Form 2d Income Tax

What is the Form 2d Income Tax

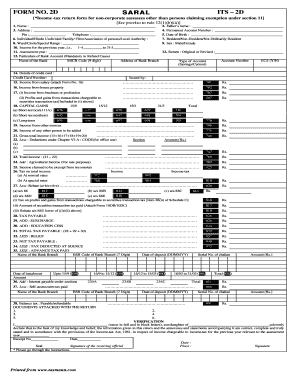

The Form 2d Income Tax is a specific tax form used in the United States for reporting income and calculating tax obligations. This form is essential for individuals to accurately declare their earnings, deductions, and credits to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance with federal tax laws and for ensuring that taxpayers fulfill their obligations without incurring penalties.

How to use the Form 2d Income Tax

Using the Form 2d Income Tax involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the IRS.

Steps to complete the Form 2d Income Tax

Completing the Form 2d Income Tax requires careful attention to detail. Follow these steps for effective completion:

- Collect all relevant financial documents, including income statements and receipts for deductions.

- Fill in your personal information accurately, including your Social Security number and filing status.

- Report all sources of income, ensuring that you include all taxable earnings.

- Calculate deductions and credits that apply to your situation to reduce your taxable income.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through an authorized e-filing service or mail it to the appropriate IRS address.

Legal use of the Form 2d Income Tax

The Form 2d Income Tax is legally binding when completed and submitted according to IRS regulations. To ensure its legal validity, it must be signed and dated by the taxpayer. Additionally, the form must comply with relevant tax laws and regulations, including accurate reporting of income and adherence to deadlines. Failure to comply may result in penalties or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2d Income Tax are crucial for taxpayers to observe. Typically, the deadline for submitting the form is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as specific deadlines for estimated tax payments throughout the year.

Required Documents

To complete the Form 2d Income Tax, several documents are necessary. These include:

- W-2 forms from employers detailing annual wages.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses, including medical expenses, charitable contributions, and business-related costs.

- Any relevant tax credits documentation, such as education credits or energy-efficient home improvements.

Quick guide on how to complete form 2d income tax

Complete Form 2d Income Tax effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents rapidly without hesitation. Manage Form 2d Income Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Form 2d Income Tax without stress

- Locate Form 2d Income Tax and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that require printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 2d Income Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2d income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2d in airSlate SignNow?

Form 2d in airSlate SignNow refers to a specific type of document format used for electronic signatures. This format ensures that your forms are compliant and easily accessible for signing. Understanding what is form 2d helps you leverage our solution for secure and efficient document signing.

-

How does airSlate SignNow utilize form 2d for eSigning?

airSlate SignNow uses form 2d to streamline the eSigning process, allowing users to send, sign, and manage documents seamlessly. This format enhances user experience by simplifying document viewing and signing. Knowing how airSlate SignNow utilizes form 2d is vital for effective document management.

-

What are the pricing options for airSlate SignNow that include form 2d support?

airSlate SignNow offers various pricing plans that include comprehensive support for form 2d. Our tiered pricing structure accommodates businesses of all sizes, ensuring affordability while providing essential features. Understanding our pricing and its relation to form 2d can help you choose the best plan for your needs.

-

Are there any benefits of using form 2d with airSlate SignNow?

Yes, using form 2d with airSlate SignNow offers numerous benefits, including enhanced document accuracy and compliance. The technology ensures that forms retain their structure and integrity during the signing process. By leveraging form 2d, you can signNowly improve your document workflows.

-

What features related to form 2d are included in airSlate SignNow?

airSlate SignNow includes multiple features related to form 2d, such as customizable templates, automatic reminders, and integration capabilities. These features help streamline your eSigning experience while maintaining the integrity of your documents. Understanding these features will enhance your use of form 2d.

-

Can I integrate other applications with airSlate SignNow using form 2d?

Absolutely! airSlate SignNow supports integration with various applications while handling form 2d. This allows for seamless data transfer and workflow automation, enhancing productivity across your operations. Integrating other applications with form 2d ensures a smoother process for your document management.

-

How secure is the data handled with form 2d in airSlate SignNow?

The data handled using form 2d in airSlate SignNow is highly secure, protected by advanced encryption protocols. Our platform prioritizes your document confidentiality, ensuring that all eSigned documents are stored securely. Security is a key consideration for us, especially when dealing with form 2d.

Get more for Form 2d Income Tax

- Policy assignmentnovation guidelines form

- Learning style rhode island department of labor and training form

- Commercial ownerseller affidavit form

- Risk assessment templates ampamp formssafetycultureabout risk assessmentus epaabout risk assessmentus epaa complete guide to

- Church event release forms

- Client contract template form

- No compete contract template form

- No cheat contract template form

Find out other Form 2d Income Tax

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word