabilities.

Get more for Pa Department Of Revenue Bureau Of Compliance Lien Section

Find out other Pa Department Of Revenue Bureau Of Compliance Lien Section

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast