Form 8809

What is the Form 8809

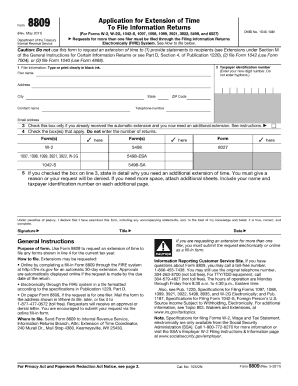

The Form 8809, officially known as the Application for Extension of Time To File Information Returns, is a crucial document used by businesses and organizations in the United States. This form allows filers to request an extension for submitting various information returns to the IRS, such as Forms 1099 and W-2. Understanding the purpose of Form 8809 is essential for ensuring compliance with federal tax regulations and avoiding potential penalties associated with late filings.

How to use the Form 8809

Using Form 8809 involves a straightforward process. Filers must complete the form by providing essential information, including the name of the organization, Employer Identification Number (EIN), and the type of returns for which an extension is being requested. It is important to accurately fill out the form to avoid delays in processing. Once completed, the form can be submitted electronically or by mail, depending on the preferences of the filer and the IRS guidelines.

Steps to complete the Form 8809

Completing Form 8809 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your organization's name and EIN.

- Indicate the type of information returns for which you are requesting an extension.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the IRS e-file system or mail it to the appropriate IRS address.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 8809 is crucial for compliance. Typically, the form must be submitted by the due date of the original information return. For example, if you are filing a Form 1099, the deadline is usually January 31. However, if the due date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the IRS website for the most current deadlines and any updates regarding extensions.

Legal use of the Form 8809

Form 8809 is legally binding when completed and submitted according to IRS guidelines. The form provides a formal request for an extension, which, if granted, protects the filer from penalties associated with late submissions. It is essential to ensure that the form is filed within the appropriate time frame and that all information is accurate to maintain its legal validity.

Penalties for Non-Compliance

Failing to file Form 8809 on time can result in significant penalties. The IRS may impose fines for each information return that is filed late. These penalties can accumulate quickly, making it vital for filers to adhere to deadlines. Additionally, non-compliance can lead to increased scrutiny from the IRS, which could result in further complications for the organization.

Quick guide on how to complete form 8809

Complete Form 8809 effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form 8809 on any device with the airSlate SignNow applications for Android or iOS, and streamline any document-related task today.

How to edit and electronically sign Form 8809 easily

- Obtain Form 8809 and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8809 to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8809

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8809 and how is it used in airSlate SignNow?

Form 8809 is a request for an extension of time to file information returns with the IRS. In airSlate SignNow, users can easily fill out and electronically sign Form 8809, streamlining the process of submitting the form to the IRS. This provides a convenient solution for businesses needing to extend their filing deadline.

-

How much does it cost to use airSlate SignNow for processing Form 8809?

airSlate SignNow offers flexible pricing plans that are cost-effective for businesses of all sizes. The exact pricing varies based on the features you choose, but preparing and eSigning Form 8809 is an integral part of our service. You can explore our plans on our website to find one that fits your needs.

-

What are the main features of airSlate SignNow concerning Form 8809?

airSlate SignNow provides a user-friendly interface for completing Form 8809, along with options for electronic signatures and secure document storage. The platform allows for real-time collaboration, making it easy for multiple users to review and sign the form efficiently. These features enhance productivity while ensuring compliance with IRS guidelines.

-

Is airSlate SignNow secure for handling Form 8809?

Yes, airSlate SignNow employs industry-leading security measures to protect sensitive information when handling Form 8809. Our platform uses encryption and secure cloud storage to ensure that your documents are safe from unauthorized access. You can confidently eSign Form 8809 knowing that your data is secure.

-

Can airSlate SignNow integrate with other software for easier Form 8809 submission?

Absolutely! airSlate SignNow offers seamless integrations with various applications, including accounting and HR software, enhancing the workflow for Form 8809 submissions. These integrations allow users to sync data effortlessly, reducing manual entry and saving time in the process.

-

What are the benefits of using airSlate SignNow for filing Form 8809?

Using airSlate SignNow for filing Form 8809 provides signNow benefits such as time savings, enhanced accuracy, and reduced paper clutter. The platform enables businesses to complete and eSign forms from anywhere, making the process more efficient and convenient. Additionally, tracking and managing your forms is simplified with our comprehensive dashboard.

-

Are there any limitations to using airSlate SignNow for Form 8809?

While airSlate SignNow is a powerful tool for Form 8809, users should be aware that certain specific legal requirements still apply to the submission of tax forms. Users should ensure they comply with all IRS regulations when utilizing our service. However, the platform is designed to facilitate this process to minimize common pitfalls.

Get more for Form 8809

- Us tax forms schedule e

- Adult family home business toolkit dhs division of daas ar form

- How to fill out eform 0990 v1

- Heap application checklist north coast energy services form

- Motion to modify visitation nebraska pdf form

- Pennsylvania instant check system form

- Syracuse complaint form new york state attorney general ag ny

- Potential third party liability notification dhcs 6168 781528775 form

Find out other Form 8809

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free