T2202A Form Agence Du Revenu Du Canada Cra Arc Gc 2011

What is the T2202A Form Agence Du Revenu Du Canada Cra arc Gc

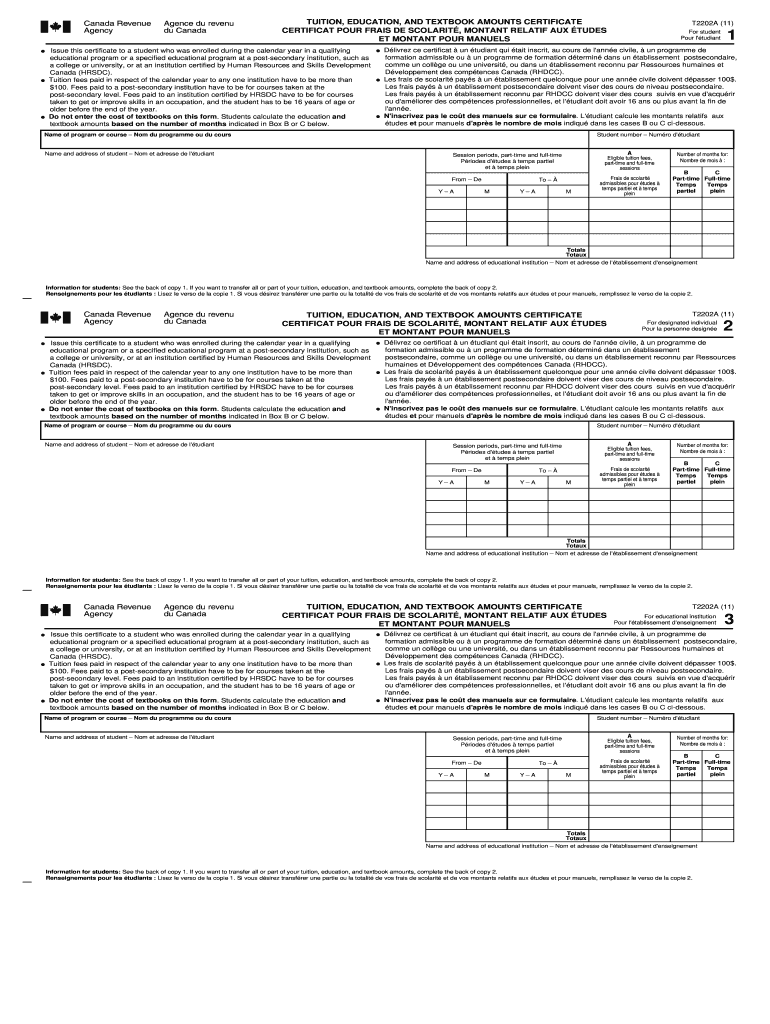

The T2202A Form, issued by the Agence Du Revenu Du Canada (ARC), is a tax document used in Canada to certify tuition fees paid by students. This form is essential for students seeking to claim tuition tax credits on their income tax returns. It provides a record of eligible tuition fees that can reduce the amount of tax owed or increase a tax refund. Understanding this form is crucial for students who wish to maximize their tax benefits related to education expenses.

Steps to complete the T2202A Form Agence Du Revenu Du Canada Cra arc Gc

Completing the T2202A Form involves several important steps to ensure accuracy and compliance with tax regulations. First, gather all necessary documents, including proof of tuition payment and enrollment status. Next, accurately fill in personal information, such as your name and student identification number. Ensure that the tuition amounts reported match those on your payment receipts. After completing the form, review all entries for accuracy before submitting it to the appropriate tax authority.

How to obtain the T2202A Form Agence Du Revenu Du Canada Cra arc Gc

The T2202A Form can typically be obtained through your educational institution. Most colleges and universities in Canada provide this form directly to students, either electronically or in paper format. If you have not received your form, contact your institution's registrar or financial aid office for assistance. Additionally, some institutions may offer access to the form through their online student portals, making it easier for students to retrieve their tax documents.

Key elements of the T2202A Form Agence Du Revenu Du Canada Cra arc Gc

Several key elements are included in the T2202A Form that students should be aware of. These elements typically include the total amount of tuition fees paid, the number of months of study, and the institution's name and address. Each of these components is critical for accurately reporting tuition expenses on your tax return. Understanding these elements can help ensure that you claim the correct amount and avoid potential issues with tax authorities.

Legal use of the T2202A Form Agence Du Revenu Du Canada Cra arc Gc

The T2202A Form is legally binding for tax purposes, meaning that the information provided must be accurate and truthful. Misrepresentation or submission of false information can lead to penalties or legal repercussions. It is important for students to understand their responsibilities when using this form, including the need to keep supporting documents for verification purposes. Compliance with tax laws ensures that students can benefit from the tax credits associated with their educational expenses.

Form Submission Methods (Online / Mail / In-Person)

Submitting the T2202A Form can be done through various methods, depending on the requirements of the tax authority. Students may have the option to submit the form online through tax software, by mail, or in-person at designated tax offices. Each submission method has its own guidelines and deadlines, so it is important to choose the method that best fits your situation while ensuring compliance with submission timelines.

Quick guide on how to complete t2202a form agence du revenu du canada cra arc gc

A concise guide on how to create your T2202A Form Agence Du Revenu Du Canada Cra arc Gc

Locating the appropriate template can prove to be difficult when you need to produce official international documentation. Even if you possess the necessary form, it might be onerous to swiftly fill it out according to all the stipulations if you rely on paper copies rather than conducting everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these obstacles. It enables you to select your T2202A Form Agence Du Revenu Du Canada Cra arc Gc and promptly complete and sign it on-site without the need to reprint documents whenever you make a mistake.

Follow these steps to prepare your T2202A Form Agence Du Revenu Du Canada Cra arc Gc using airSlate SignNow:

- Hit the Get Form button to upload your document to our editor immediately.

- Begin with the initial empty field, enter your information, and move forward with the Next tool.

- Populate the blank spaces with the Cross and Check tools from the toolbar above.

- Choose the Highlight or Line options to emphasize the most vital information.

- Click on Image to upload one if your T2202A Form Agence Du Revenu Du Canada Cra arc Gc necessitates it.

- Utilize the pane on the right to add extra fields for you or others to complete if needed.

- Review your responses and confirm the form by selecting Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Complete the editing process by clicking the Done button and selecting your file-sharing preferences.

After your T2202A Form Agence Du Revenu Du Canada Cra arc Gc is ready, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders based on your preferences. Don’t squander time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

Find and fill out the correct t2202a form agence du revenu du canada cra arc gc

FAQs

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

What is the procedure to fill out the DU admission form? How many colleges and courses can I fill in?

It's as simple as filling any school admission form but you need to be quite careful while filling for courses ,don't mind you are from which stream in class 12 choose all the courses you feel like choosing,there is no limitations in choosing course and yes you must fill all the courses related to your stream ,additionally there is no choice for filling of college names in the application form .

-

In the beginning, how many forms do we have to fill out at DU?

Actually, an individual can fill only one form for delhi university. If anyone fill more than one then it would be automatically rejected. So concluding that ur question is not correct.

-

We got our 12th results after filling out the form of DU. Do we have to upload it now? If yes, how?

Yes you have to upload it now.You can do it easily by logging in DU websiteTHERE WILL BE OPTION OF UPLOADING MARKSHEET UPLOAD YOUR PHOTO COPY OF MARKSHEET.A SIMPLE AS THAT.

Create this form in 5 minutes!

How to create an eSignature for the t2202a form agence du revenu du canada cra arc gc

How to generate an eSignature for the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc in the online mode

How to generate an electronic signature for the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc in Google Chrome

How to make an electronic signature for signing the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc in Gmail

How to generate an electronic signature for the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc straight from your smart phone

How to make an electronic signature for the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc on iOS

How to generate an electronic signature for the T2202a Form Agence Du Revenu Du Canada Cra Arc Gc on Android

People also ask

-

What is the T2202A Form and why is it important for Canadian tax returns?

The T2202A Form, issued by the Agence Du Revenu Du Canada (CRA), is essential for students as it certifies their eligibility for tuition credits. This form helps students claim deductions on their income tax return, ensuring they maximize their tax benefits. Using airSlate SignNow simplifies the process of obtaining and signing the T2202A Form, making it easier for students to manage their documentation.

-

How can airSlate SignNow help me with the T2202A Form Agence Du Revenu Du Canada CRA ARC GC?

airSlate SignNow offers a seamless solution for handling the T2202A Form, Agence Du Revenu Du Canada, CRA, and ARC GC by providing easy eSigning and document management features. You can upload, share, and sign your T2202A Form electronically, reducing the time and hassle associated with paperwork. This ensures that you can focus more on your studies rather than administrative tasks.

-

What are the pricing options for using airSlate SignNow for the T2202A Form?

airSlate SignNow offers competitive pricing plans that cater to various needs, whether you are an individual student or part of a larger organization. Each plan includes features that make managing forms like the T2202A Form Agence Du Revenu Du Canada CRA ARC GC both affordable and efficient. You can choose a monthly or annual subscription based on your usage needs.

-

Is airSlate SignNow compliant with Canadian regulations for the T2202A Form?

Yes, airSlate SignNow is fully compliant with Canadian regulations, ensuring that your T2202A Form, Agence Du Revenu Du Canada (CRA) ARC GC is handled according to the highest standards of data security and privacy. Our platform adheres to industry regulations, making it a trustworthy solution for managing your important tax documents.

-

Can I integrate airSlate SignNow with other applications to manage the T2202A Form?

Absolutely! airSlate SignNow offers various integrations with popular applications, allowing you to streamline the process of managing the T2202A Form, Agence Du Revenu Du Canada CRA ARC GC. Whether you need to connect with CRM systems, cloud storage, or email platforms, our integration capabilities enhance your workflow and document management.

-

What features does airSlate SignNow provide for signing the T2202A Form?

airSlate SignNow provides a range of features specifically designed for signing documents like the T2202A Form. With electronic signatures, customizable templates, and real-time notifications, users can easily complete their documentation efficiently. This ensures that your T2202A Form, Agence Du Revenu Du Canada CRA ARC GC, is processed quickly and accurately.

-

How secure is my information when using airSlate SignNow for the T2202A Form?

Your information is safe with airSlate SignNow. We utilize advanced encryption and security protocols to protect your data, especially for sensitive documents like the T2202A Form, Agence Du Revenu Du Canada CRA ARC GC. Our commitment to security means you can confidently manage your documents without worrying about unauthorized access.

Get more for T2202A Form Agence Du Revenu Du Canada Cra arc Gc

- New jersey birth certificate sample form

- Diligent effort form

- Tennessee subpoena form

- Passport application nz form

- Delegation of services agreements physician assistant board pac ca form

- Civ 252 joint trial readiness conference report format

- Department of public safety division of fire safety fire form

- Maryland poultry registration form pdf maryland department of mda maryland

Find out other T2202A Form Agence Du Revenu Du Canada Cra arc Gc

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now