Guarantor Form for Loan

What is the guarantor form for loan

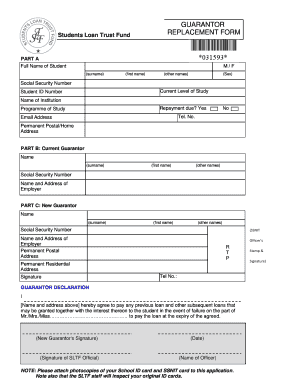

The guarantor form for loan is a legal document that allows a third party to agree to take on the responsibility of repaying a loan if the primary borrower defaults. This form is commonly used in various lending scenarios, including personal loans and student loans. By signing this document, the guarantor assures the lender that they will fulfill the financial obligations should the borrower be unable to do so. This form typically includes details about the borrower, the guarantor, the loan amount, and the terms of repayment.

Key elements of the guarantor form for loan

Understanding the key elements of the guarantor form for loan is essential for both borrowers and guarantors. The primary components include:

- Borrower Information: Full name, address, and contact details of the individual applying for the loan.

- Guarantor Information: Similar details for the person agreeing to act as the guarantor.

- Loan Details: The amount of the loan, interest rate, and repayment terms.

- Signatures: Both the borrower and guarantor must sign the form to validate the agreement.

- Legal Language: Specific terms outlining the responsibilities of the guarantor in case of default.

How to use the guarantor form for loan

Using the guarantor form for loan involves several steps to ensure it is completed correctly. First, the borrower should provide the necessary information about themselves and the loan. Next, the guarantor must review the document to understand their obligations. Once both parties are satisfied, they can sign the form. It is advisable to keep copies of the signed document for future reference. Additionally, using an electronic signature platform like signNow can streamline this process, ensuring that the form is securely signed and stored.

Steps to complete the guarantor form for loan

Completing the guarantor form for loan requires careful attention to detail. Here are the steps to follow:

- Gather necessary personal information for both the borrower and the guarantor.

- Fill out the form with accurate loan details, including the amount and repayment terms.

- Review the form to ensure all information is correct and complete.

- Both parties should sign the form, either physically or electronically.

- Store the completed form in a safe place for future reference.

Legal use of the guarantor form for loan

The guarantor form for loan is legally binding when certain conditions are met. For it to be enforceable, both the borrower and the guarantor must provide their consent and signatures. Additionally, the form should comply with relevant laws, such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Using a reputable electronic signature platform can help ensure that the form meets these legal requirements, providing an added layer of security and compliance.

How to obtain the guarantor form for loan

Obtaining the guarantor form for loan is a straightforward process. Most lenders provide this form as part of their loan application package. It can also be available on their websites or through customer service. If you are unsure where to find it, consider contacting your lender directly for assistance. Additionally, electronic signature platforms may offer templates for the guarantor form, allowing for easy customization and completion.

Quick guide on how to complete guarantor form for loan

Effortlessly Prepare Guarantor Form For Loan on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Guarantor Form For Loan on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Easiest Way to Modify and Electronically Sign Guarantor Form For Loan with Ease

- Find Guarantor Form For Loan and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or redact sensitive data using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, cumbersome form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Guarantor Form For Loan and ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the guarantor form for loan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a guarantor form for loan?

A guarantor form for loan is a document that allows a third party to guarantee the repayment of a loan if you default. This form is essential in lending situations where the borrower may not qualify based on their creditworthiness alone. By using a guarantor, lenders can minimize their risk and increase the chances of loan approval.

-

How can I create a guarantor form for loan using airSlate SignNow?

Creating a guarantor form for loan with airSlate SignNow is simple and straightforward. You can select from pre-existing templates or create one from scratch, incorporating all necessary fields. Once your form is finalized, you can easily send it out for electronic signatures, ensuring a seamless process.

-

Is there a cost associated with using the guarantor form for loan?

airSlate SignNow offers competitive pricing plans that include access to the guarantor form for loan feature. You can choose a plan that best fits your needs, whether for personal or business use. Additionally, there are often free trials available, allowing you to explore the platform's features before committing.

-

What are the benefits of using airSlate SignNow for a guarantor form for loan?

Using airSlate SignNow for a guarantor form for loan streamlines the document signing process, enhancing efficiency and saving time. The platform allows for easy collaboration, secure storage, and real-time tracking of documents. This means you can focus more on your loan approvals rather than getting bogged down by paperwork.

-

Can I customize my guarantor form for loan?

Absolutely! airSlate SignNow allows you to fully customize your guarantor form for loan to suit your specific needs. You can add tailored fields, branding, and additional clauses to ensure that the form aligns perfectly with your requirements. This flexibility helps create a professional and personalized experience for all parties involved.

-

What integrations does airSlate SignNow offer for managing guarantor forms?

airSlate SignNow integrates seamlessly with various applications, enhancing the management of your guarantor form for loan. You can connect it with CRM systems, email platforms, and cloud storage solutions for better workflow efficiency. These integrations ensure that all your documents are easily accessible and manageable in one centralized location.

-

Is it safe to use airSlate SignNow for a guarantor form for loan?

Yes, airSlate SignNow prioritizes the security of your data, making it a safe choice for handling your guarantor form for loan. The platform uses advanced encryption and security measures to protect your documents during transmission and storage. You can have peace of mind knowing that your sensitive information is well-guarded.

Get more for Guarantor Form For Loan

- 139 r form

- Mississippi form immunization

- Boston mutual life insurance company group disability claim missouriwestern form

- Police statement form

- Absence excuse form student health services the ohio state shc osu

- Forklift supervisor evaluation form

- Recipe form lima osu

- Physician module lesson 1 the ohio state college of medicine medicine osu form

Find out other Guarantor Form For Loan

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors