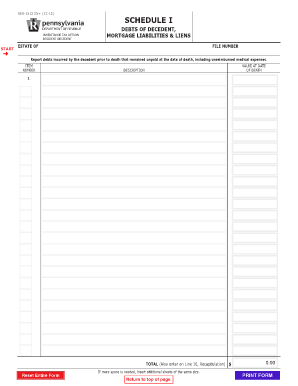

Pa Inheritance Tax Form

What is the Pennsylvania Inheritance Tax Form?

The Pennsylvania inheritance tax form is a legal document used to report the transfer of assets from a deceased individual to their beneficiaries. This form is essential for calculating the inheritance tax owed to the state of Pennsylvania. The tax applies to the value of the estate being inherited, and the rate varies based on the relationship of the heir to the deceased. Understanding the purpose and requirements of this form is crucial for ensuring compliance with state tax laws.

Steps to Complete the Pennsylvania Inheritance Tax Form

Completing the Pennsylvania inheritance tax form involves several key steps:

- Gather necessary documentation, including the death certificate and a list of assets.

- Determine the value of the estate, including property, bank accounts, and other assets.

- Identify the beneficiaries and their relationship to the deceased, as this affects the tax rate.

- Fill out the form accurately, ensuring all required information is included.

- Review the completed form for accuracy before submission.

How to Obtain the Pennsylvania Inheritance Tax Form

The Pennsylvania inheritance tax form can be obtained through several channels. It is available online through the Pennsylvania Department of Revenue's website. Additionally, individuals can request a physical copy by contacting the local tax office or visiting in person. Ensuring you have the correct version of the form is important, as updates may occur periodically.

Legal Use of the Pennsylvania Inheritance Tax Form

The legal use of the Pennsylvania inheritance tax form is governed by state laws that dictate its proper completion and submission. The form must be filed within nine months of the decedent's date of death to avoid penalties. Failure to file the form accurately and on time can result in additional taxes and interest charges, underscoring the importance of understanding the legal implications associated with this document.

Required Documents for the Pennsylvania Inheritance Tax Form

When completing the Pennsylvania inheritance tax form, several documents are required to ensure accurate reporting:

- The death certificate of the deceased.

- A detailed inventory of the estate's assets, including real estate and personal property.

- Documentation of any debts or liabilities that may affect the estate's value.

- Information regarding the beneficiaries, including their relationship to the deceased.

Form Submission Methods

The Pennsylvania inheritance tax form can be submitted through various methods, providing flexibility for filers. Options include:

- Online submission via the Pennsylvania Department of Revenue's e-filing system.

- Mailing a completed paper form to the appropriate tax office.

- In-person submission at local tax offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete pa inheritance tax form

Effortlessly Prepare Pa Inheritance Tax Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to access the appropriate template and store it securely online. airSlate SignNow offers you all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Pa Inheritance Tax Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related workflow today.

How to modify and eSign Pa Inheritance Tax Form with ease

- Find Pa Inheritance Tax Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new copies. airSlate SignNow meets your needs in document management within a few clicks from your chosen device. Edit and eSign Pa Inheritance Tax Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa inheritance tax form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are PA inheritance tax forms?

PA inheritance tax forms are official documents that need to be completed and filed when an estate is administered in Pennsylvania. These forms are essential for reporting and calculating the tax owed on the transfer of property and assets after someone's death. Properly completing PA inheritance tax forms ensures compliance with state laws and avoids any potential penalties.

-

How can airSlate SignNow help with PA inheritance tax forms?

airSlate SignNow simplifies the process of handling PA inheritance tax forms by providing an easy-to-use platform for eSigning and sending documents securely. Our software allows users to upload, share, and electronically sign PA inheritance tax forms, reducing the time and effort involved in the documentation process. Additionally, our platform ensures that all forms are stored securely and accessible whenever needed.

-

Are there any fees associated with using airSlate SignNow for PA inheritance tax forms?

While airSlate SignNow offers a cost-effective solution for managing PA inheritance tax forms, there are subscription fees based on the plan chosen. However, users can benefit from the extensive features and capabilities that streamline document workflows. We also offer a free trial, allowing potential users to explore how our service can cater to their needs without any upfront costs.

-

What features does airSlate SignNow offer for managing PA inheritance tax forms?

airSlate SignNow provides a variety of features for managing PA inheritance tax forms, including eSignature capabilities, customizable templates, and document tracking. Users can create templates for common forms and drafts, which saves time on repetitive tasks. Our platform also allows for collaboration, enabling multiple parties to review and sign the forms efficiently.

-

Can I integrate airSlate SignNow with other software for handling PA inheritance tax forms?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to connect your existing workflow to handle PA inheritance tax forms. This includes popular platforms like Google Drive, Dropbox, and CRM systems. Integrations enhance productivity by allowing users to manage documents seamlessly within their current ecosystem.

-

What are the benefits of using airSlate SignNow for PA inheritance tax forms compared to paper methods?

Using airSlate SignNow for PA inheritance tax forms offers numerous benefits over traditional paper methods, such as faster processing times and reduced physical storage needs. The digital platform allows for instant access to documents and quicker turnaround on signatures. Additionally, utilizing eSignatures enhances security and provides a clear audit trail for each transaction.

-

How secure is airSlate SignNow when handling PA inheritance tax forms?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like PA inheritance tax forms. Our platform uses advanced encryption protocols to protect data both in transit and at rest. Users can trust that their documents are stored securely and that their privacy is safeguarded throughout the signing process.

Get more for Pa Inheritance Tax Form

Find out other Pa Inheritance Tax Form

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF