Www K State Edusfamanage2022 Student Nontax Filer Form K State Edu 2022-2026

Understanding the IRS Non-Filer Form

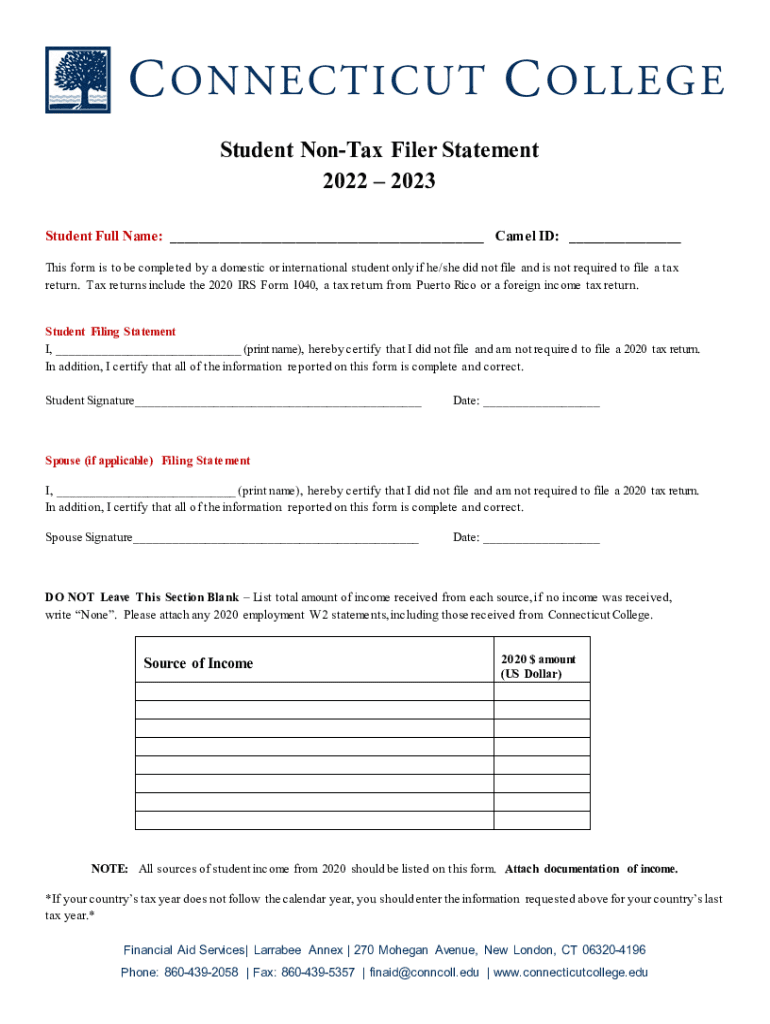

The IRS non-filer form is designed for individuals who are not required to file a federal income tax return. This form is particularly useful for students, low-income earners, or those who have no taxable income. By submitting this form, individuals can confirm their non-filer status, which may be necessary for various applications, such as financial aid or government assistance programs. The form provides a clear declaration of income status, ensuring that applicants can access benefits without confusion regarding their tax obligations.

Steps to Complete the IRS Non-Filer Form

Completing the IRS non-filer form involves several straightforward steps:

- Gather necessary information, including your name, address, Social Security number, and details about any dependents.

- Indicate your income status clearly. If you have no income, make sure to state that explicitly.

- Review the form for accuracy, ensuring all information is correct and complete.

- Sign and date the form to validate your submission.

Once completed, the form can be submitted according to the guidelines provided by the IRS.

Legal Use of the IRS Non-Filer Form

The IRS non-filer form serves as a legal document that verifies an individual's non-filing status. It is essential for various situations, including applying for financial aid or other government programs. The form's legal standing is upheld as long as it is filled out accurately and submitted in accordance with IRS guidelines. Furthermore, it is important to keep a copy of the submitted form for personal records, as it may be required for future verification.

Filing Deadlines and Important Dates

When dealing with the IRS non-filer form, it is crucial to be aware of relevant deadlines. Typically, the form should be submitted by the tax filing deadline, which is usually April 15 for most individuals. However, if you are applying for financial aid or other benefits, earlier submission may be beneficial to meet specific program deadlines. Always check the IRS website or consult with a tax professional for the most current dates and any changes that may occur.

Required Documents for the IRS Non-Filer Form

To complete the IRS non-filer form, you will need several documents to support your application:

- Proof of identity, such as a driver's license or Social Security card.

- Documentation of any income, if applicable, even if it is below the filing threshold.

- Information on any dependents you may claim, including their Social Security numbers.

Having these documents ready will streamline the process and ensure that your form is completed accurately.

Form Submission Methods

The IRS non-filer form can be submitted through various methods, providing flexibility for individuals. The options include:

- Online submission through the IRS website, which is often the fastest method.

- Mailing a physical copy of the form to the appropriate IRS address.

- In-person submission at designated IRS offices, though this may require an appointment.

Choosing the right submission method depends on personal preference and urgency.

Quick guide on how to complete www k state edusfamanage2022 student nontax filer form k state edu

Effortlessly Prepare Www k state edusfamanage2022 Student Nontax Filer Form K state edu on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it digitally. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Www k state edusfamanage2022 Student Nontax Filer Form K state edu on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to Edit and Electronically Sign Www k state edusfamanage2022 Student Nontax Filer Form K state edu with Ease

- Obtain Www k state edusfamanage2022 Student Nontax Filer Form K state edu and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your edits.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Www k state edusfamanage2022 Student Nontax Filer Form K state edu and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct www k state edusfamanage2022 student nontax filer form k state edu

Create this form in 5 minutes!

How to create an eSignature for the www k state edusfamanage2022 student nontax filer form k state edu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 2022 student non tax filer statement?

A 2022 student non tax filer statement is a document that confirms a student did not file a federal tax return for the year 2022. It is often required for financial aid applications and can be used to verify income information for students who did not earn enough to file taxes.

-

Why do I need a 2022 student non tax filer statement?

You need a 2022 student non tax filer statement to provide proof of your financial situation when applying for student aid, scholarships, or grants. It demonstrates your eligibility for various financial assistance programs without the need for tax return documentation.

-

How can I obtain a 2022 student non tax filer statement?

You can obtain a 2022 student non tax filer statement by requesting it from your school or financial aid office. Many institutions provide templates that you can fill out to signNow your non-filing status for the year.

-

Is there a fee for obtaining a 2022 student non tax filer statement?

Most schools do not charge a fee for issuing a 2022 student non tax filer statement. However, it’s advisable to check with your specific institution as some might have nominal charges for processing such requests.

-

What features does airSlate SignNow offer for signing the 2022 student non tax filer statement?

airSlate SignNow offers a user-friendly interface for signing documents electronically, including the 2022 student non tax filer statement. You can easily send, sign, and store your documents securely, which streamlines the process and reduces paper waste.

-

Can I integrate airSlate SignNow with other software for the 2022 student non tax filer statement?

Yes, airSlate SignNow provides integration options with various software like Google Drive, Salesforce, and Dropbox. This allows you to manage your documents more efficiently and ensures that your 2022 student non tax filer statement is easily accessible.

-

What are the benefits of using airSlate SignNow for my 2022 student non tax filer statement?

Using airSlate SignNow for your 2022 student non tax filer statement simplifies the signing process, making it quick and reliable. The platform enhances security, provides real-time tracking, and allows for automated reminders, ensuring you never miss a deadline.

Get more for Www k state edusfamanage2022 Student Nontax Filer Form K state edu

Find out other Www k state edusfamanage2022 Student Nontax Filer Form K state edu

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe