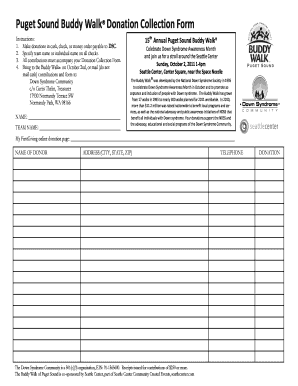

Donation Collection Form

What is the donation collection form?

The donation collection form is a document used by organizations to gather contributions from individuals or entities. This form typically captures essential information such as the donor's name, contact details, donation amount, and payment method. It serves as a record for both the donor and the organization, ensuring transparency and accountability in the donation process. The form may also include sections for the donor to specify any preferences regarding the use of their contribution, such as designated projects or general support.

How to use the donation collection form

Using the donation collection form involves a straightforward process. First, ensure that the form is accessible, whether in a digital format or printed version. Donors should fill in their details accurately, including their name, address, and the amount they wish to donate. If applicable, they should indicate any specific purposes for their donation. Once completed, the form can be submitted according to the organization’s guidelines, which may include online submission, mailing, or in-person delivery. It is essential for donors to keep a copy of the completed form for their records.

Steps to complete the donation collection form

Completing the donation collection form involves several key steps:

- Gather necessary information: Collect your personal details, including your name, address, and contact information.

- Specify donation details: Indicate the amount you wish to donate and any specific allocation for the funds.

- Choose a payment method: Select how you will make your donation, whether by credit card, check, or another method.

- Review the form: Ensure all information is accurate and complete before submission.

- Submit the form: Follow the organization’s instructions for submitting the form, whether online or by mail.

Legal use of the donation collection form

The donation collection form must comply with various legal standards to ensure its validity. In the United States, organizations must adhere to regulations concerning charitable contributions, including providing donors with written acknowledgment of their donations for tax purposes. This acknowledgment typically includes the organization’s name, the donation amount, and a statement regarding any goods or services provided in exchange for the donation. Compliance with these requirements helps protect both the donor and the organization, ensuring transparency and accountability.

Key elements of the donation collection form

Several key elements are essential for a comprehensive donation collection form:

- Donor Information: Name, address, and contact details of the donor.

- Donation Amount: The specific amount being donated.

- Payment Method: Options for how the donation will be made.

- Purpose of Donation: Any specific project or cause the donor wishes to support.

- Acknowledgment Section: A statement confirming the organization’s receipt of the donation.

Form submission methods

There are several methods for submitting the donation collection form, allowing flexibility for donors:

- Online Submission: Many organizations offer digital forms that can be filled out and submitted through their websites.

- Mail: Donors can print the completed form and send it via postal mail to the organization’s address.

- In-Person: Some organizations may allow donors to submit the form in person, particularly during events or at their offices.

Quick guide on how to complete donation collection form

Complete donation collection form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Handle donation collection form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign donation collection form without hassle

- Obtain donation collection form and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searching for forms, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Edit and eSign donation collection form while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to donation collection form

Create this form in 5 minutes!

How to create an eSignature for the donation collection form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask donation collection form

-

What is a donation collection form and how can it benefit my organization?

A donation collection form is a digital document that allows organizations to collect donations online efficiently. By using a donation collection form, you can streamline the donation process, making it easier for donors to contribute, which could lead to increased fundraising success for your organization.

-

How does airSlate SignNow make creating a donation collection form easy?

airSlate SignNow offers a user-friendly interface that allows you to create a donation collection form quickly. You can customize fields, add your branding, and set up secure payment options, all without needing extensive technical skills, making it accessible for everyone in your organization.

-

Is there a cost associated with using a donation collection form on airSlate SignNow?

Yes, airSlate SignNow offers affordable pricing plans that can accommodate organizations of various sizes. Depending on your needs, you can choose a plan that provides the features required for your donation collection form, ensuring you get the best value for your investment.

-

Can I integrate my donation collection form with other platforms?

Absolutely! airSlate SignNow allows you to integrate your donation collection form with various third-party applications, such as CRM systems and payment processors. This integration leads to seamless data management and helps you better track your fundraising efforts.

-

What security features are included with the donation collection form?

When using a donation collection form through airSlate SignNow, you can be confident in the security of donor information. The platform uses encryption and secure cloud storage to protect sensitive data, ensuring that both you and your donors can trust the transaction process.

-

Can I customize my donation collection form to fit my brand’s identity?

Yes, airSlate SignNow allows complete customization of your donation collection form. You can modify colors, fonts, and add your logo to ensure that the form aligns with your organization’s branding, making it visually appealing and recognizable to your supporters.

-

How can I track donations collected through the donation collection form?

With airSlate SignNow's tracking features, you can easily monitor donations collected through your donation collection form. The platform provides real-time analytics, enabling you to review performance metrics and understand donor trends, which is vital for improving your fundraising strategy.

Get more for donation collection form

- Commonwealth of virginia department of criminal justice form

- Photocopied receipts are not admissable do not fax expense claims form

- Online canada eta application form axis travel centre

- Assets publishing service gov ukgovernmentguidance notes on part b3 5application for an form

- Application form and supporting documents environment

- In an installation with more than 40000 places form

- Original raffle license application wisconsin department of form

- Affirmation of isolation department of health form

Find out other donation collection form

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile