1702 Mx Form

What is the 1702 Mx Form

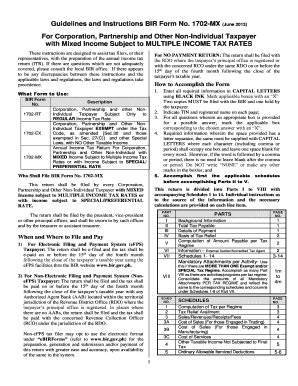

The 1702 Mx form is a tax document primarily used by businesses in the Philippines for income tax purposes. It is essential for corporations, partnerships, and other entities to report their income and expenses accurately. This form helps ensure compliance with tax regulations and provides the necessary information for the Bureau of Internal Revenue (BIR) to assess tax liabilities. Understanding the purpose and requirements of the 1702 Mx form is crucial for businesses to maintain good standing with tax authorities.

Steps to complete the 1702 Mx Form

Completing the 1702 Mx form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, fill in the required information, such as business name, Tax Identification Number (TIN), and financial figures. It is important to double-check all entries for accuracy. Once completed, review the form for any missing information or discrepancies before submission. Finally, ensure that the form is submitted by the designated deadline to avoid penalties.

Legal use of the 1702 Mx Form

The legal use of the 1702 Mx form is governed by tax laws and regulations set forth by the BIR. To be considered valid, the form must be filled out accurately and submitted on time. Electronic signatures may be used if they comply with legal standards, ensuring that the document is legally binding. Businesses must retain copies of submitted forms for their records, as they may be required for audits or future reference. Understanding the legal implications of the 1702 Mx form is essential for businesses to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1702 Mx form are critical for compliance. Typically, businesses must submit their tax returns annually, with specific dates varying based on the type of entity and fiscal year-end. It is important to stay informed about these deadlines to avoid late fees and penalties. Additionally, businesses should be aware of any changes in tax regulations that may affect filing dates. Keeping a calendar of important dates related to the 1702 Mx form can help ensure timely submissions.

Required Documents

To complete the 1702 Mx form, several documents are required. These include financial statements, such as income statements and balance sheets, along with supporting documents like receipts and invoices for expenses. Additionally, a copy of the previous year's tax return may be necessary for reference. Ensuring that all required documents are gathered before starting the form will streamline the completion process and help maintain accuracy.

Form Submission Methods

The 1702 Mx form can be submitted in various ways, including online, by mail, or in person. Online submission is often the most efficient method, allowing for quicker processing and confirmation. When submitting by mail, it is advisable to use certified mail to ensure delivery. In-person submissions may be made at local BIR offices. Understanding the available submission methods can help businesses choose the most convenient and reliable option for their needs.

Quick guide on how to complete 1702 mx form

Complete 1702 Mx Form effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage 1702 Mx Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to modify and eSign 1702 Mx Form with ease

- Find 1702 Mx Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 1702 Mx Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1702 mx form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1702mx solution offered by airSlate SignNow?

The 1702mx solution from airSlate SignNow is designed to streamline document signing and management for businesses. It allows users to easily send, eSign, and manage documents online using a cost-effective and intuitive platform. This makes it an ideal solution for companies looking to enhance their workflow efficiency.

-

How much does the 1702mx plan cost?

The pricing for the 1702mx plan is competitive and designed to meet the needs of various businesses. airSlate SignNow offers transparent pricing structures, and you can choose from monthly, annual, or volume licensing options to best fit your budget. Visit our website for detailed pricing information.

-

What features are included in the 1702mx package?

The 1702mx package includes features such as document templates, custom branding, real-time notifications, and mobile access. These functionalities are designed to enhance user experience and streamline the signing process. Additionally, the package supports team collaboration, making it ideal for businesses of all sizes.

-

What are the benefits of using airSlate SignNow's 1702mx solution?

Using airSlate SignNow's 1702mx solution offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for document handling. Businesses can complete transactions faster and improve customer relationships by providing a seamless signing experience. Furthermore, the solution ensures compliance with legal standards.

-

Can the 1702mx solution integrate with other software?

Yes, the 1702mx solution by airSlate SignNow allows for easy integration with various software applications, including CRM and project management tools. This interoperability enables businesses to incorporate eSigning into their existing workflows without disruption. Check our integrations page for a full list of compatible applications.

-

Is the 1702mx solution secure for sensitive documents?

Absolutely, the 1702mx solution is built with top-notch security measures to protect sensitive documents. airSlate SignNow employs encryption and strict authentication protocols to ensure that all data remains safe. This makes it a trustworthy option for businesses handling confidential information.

-

How can I get started with the 1702mx solution?

Getting started with the 1702mx solution is simple. You can sign up for a free trial on the airSlate SignNow website, which will allow you to explore the features and capabilities firsthand. Once you're familiar with the platform, you can choose a suitable plan that meets your business requirements.

Get more for 1702 Mx Form

Find out other 1702 Mx Form

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free