Ns Make Up Pay Form 2014-2026

What is the Ns Make Up Pay Form

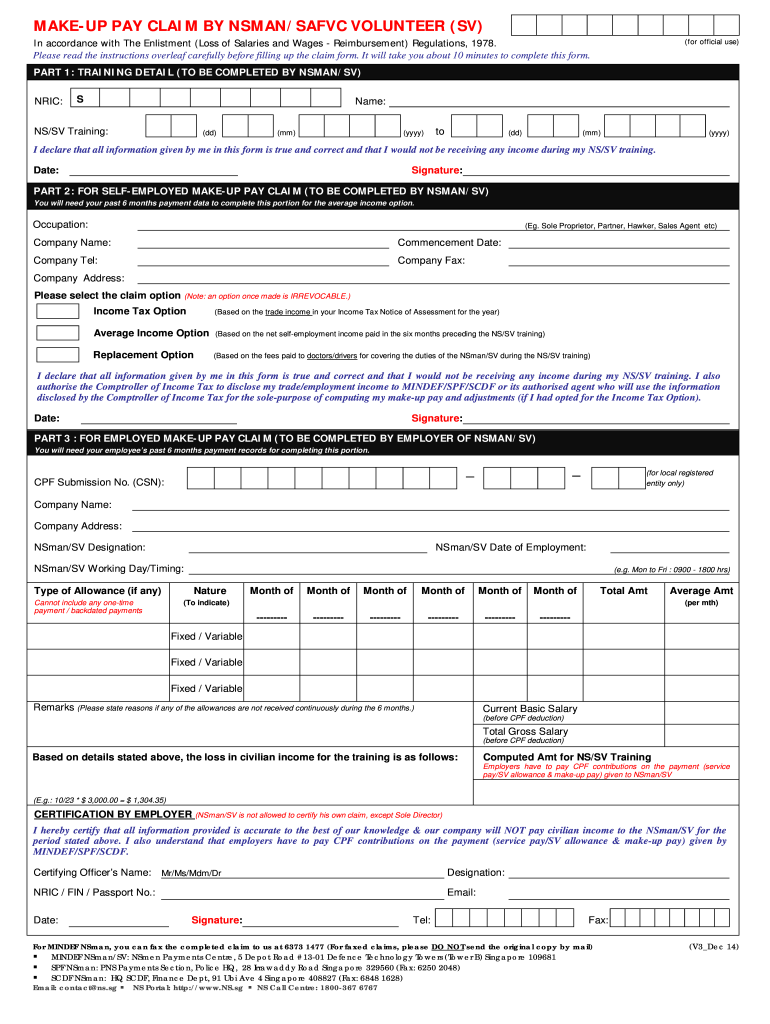

The Ns Make Up Pay Form is a document used by individuals to claim compensation for additional pay due to various circumstances, such as service-related duties or adjustments in pay rates. This form is essential for ensuring that claims are processed accurately and efficiently. It is designed for members of the armed forces or related personnel who may be eligible for additional compensation based on specific criteria.

How to use the Ns Make Up Pay Form

Using the Ns Make Up Pay Form involves a few straightforward steps. First, obtain the form from a reliable source, such as your unit's administrative office or an official military website. Next, fill out the required fields with accurate personal and service-related information. Be sure to double-check for any errors. Once completed, submit the form according to the specified submission methods, which may include online submission, mailing, or in-person delivery.

Steps to complete the Ns Make Up Pay Form

To complete the Ns Make Up Pay Form effectively, follow these steps:

- Gather necessary documentation, including service records and any relevant pay stubs.

- Fill in your personal information, including your name, rank, and service number.

- Clearly state the reason for your claim, providing detailed explanations where necessary.

- Review the form for completeness, ensuring all required fields are filled.

- Submit the form through the designated channels, keeping a copy for your records.

Legal use of the Ns Make Up Pay Form

The Ns Make Up Pay Form must be completed and submitted in accordance with legal guidelines to ensure its validity. This includes providing truthful information and adhering to deadlines set by military regulations. Misrepresentation or failure to comply with submission guidelines may result in penalties, including denial of the claim or disciplinary action.

Required Documents

When submitting the Ns Make Up Pay Form, specific documents may be required to support your claim. These typically include:

- Service records that verify your eligibility for additional pay.

- Pay stubs or documentation that reflect your current pay status.

- Any additional forms or evidence requested by the reviewing authority.

Form Submission Methods

The Ns Make Up Pay Form can be submitted through various methods, depending on the guidelines provided by your unit or command. Common submission methods include:

- Online submission through the designated military portal.

- Mailing the completed form to the appropriate administrative office.

- Delivering the form in person to your unit's administrative office.

Quick guide on how to complete mindef nsmen makeup pay claim form 2014 2019

A brief manual on how to create your Ns Make Up Pay Form

Finding the appropriate template can be difficult when you have to submit formal international paperwork. Even if you possess the required form, it can be tedious to quickly prepare it according to all the specifications if you rely on printed copies rather than handling everything digitally. airSlate SignNow is the web-based eSignature platform that assists you in overcoming these obstacles. It allows you to choose your Ns Make Up Pay Form and swiftly fill it out and sign it on-site without needing to reprint documents if you make an error.

The following are the actions required to prepare your Ns Make Up Pay Form with airSlate SignNow:

- Press the Get Form button to instantly add your document to our editor.

- Begin at the first empty field, enter the necessary information, and continue using the Next tool.

- Complete the blank fields utilizing the Cross and Check options available in the toolbar above.

- Choose the Highlight or Line functions to emphasize the most important details.

- Click on Image and upload one if your Ns Make Up Pay Form requires it.

- Utilize the right-side panel to add more sections for yourself or others to fill out if necessary.

- Review your entries and finalize the document by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing of the form by clicking the Done button and selecting your file-sharing preferences.

Once your Ns Make Up Pay Form is ready, you can distribute it according to your preference - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your finished paperwork in your account, organized in folders as you see fit. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct mindef nsmen makeup pay claim form 2014 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

How can I avoid paying a parking ticket? I filled out a form at the city hall, but they sent me a mail saying my "claim was denied"?

How did they determine your parking violation and how far are you willing to take it?Chalking tires had been deemed a violation of your 4th amendment rightsCourt Says Using Chalk On Tires For Parking Enforcement Violates Constitution

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

Will the NEET 2018 give admission in paramedical courses and Ayush courses too? If yes, how do you fill out the form to claim a seat if scored well?

wait for notifications.

Create this form in 5 minutes!

How to create an eSignature for the mindef nsmen makeup pay claim form 2014 2019

How to generate an electronic signature for the Mindef Nsmen Makeup Pay Claim Form 2014 2019 online

How to create an electronic signature for your Mindef Nsmen Makeup Pay Claim Form 2014 2019 in Chrome

How to create an electronic signature for putting it on the Mindef Nsmen Makeup Pay Claim Form 2014 2019 in Gmail

How to make an eSignature for the Mindef Nsmen Makeup Pay Claim Form 2014 2019 right from your mobile device

How to generate an eSignature for the Mindef Nsmen Makeup Pay Claim Form 2014 2019 on iOS devices

How to create an eSignature for the Mindef Nsmen Makeup Pay Claim Form 2014 2019 on Android devices

People also ask

-

What is the ns make up claim form?

The ns make up claim form is a document designed to help individuals or businesses report and claim losses or damages. Using the airSlate SignNow platform, you can easily fill out and eSign this form online, streamlining the process and ensuring accuracy.

-

How do I access the ns make up claim form using airSlate SignNow?

To access the ns make up claim form, simply log in to your airSlate SignNow account and navigate to the document templates section. From there, you can search for the ns make up claim form and start filling it out with your specific information.

-

Can I customize the ns make up claim form on airSlate SignNow?

Yes, you can customize the ns make up claim form in airSlate SignNow to suit your specific needs. Our platform allows you to add fields, change text, and modify the layout, ensuring the form meets your exact requirements.

-

Are there any costs associated with using the ns make up claim form?

Using the ns make up claim form through airSlate SignNow comes at a competitive price. Depending on your subscription plan, you may access the form at no additional cost, making it a cost-effective solution for document management.

-

What are the benefits of using airSlate SignNow for the ns make up claim form?

Using airSlate SignNow for the ns make up claim form provides numerous benefits, including time savings and increased efficiency. You can send, eSign, and securely store your claim form all in one platform, reducing paperwork and speeding up the claims process.

-

Is the ns make up claim form secure on airSlate SignNow?

Absolutely! The ns make up claim form on airSlate SignNow is secured with advanced encryption protocols. This means your personal and sensitive information are protected during the eSigning and submission process, giving you peace of mind.

-

Does airSlate SignNow integrate with other tools when using the ns make up claim form?

Yes, airSlate SignNow offers a range of integrations with popular business tools. When using the ns make up claim form, you can seamlessly connect with CRM systems, project management software, and cloud storage solutions to enhance your workflow.

Get more for Ns Make Up Pay Form

- Zahtjev za kreditkreditnu karticu sberbank form

- Petition for dissolution of marriage family court forms

- E form 00580 08 rbc direct investing

- Osha respirator medical evaluation questionnaire hvfd com form

- Compassion satisfaction fatigue self test for helpers form

- Supervisors injury investigation report form

- Majorette sign up 13132253 form

- Ithaca college sickle cell trait form ithaca

Find out other Ns Make Up Pay Form

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney