Ct1040ext Form

What is the Ct1040ext Form

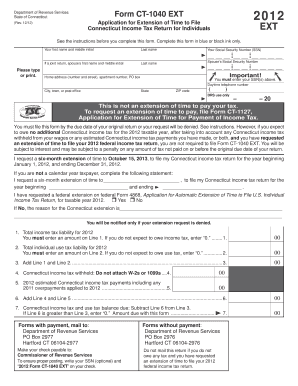

The Ct1040ext Form is an extension application for taxpayers in Connecticut who need additional time to file their state income tax returns. This form allows individuals and businesses to request a six-month extension beyond the original filing deadline. It is essential for those who may not have all the necessary documentation or require more time to prepare their tax returns accurately. By submitting the Ct1040ext Form, taxpayers can avoid late filing penalties while ensuring compliance with state tax regulations.

How to use the Ct1040ext Form

To use the Ct1040ext Form effectively, taxpayers must first complete the form with accurate information, including their name, address, and Social Security number or Employer Identification Number. After filling out the required fields, the form must be submitted to the Connecticut Department of Revenue Services. It is important to note that submitting this form does not extend the time to pay any taxes owed; therefore, taxpayers should estimate their tax liability and make any necessary payments by the original due date to avoid interest and penalties.

Steps to complete the Ct1040ext Form

Completing the Ct1040ext Form involves several key steps:

- Download the Ct1040ext Form from the Connecticut Department of Revenue Services website.

- Fill in your personal information, including your name, address, and identification number.

- Estimate your tax liability and indicate any payments made to date.

- Sign and date the form to certify the information provided is accurate.

- Submit the completed form by mail or electronically, depending on your preference.

Filing Deadlines / Important Dates

The filing deadline for the Ct1040ext Form typically aligns with the original due date for Connecticut state income tax returns, which is generally April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for taxpayers to file the Ct1040ext Form before this deadline to ensure they receive the full six-month extension. Additionally, any tax payments owed should be made by the original deadline to avoid accruing interest and penalties.

Legal use of the Ct1040ext Form

The Ct1040ext Form is legally recognized by the Connecticut Department of Revenue Services as a valid request for an extension to file state income taxes. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the state, including accurate completion of the form and timely submission. Failure to comply with these regulations may result in penalties, including late fees and interest on unpaid taxes. Therefore, understanding the legal implications of using the Ct1040ext Form is essential for maintaining compliance.

Key elements of the Ct1040ext Form

Key elements of the Ct1040ext Form include:

- Taxpayer Information: Name, address, and identification numbers.

- Estimated Tax Liability: An estimate of the taxes owed for the year.

- Payment Information: Details of any payments made toward the estimated tax liability.

- Signature: A certification of the accuracy of the information provided.

Quick guide on how to complete ct1040ext form

Effortlessly Prepare Ct1040ext Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents quickly and without any delays. Manage Ct1040ext Form on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to Alter and eSign Ct1040ext Form with Ease

- Find Ct1040ext Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specially designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and select the Done button to save your amendments.

- Choose how you want to share your form, whether via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Ct1040ext Form and assure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct1040ext form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ct1040ext Form?

The Ct1040ext Form is an application for a six-month extension to file your Connecticut income tax return. Using airSlate SignNow, you can easily complete and submit the Ct1040ext Form online, streamlining the filing process and avoiding penalties.

-

How can airSlate SignNow help with the Ct1040ext Form?

AirSlate SignNow allows you to electronically sign and send the Ct1040ext Form securely. Our platform ensures that your documents are easily accessible and can be completed quickly, which saves you time and reduces the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for the Ct1040ext Form?

AirSlate SignNow offers a variety of pricing plans, making it a cost-effective solution for filing the Ct1040ext Form. You can choose a plan that fits your needs and budget, ensuring you save both time and money during tax season.

-

What features does airSlate SignNow offer for taxes like the Ct1040ext Form?

With airSlate SignNow, you gain access to features such as document templates, real-time tracking, and collaborative editing. These features make it easier to manage your Ct1040ext Form and ensure that the filing process is efficient and user-friendly.

-

Can I save my Ct1040ext Form on airSlate SignNow for future use?

Yes, airSlate SignNow allows you to save your completed Ct1040ext Form for future reference. This capability helps you keep track of your tax documents over the years and makes it easy to access them when needed.

-

Does airSlate SignNow integrate with other accounting software for the Ct1040ext Form?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and tax software, making it simple to manage your Ct1040ext Form alongside your other financial documents. This integration enhances workflow efficiency and reduces data entry errors.

-

What are the benefits of eSigning the Ct1040ext Form using airSlate SignNow?

By using airSlate SignNow to eSign the Ct1040ext Form, you gain the convenience of signing documents anytime, anywhere. This flexibility ensures you can meet deadlines without the stress of traditional paper-based methods.

Get more for Ct1040ext Form

Find out other Ct1040ext Form

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement