Ador82514b Form

What is the Ador82514b

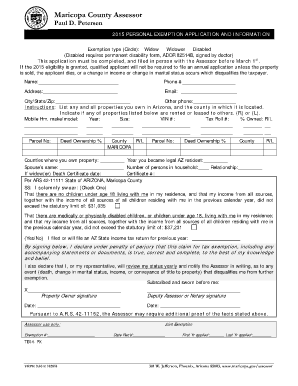

The Ador82514b is a specific form used primarily for tax purposes in the United States. It serves as a declaration or report that must be submitted to the appropriate government authorities, typically the Internal Revenue Service (IRS). This form is essential for individuals or businesses to comply with tax regulations and ensure accurate reporting of income, deductions, or other financial information. Understanding its purpose and requirements is crucial for maintaining compliance and avoiding penalties.

How to use the Ador82514b

Using the Ador82514b involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and receipts. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is advisable to review the form for any potential errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific guidelines provided by the IRS. Utilizing a digital platform can streamline this process and enhance accuracy.

Steps to complete the Ador82514b

Completing the Ador82514b requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents.

- Access the Ador82514b form from the IRS website or a trusted source.

- Fill in your personal information, including name, address, and Social Security number.

- Report your income and any deductions accurately.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or print and mail it to the appropriate address.

Legal use of the Ador82514b

The Ador82514b is legally binding when completed and submitted according to IRS regulations. To ensure its legal standing, it must be filled out accurately and submitted by the designated deadlines. Compliance with relevant tax laws is essential to avoid penalties and ensure that the form is accepted by the IRS. Utilizing secure digital tools for completion can further enhance the legal validity of the form.

Required Documents

To complete the Ador82514b, certain documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s.

- Receipts for deductible expenses.

- Previous tax returns for reference.

- Any additional forms or schedules that may be required based on your financial situation.

Form Submission Methods

The Ador82514b can be submitted through various methods. The most common options include:

- Electronic submission via the IRS e-file system, which is secure and efficient.

- Mailing a paper copy of the form to the designated IRS address.

- In-person submission at local IRS offices, if necessary.

Eligibility Criteria

Eligibility to use the Ador82514b typically depends on your financial situation and filing status. Individuals or businesses with specific income levels or types of income may be required to use this form. It is important to review the IRS guidelines to determine whether you meet the criteria for using the Ador82514b. Consulting with a tax professional can also provide clarity on eligibility requirements.

Quick guide on how to complete ador82514b

Complete Ador82514b effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Ador82514b on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Ador82514b effortlessly

- Obtain Ador82514b and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, either via email, SMS, or an invite link, or download it onto your computer.

Forget about lost or mislaid files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Ador82514b and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ador82514b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the core function of airSlate SignNow in relation to ador82514b?

AirSlate SignNow is designed to help businesses send and eSign documents efficiently. The platform's association with ador82514b highlights its ability to simplify document workflows, enabling users to execute agreements faster and with greater ease.

-

How much does airSlate SignNow cost for users interested in ador82514b?

AirSlate SignNow offers flexible pricing plans that provide excellent value for users interested in ador82514b. Plans cater to various business sizes and needs, ensuring that every company can find a cost-effective solution that fits their budget.

-

What features does airSlate SignNow offer related to ador82514b?

Key features of airSlate SignNow include document templates, workflow automation, and real-time tracking, all of which align with the capabilities of ador82514b. These features streamline the signing process, helping businesses save time and reduce manual errors.

-

Can airSlate SignNow integration support ador82514b?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing its utility for ador82514b users. These integrations improve collaboration and document management, allowing teams to stay connected and productive.

-

What are the benefits of using airSlate SignNow with ador82514b?

Using airSlate SignNow with ador82514b can signNowly improve workflow efficiency. The combination ensures secure and fast document processing, which minimizes delays and enhances productivity across teams.

-

Is airSlate SignNow user-friendly for those exploring ador82514b?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible even for those new to solutions like ador82514b. Its intuitive interface allows users to navigate the document signing process easily.

-

How can businesses ensure secure signing with ador82514b on airSlate SignNow?

AirSlate SignNow implements advanced security protocols, ensuring that users can trust their documents are safe while using ador82514b. Features such as document encryption and authentication measures help protect sensitive information.

Get more for Ador82514b

- Policy benefit payout form hdfc life

- No claim certificate kribhco form

- Notice to disclose application form

- Statement of employment insurance and other benefits form

- Kbc sfs form

- Hse retirement form

- Asb superannuation master trust withdrawal request form

- Rnzna brochure royal new zealand naval association inc rnzna org form

Find out other Ador82514b

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT