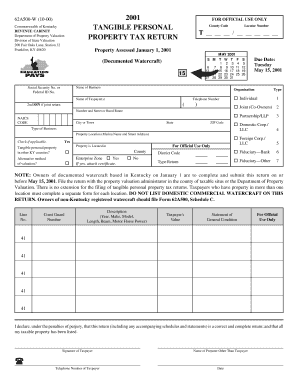

62A500 W Kentucky Department of Revenue Revenue Ky Form

What is the 62A500 W Kentucky Department Of Revenue Revenue Ky

The 62A500 W Kentucky Department of Revenue form is a crucial document used primarily for tax purposes within the state of Kentucky. This form is typically associated with the reporting of specific tax information to the Kentucky Department of Revenue. It plays an essential role in ensuring compliance with state tax laws and regulations, helping both individuals and businesses accurately report their financial activities. Understanding the purpose and requirements of this form is vital for anyone engaging in taxable activities in Kentucky.

How to use the 62A500 W Kentucky Department Of Revenue Revenue Ky

Using the 62A500 W Kentucky Department of Revenue form involves several key steps. First, ensure you have the most current version of the form, which can be obtained from the Kentucky Department of Revenue's official website or through authorized sources. Next, gather all necessary financial documents and information required to complete the form accurately. This may include income statements, deductions, and other relevant financial data. Once the form is filled out, it must be submitted according to the specific guidelines provided by the Department of Revenue, ensuring that all information is accurate and complete to avoid potential penalties.

Steps to complete the 62A500 W Kentucky Department Of Revenue Revenue Ky

Completing the 62A500 W form requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from the Kentucky Department of Revenue.

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary financial documents, including income and expense records.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check your entries for any errors or omissions.

- Submit the completed form according to the specified submission methods, whether online, by mail, or in person.

Legal use of the 62A500 W Kentucky Department Of Revenue Revenue Ky

The legal use of the 62A500 W form is grounded in its compliance with state tax laws. This form must be filled out truthfully and accurately, as any misinformation can lead to legal repercussions, including fines or audits. It is essential to understand that the form serves as a declaration of income and tax obligations, and its misuse may result in penalties from the Kentucky Department of Revenue. Therefore, ensuring that all information is correct and submitted on time is crucial for legal compliance.

Key elements of the 62A500 W Kentucky Department Of Revenue Revenue Ky

Key elements of the 62A500 W form include:

- Taxpayer Information: Personal details such as name, address, and Social Security number or Employer Identification Number.

- Income Reporting: Sections to report various types of income earned during the tax period.

- Deductions and Credits: Areas to claim any applicable deductions or tax credits, which can reduce overall tax liability.

- Signature: A declaration that the information provided is accurate, requiring the taxpayer's signature to validate the form.

State-specific rules for the 62A500 W Kentucky Department Of Revenue Revenue Ky

State-specific rules for the 62A500 W form are established by the Kentucky Department of Revenue. These rules dictate the requirements for completing and submitting the form, including deadlines, acceptable methods of submission, and any additional documentation that may be required. It is important for taxpayers to familiarize themselves with these regulations to ensure compliance and avoid potential issues with their tax filings.

Quick guide on how to complete 62a500 w kentucky department of revenue revenue ky

Complete 62A500 W Kentucky Department Of Revenue Revenue Ky effortlessly on any device

Online document management has become widely adopted by businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage 62A500 W Kentucky Department Of Revenue Revenue Ky on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign 62A500 W Kentucky Department Of Revenue Revenue Ky with ease

- Locate 62A500 W Kentucky Department Of Revenue Revenue Ky and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Alter and electronically sign 62A500 W Kentucky Department Of Revenue Revenue Ky while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 62a500 w kentucky department of revenue revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 62A500 W Kentucky Department Of Revenue Revenue Ky form, and why is it important?

The 62A500 W Kentucky Department Of Revenue Revenue Ky form is crucial for businesses operating in Kentucky, as it outlines specific revenue details necessary for tax compliance. Understanding this form helps ensure accurate reporting and filing, mitigating risks associated with potential fines.

-

How can airSlate SignNow assist with the 62A500 W Kentucky Department Of Revenue Revenue Ky form?

airSlate SignNow simplifies the completion and submission of the 62A500 W Kentucky Department Of Revenue Revenue Ky form by providing templates and eSigning capabilities. This allows businesses to streamline their processes, ensuring compliance and saving time.

-

What are the pricing options for using airSlate SignNow with the 62A500 W Kentucky Department Of Revenue Revenue Ky?

airSlate SignNow offers flexible pricing plans tailored to various business needs, starting from affordable monthly subscriptions. This cost-effective solution ensures that businesses can access necessary features while managing their budget effectively when dealing with the 62A500 W Kentucky Department Of Revenue Revenue Ky.

-

Can I integrate airSlate SignNow with other tools when handling the 62A500 W Kentucky Department Of Revenue Revenue Ky?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing workflow efficiency when dealing with the 62A500 W Kentucky Department Of Revenue Revenue Ky. Integration with tools such as CRM systems or document management software allows for a unified process.

-

What features does airSlate SignNow provide for managing the 62A500 W Kentucky Department Of Revenue Revenue Ky?

AirSlate SignNow provides features like customizable templates, eSignature capabilities, and secure document storage to effectively manage the 62A500 W Kentucky Department Of Revenue Revenue Ky. These features help simplify the document workflow and ensure compliance with state regulations.

-

Is airSlate SignNow secure for handling sensitive information related to the 62A500 W Kentucky Department Of Revenue Revenue Ky?

Absolutely. airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring the safety of all sensitive information related to the 62A500 W Kentucky Department Of Revenue Revenue Ky. Rest assured that your data is protected throughout the signing and submission process.

-

What are the benefits of using airSlate SignNow for the 62A500 W Kentucky Department Of Revenue Revenue Ky?

Using airSlate SignNow for the 62A500 W Kentucky Department Of Revenue Revenue Ky brings numerous benefits, including increased efficiency, reduced paperwork, and faster turnaround times. This allows businesses to stay compliant while focusing on growth and operations.

Get more for 62A500 W Kentucky Department Of Revenue Revenue Ky

Find out other 62A500 W Kentucky Department Of Revenue Revenue Ky

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter